eGain (NASDAQ:EGAN) Full Year 2024 Results

Key Financial Results

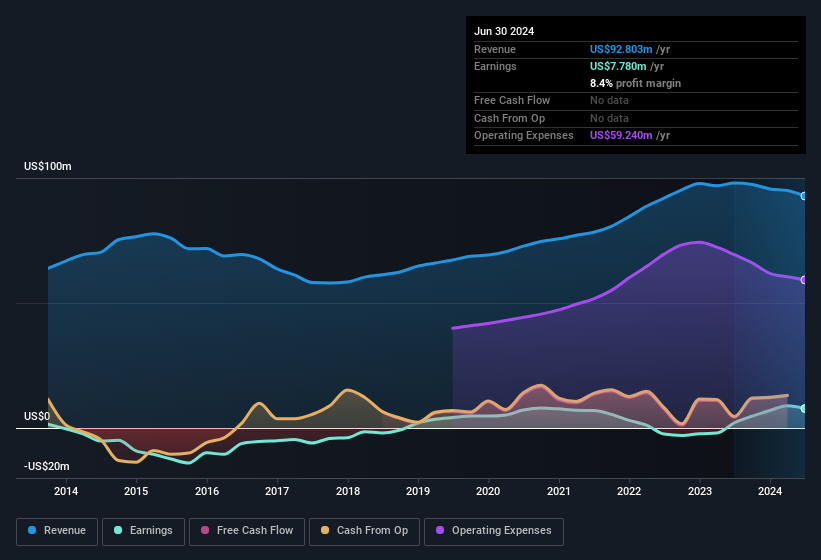

- Revenue: US$92.8m (down 5.3% from FY 2023).

- Net income: US$7.78m (up 269% from FY 2023).

- Profit margin: 8.4% (up from 2.2% in FY 2023). The increase in margin was driven by lower expenses.

- EPS: US$0.25 (up from US$0.066 in FY 2023).

All figures shown in the chart above are for the trailing 12 month (TTM) period

eGain Revenues and Earnings Beat Expectations

Revenue exceeded analyst estimates by 1.2%. Earnings per share (EPS) also surpassed analyst estimates by 32%.

The company's shares are down 22% from a week ago.

Balance Sheet Analysis

Just as investors must consider earnings, it is also important to take into account the strength of a company's balance sheet. We have a graphic representation of eGain's balance sheet and an in-depth analysis of the company's financial position.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:EGAN

eGain

Engages in the development, license, implementation, and support of its customer service infrastructure software solutions in North America, Europe, the Middle East, Africa, and the Asia Pacific.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026