Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Evolving Systems, Inc. (NASDAQ:EVOL) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Evolving Systems

What Is Evolving Systems's Net Debt?

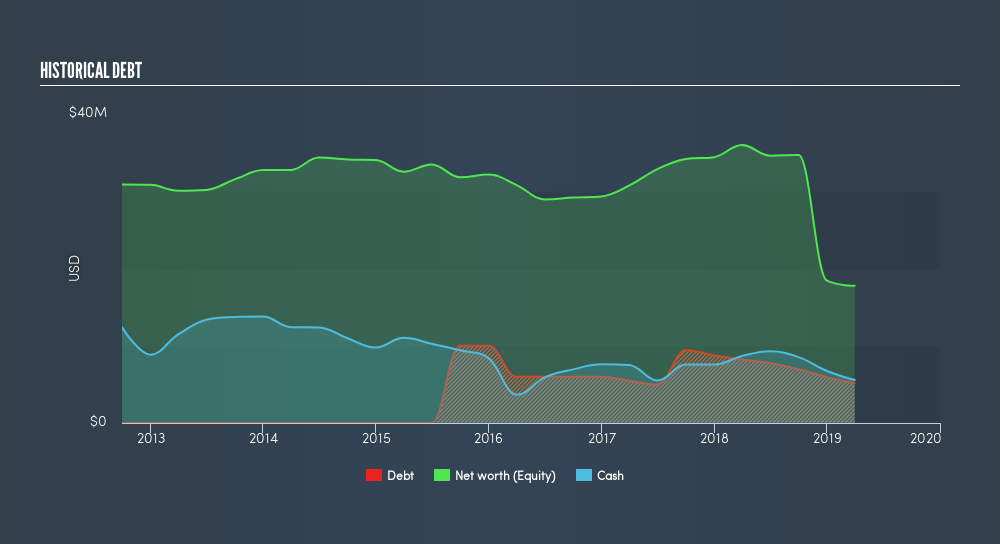

As you can see below, Evolving Systems had US$5.15m of debt at March 2019, down from US$8.23m a year prior. However, its balance sheet shows it holds US$5.56m in cash, so it actually has US$413.0k net cash.

How Strong Is Evolving Systems's Balance Sheet?

The latest balance sheet data shows that Evolving Systems had liabilities of US$14.7m due within a year, and liabilities of US$1.15m falling due after that. Offsetting this, it had US$5.56m in cash and US$11.9m in receivables that were due within 12 months. So it actually has US$1.60m more liquid assets than total liabilities.

This surplus suggests that Evolving Systems is using debt in a way that is appears to be both safe and conservative. Due to its strong net asset position, it is not likely to face issues with its lenders. Given that Evolving Systems has more cash than debt, we're pretty confident it can manage its debt safely.

Shareholders should be aware that Evolving Systems's EBIT was down 94% last year. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Evolving Systems will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. Evolving Systems may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Happily for any shareholders, Evolving Systems actually produced more free cash flow than EBIT over the last three years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that Evolving Systems has net cash of US$413k, as well as more liquid assets than liabilities. And it impressed us with free cash flow of US$128k, being 108% of its EBIT. So we don't have any problem with Evolving Systems's use of debt. We'd be motivated to research the stock further if we found out that Evolving Systems insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About OTCPK:EVOL

Symbolic Logic

A research and development organization, focuses on developing proprietary algorithms that model and predict behaviour of dynamic systems.

Low with weak fundamentals.

Similar Companies

Market Insights

Community Narratives