- United States

- /

- Software

- /

- NasdaqGM:EVBG

Investors Give Everbridge, Inc. (NASDAQ:EVBG) Shares A 30% Hiding

Everbridge, Inc. (NASDAQ:EVBG) shareholders that were waiting for something to happen have been dealt a blow with a 30% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 47% share price drop.

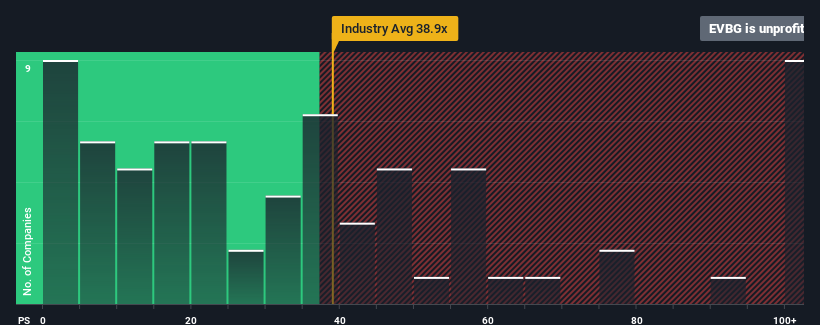

Since its price has dipped substantially, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 15x, you may consider Everbridge as a highly attractive investment with its -15.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

With earnings growth that's superior to most other companies of late, Everbridge has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Everbridge

How Is Everbridge's Growth Trending?

Everbridge's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Retrospectively, the last year delivered an exceptional 38% gain to the company's bottom line. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next year should generate growth of 25% as estimated by the twelve analysts watching the company. With the market only predicted to deliver 5.0%, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that Everbridge's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Everbridge's P/E

Shares in Everbridge have plummeted and its P/E is now low enough to touch the ground. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Everbridge currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Before you settle on your opinion, we've discovered 2 warning signs for Everbridge that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Everbridge might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:EVBG

Everbridge

Operates as a software company that enables customers to anticipate, mitigate, respond to, and recover from critical events in North America and internationally.

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives