- United States

- /

- Software

- /

- NasdaqGM:FIVN

Five9 (FIVN): Valuation Outlook After Launching Fusion Integration With Epic in Healthcare

Reviewed by Simply Wall St

Five9 (FIVN) just rolled out Five9 Fusion for Epic, building a direct bridge between its cloud contact center platform and Epic’s electronic health record system. For investors watching the CCaaS space, this native integration with Epic is more than a headline. It demonstrates Five9’s ability to expand into healthcare, a sector seeking streamlined communications and automation. The move brings advanced features such as instant patient context and built-in HIPAA-compliant call recording to the core of hospital and clinic workflows, potentially making life easier for agents and improving how patients interact with providers.

This product launch comes at a time when Five9’s stock has been moving sideways, lacking momentum. The share price slipped around 5% over the past month and remains down 18% in the past year. Despite positive annual revenue and net income growth, the stock’s performance has underwhelmed long-term holders, with returns over the past 3 and 5 years showing substantial declines. Still, the new healthcare focus may serve as a catalyst that could reset market perception about growth and earnings visibility.

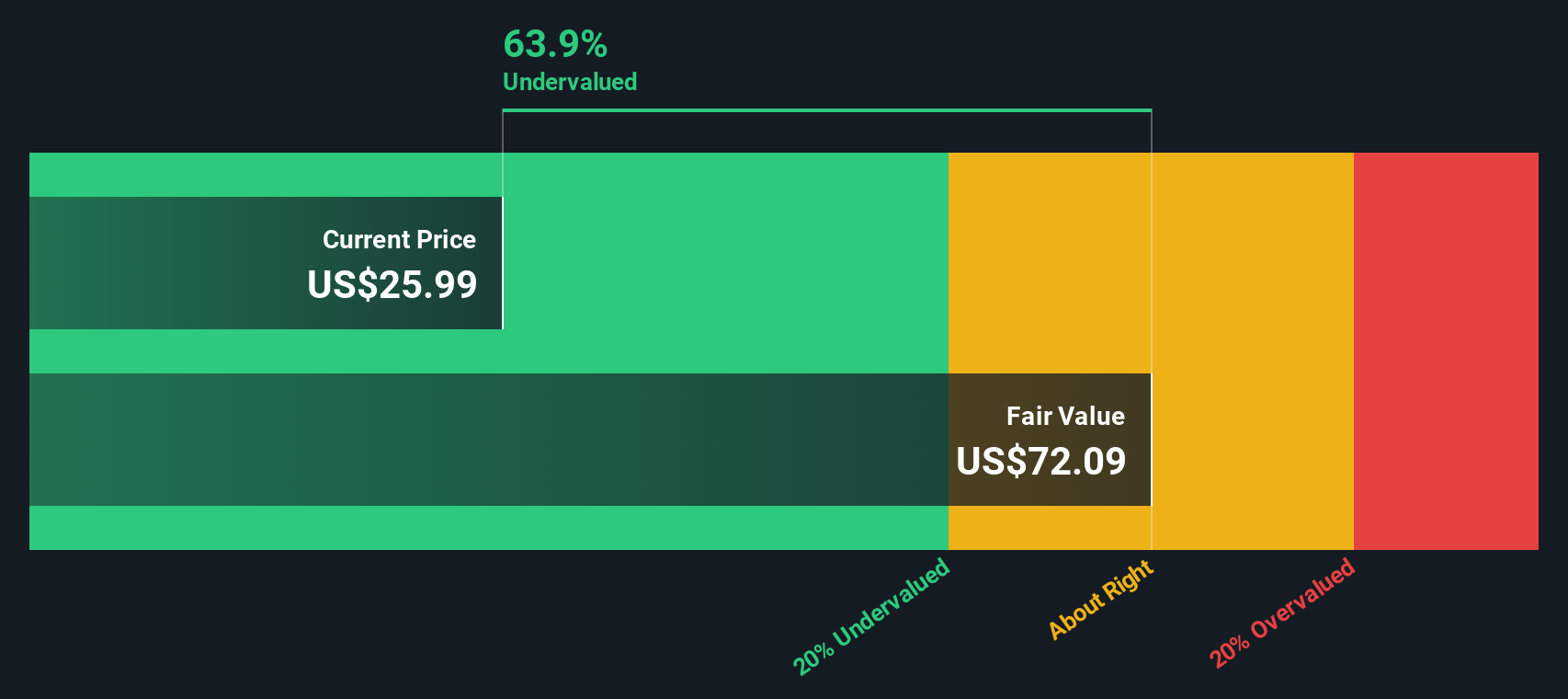

With shares near multi-year lows and new initiatives such as the Epic integration underway, investors may be considering whether Five9 is undervalued or if the market has already priced in its future growth story.

Most Popular Narrative: 24% Undervalued

According to community narrative, Five9 is viewed as significantly undervalued, with analysts projecting a fair value roughly 24% above its current share price. The market may be discounting future growth and missing key drivers behind this price target.

Five9's accelerated adoption of AI-driven solutions, highlighted by 42% Enterprise AI revenue growth and a surge in AI bookings (representing over 20% of Enterprise new ACV), positions the company to benefit from increasing enterprise investment in AI and automation for customer experience. This supports higher recurring revenues and expanded net margins as AI products command premium pricing.

What is fueling this sharp upside? The analysts behind this narrative factor in ambitious growth trajectories, but what is their central bet that sets this apart from the crowd? The full narrative breaks down the core quantitative assumptions and exposes why bold financial projections have bulls so convinced. It also leaves skeptics guessing if the discount is a rare opportunity or a warning sign. Want to know what numbers support that headline valuation? You will have to dive in to find out.

Result: Fair Value of $36.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, intensifying competition from larger vendors or ongoing leadership uncertainty could quickly change Five9’s outlook and threaten these bullish projections.

Find out about the key risks to this Five9 narrative.Another View: What Does Our DCF Model Say?

Looking at Five9 through the lens of our DCF model presents a clear picture as well. This approach reinforces the view that shares appear undervalued. However, it raises the question of whether the assumptions used are too optimistic or just right.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Five9 Narrative

If you want to put the story to the test or see how your own research stacks up, you can craft your narrative in just a few minutes. do it your way.

A great starting point for your Five9 research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more smart opportunities?

Why stop at one idea when you could be spotting your next big winner? Let’s open the door to more possibilities. If you want to stay ahead, start leveraging powerful filters that highlight standout stocks others might be missing. Don’t let these unique investment angles pass you by.

- Uncover proven income potential and access leading companies offering dividend stocks with yields > 3%, making regular yields above 3% part of your strategy.

- Chase future growth trends by tapping into vibrant healthcare AI stocks, where healthcare meets artificial intelligence for ground-breaking advances.

- Step into a new era of finance with innovative cryptocurrency and blockchain stocks, which are shaping blockchain and digital asset revolutions today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FIVN

Five9

Provides intelligent cloud software for contact centers in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives