- United States

- /

- Software

- /

- NasdaqGS:FRSH

Does Freshworks Offer Opportunity After 31.6% YTD Decline in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with your Freshworks shares? You are not alone. In a market climate that keeps investors on their toes, Freshworks has become a talking point for those watching the SaaS sector closely. The stock closed at $10.88 recently, but it’s been quite a ride, with a decline of 14.5% over the past month and a year-to-date dip of 31.6%. Even so, if you look a bit deeper, there are hints that the company might be misunderstood or simply overlooked for now. Freshworks has a value score of 5 out of 6 on our quick-check screen for undervaluation, suggesting there could be more upside than downside at these prices. With the broader tech market facing uncertainty and sentiment shifting on riskier names, Freshworks’ current price might not reflect its real potential. Before making a move, let’s dig into how the most widely used valuation methods stack up for Freshworks and see what they reveal. Toward the end, I will share an even smarter way to judge whether the stock is truly undervalued.

Why Freshworks is lagging behind its peers

Approach 1: Freshworks Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today’s dollars. This approach helps investors gauge what a business may truly be worth based on its ability to generate cash over time, rather than relying solely on current earnings or book value.

For Freshworks, the current Free Cash Flow stands at $185 million. Analysts expect it to grow steadily; by 2028, projections call for Freshworks to generate about $360.6 million in Free Cash Flow. Beyond this time frame, longer-term estimates are extrapolated based on the company’s growth trends, reaching nearly $594 million by 2035. All these figures are calculated in US dollars and reflect the company's performance in millions, not billions.

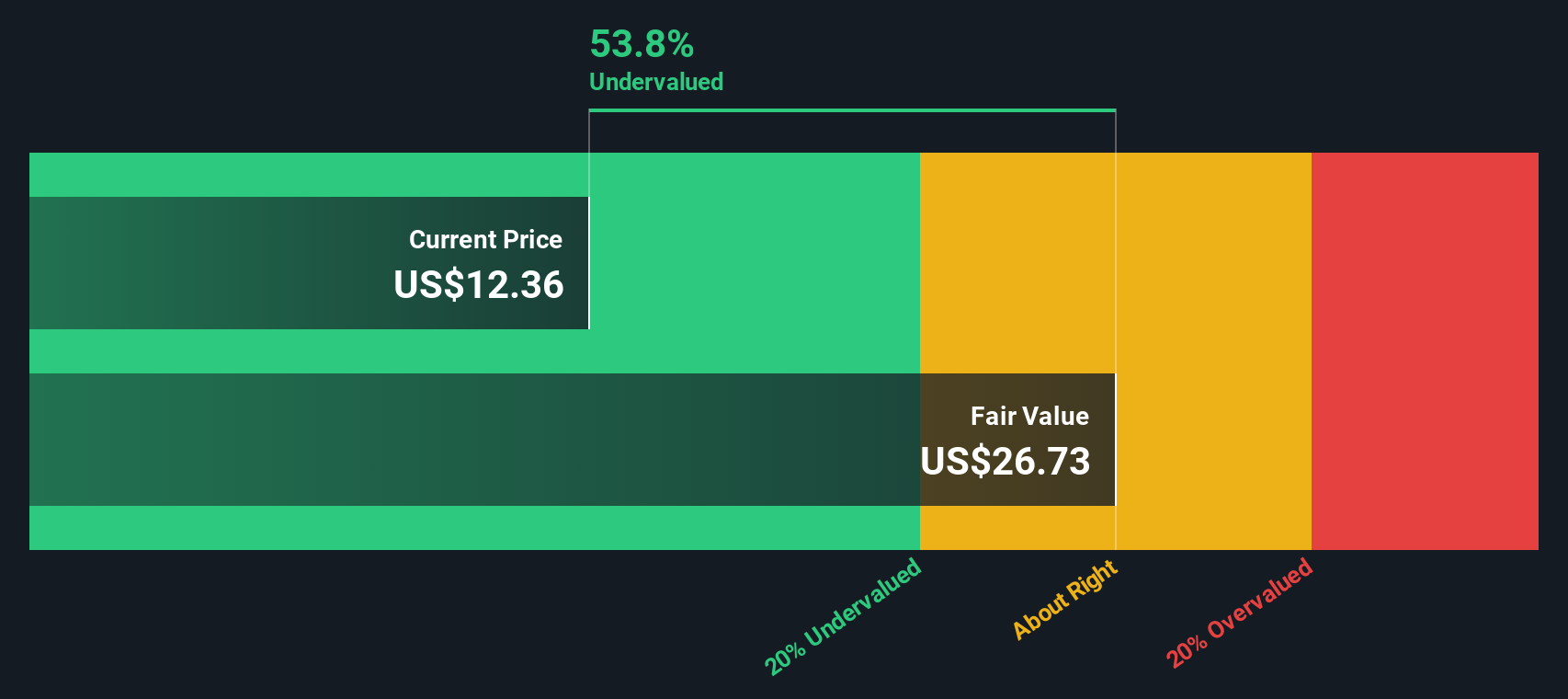

Based on these projections, the DCF model estimates an intrinsic value of $26.82 per Freshworks share. With the stock recently trading at $10.88, this model suggests a discount of 59.4% from what investors might consider its fair value, implying the stock is significantly undervalued at the moment.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Freshworks is undervalued by 59.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

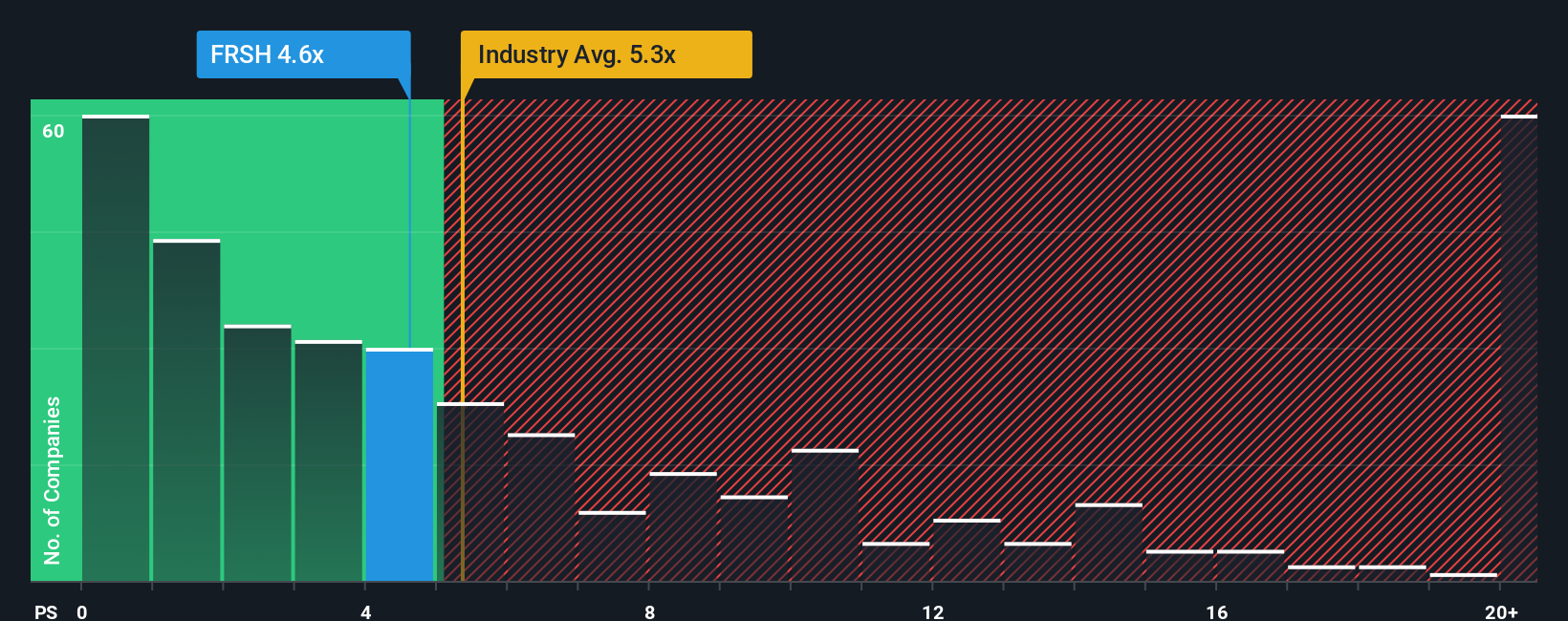

Approach 2: Freshworks Price vs Sales

The Price-to-Sales (P/S) ratio is a popular valuation metric, especially for software companies like Freshworks where profits may be limited by ongoing investments in growth. Because revenue tends to be more stable than earnings for fast-growing tech firms, the P/S ratio can offer valuable insight into how the market values a company relative to its sales. This is helpful for both profitable and unprofitable companies when comparing value across peers in the same industry.

Growth expectations, risk, and profitability all have an impact on what constitutes a fair P/S ratio. Higher anticipated growth and fewer risks usually justify a premium on this multiple, while uncertainty or disappointing growth prospects can push the ratio lower.

Currently, Freshworks trades at a P/S ratio of 4.05x. For context, the average software industry peer sits at 7.25x, and the broader industry itself averages 4.96x. At first glance, Freshworks appears relatively inexpensive compared to both benchmarks.

This is where the Simply Wall St "Fair Ratio" comes in. Unlike simple peer or industry comparisons, this metric is tailored to Freshworks’ business. It reflects factors such as its revenue growth outlook, risk profile, profit margins, and market capitalization. In Freshworks’ case, the Fair Ratio is calculated to be 6.31x, providing a more customized benchmark than a generic industry average or competitor comparison.

With Freshworks’ actual P/S ratio notably below the Fair Ratio, it suggests that the stock may be undervalued based on these underlying fundamentals and risk factors.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Freshworks Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple, powerful tool that lets you define your own story for a company, connecting your personal view on its prospects with key financial forecasts like future revenue, margins, and what you believe is a fair value for the stock.

Unlike standard metrics, Narratives help you make sense of the numbers through your unique lens, linking the story of a company to its financial future and translating that into an actionable fair value. Accessible on Simply Wall St’s Community page, a platform used by millions, everyone from beginners to seasoned investors can quickly set or update a Narrative in just a few clicks.

With Narratives, you are able to see at a glance whether Freshworks looks attractive by comparing your calculated Fair Value to the current share price. Plus, as new company news or earnings are released, Narratives dynamically update and keep your view fresh without manual effort.

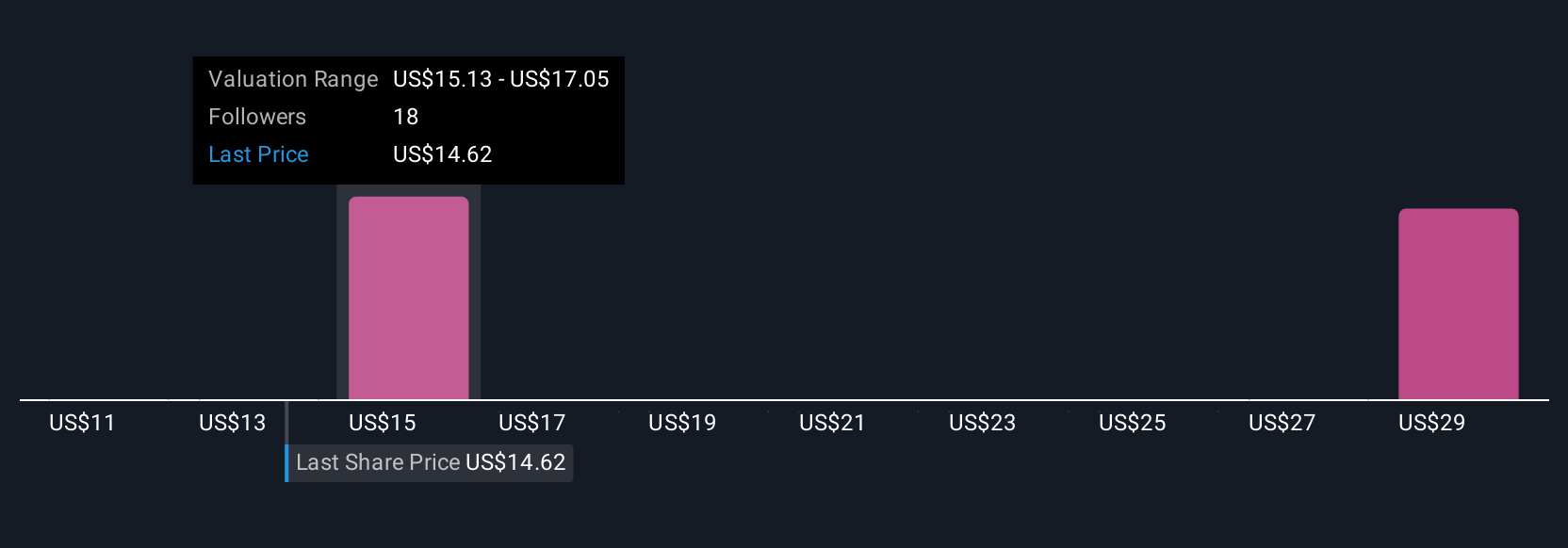

For example, recent Narratives for Freshworks include a bullish forecast of $27.00 per share, envisioning strong AI-driven growth and expanding partnerships, and a more cautious estimate at $18.00, reflecting competitive and margin pressures. Your own perspective can sit anywhere on that spectrum, and with Narratives, you can track it in real time.

Do you think there's more to the story for Freshworks? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FRSH

Freshworks

A software development company, provides software-as-a-service products in North America, Europe, the Middle East, Africa, Asia Pacific, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion