- United States

- /

- Software

- /

- NasdaqGS:VRNS

Exploring 3 High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

As of late October 2025, the U.S. stock market has shown resilience with major indices like the Nasdaq, S&P 500, and Dow Jones Industrial Average posting solid weekly and monthly gains, buoyed by strong performances from tech giants such as Amazon. In this environment of robust tech sector growth, identifying high-growth tech stocks involves evaluating companies that demonstrate strong earnings potential and adaptability to technological advancements driving current market momentum.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Exelixis | 10.58% | 20.85% | ★★★★★☆ |

| Palantir Technologies | 25.12% | 31.65% | ★★★★★★ |

| RenovoRx | 65.52% | 68.63% | ★★★★★☆ |

| Workday | 11.20% | 32.07% | ★★★★★☆ |

| Gorilla Technology Group | 32.75% | 122.61% | ★★★★★☆ |

| Circle Internet Group | 27.53% | 82.41% | ★★★★★☆ |

| Aldeyra Therapeutics | 42.92% | 73.80% | ★★★★★☆ |

| OS Therapies | 56.64% | 68.61% | ★★★★★☆ |

| Vanda Pharmaceuticals | 23.06% | 68.52% | ★★★★★☆ |

| Zscaler | 15.72% | 40.94% | ★★★★★☆ |

Click here to see the full list of 71 stocks from our US High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Five9 (FIVN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Five9, Inc. offers intelligent cloud software solutions for contact centers globally and has a market capitalization of approximately $1.88 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $1.11 billion.

Five9, a provider of cloud-based contact center solutions, has demonstrated robust growth with an annual revenue increase of 8.6% and a remarkable earnings surge of 42.8% per year. The company's strategic focus on R&D is evident from its significant investment in innovation, which supports its competitive edge in the rapidly evolving AI-driven customer experience sector. Recently, Five9 announced a partnership with Afiniti to integrate AI pairing technology into its platform, enhancing agent performance and customer satisfaction—a move likely to bolster its market position further. This collaboration follows other innovative product launches like Five9 Fusion for ServiceNow, streamlining contact center operations by merging voice and digital interactions through AI transcription streams. With these advancements and ongoing executive enhancements such as the recent board appointments, Five9 is well-positioned to capitalize on growing demand for efficient and personalized customer service solutions.

- Get an in-depth perspective on Five9's performance by reading our health report here.

Review our historical performance report to gain insights into Five9's's past performance.

Varonis Systems (VRNS)

Simply Wall St Growth Rating: ★★★★☆☆

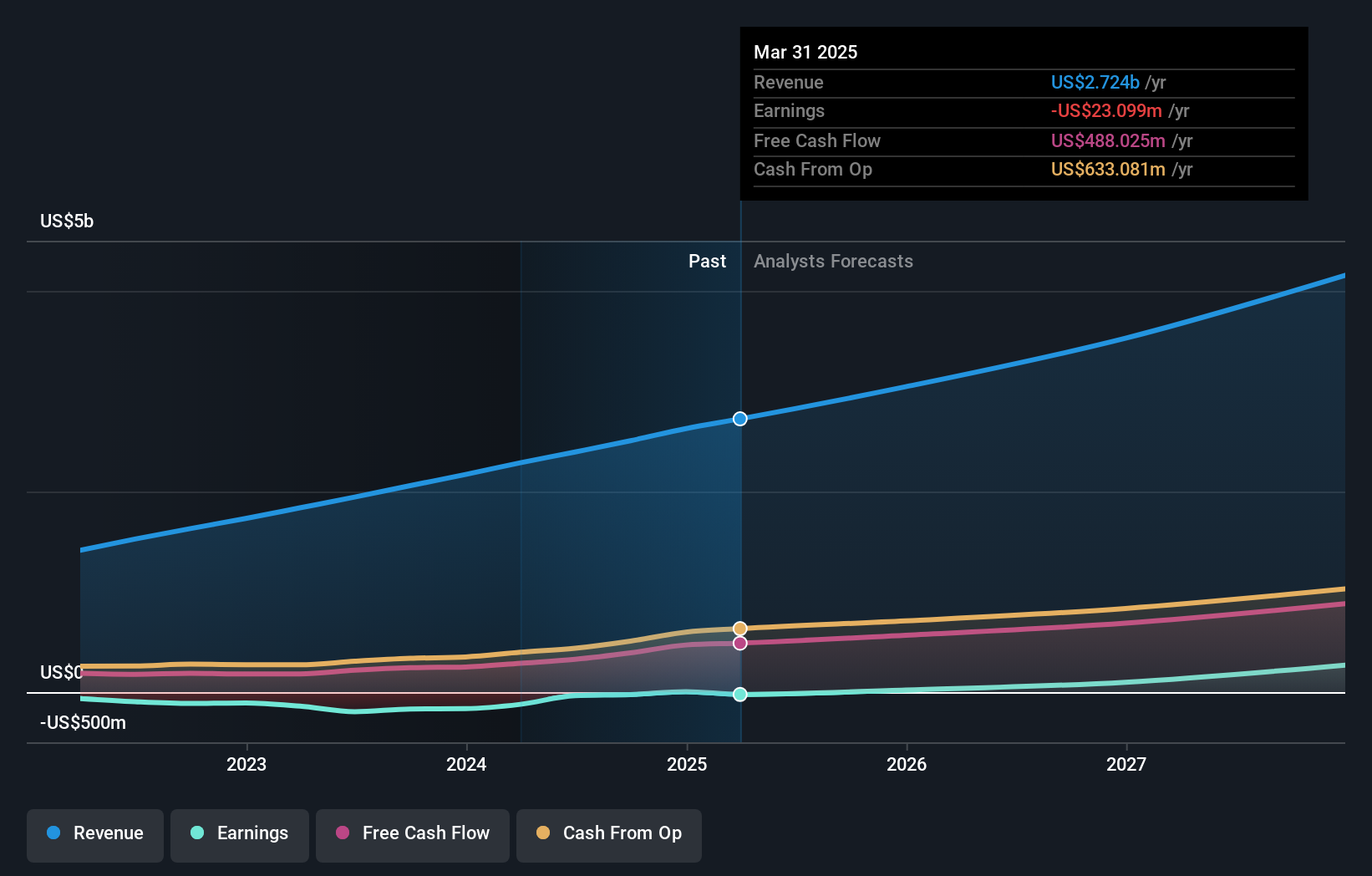

Overview: Varonis Systems, Inc. offers software solutions that utilize AI-powered technology to discover and classify critical data, remediate exposures, and detect advanced threats across North America, Europe, APAC, and other regions; the company has a market cap of approximately $4.15 billion.

Operations: Varonis generates revenue primarily from its data processing segment, which amounts to $608.68 million. The company leverages AI-powered technology to address data security challenges across multiple regions, including North America, Europe, and APAC.

Varonis Systems, despite its unprofitable status, is poised for significant growth with expected revenue and earnings increases of 13.6% and 38.36% per year respectively, outpacing the US market average. The company's commitment to innovation is underscored by a robust R&D strategy, crucial in the competitive tech landscape where AI and data security are paramount. Recent initiatives include launching Varonis Interceptor for advanced email security and enhancing Salesforce integration with new AI identity protection capabilities, demonstrating its agility in adapting to emerging tech trends. With a recent authorization to repurchase up to $150 million in shares, Varonis is also signaling confidence in its future financial health.

- Unlock comprehensive insights into our analysis of Varonis Systems stock in this health report.

Examine Varonis Systems' past performance report to understand how it has performed in the past.

HubSpot (HUBS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: HubSpot, Inc. offers a cloud-based CRM platform for businesses across the Americas, Europe, and the Asia Pacific, with a market capitalization of approximately $25.92 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, totaling $2.85 billion.

HubSpot, transitioning into profitability, is expected to see earnings grow by 46.42% annually over the next three years, outpacing its 14.5% revenue growth forecast which also exceeds the US market average of 10.5%. This growth trajectory is supported by significant R&D investments and strategic partnerships enhancing its software ecosystem, as evidenced by recent integrations with Talkdesk and CallRail that streamline customer interactions through AI-driven tools within HubSpot's platform. These collaborations not only enhance user experience but also solidify HubSpot's position in a competitive landscape where seamless digital workflows and efficient data utilization are critical for scaling operations.

- Delve into the full analysis health report here for a deeper understanding of HubSpot.

Understand HubSpot's track record by examining our Past report.

Turning Ideas Into Actions

- Reveal the 71 hidden gems among our US High Growth Tech and AI Stocks screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRNS

Varonis Systems

Provides software products and services that continuously discover and classify critical data, remediate exposures, and detect advanced threats with AI-powered technology in North America, Europe, APAC, and rest of world.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives