- United States

- /

- Software

- /

- NasdaqGS:DOCU

How DocuSign’s (DOCU) Integration With ChatGPT Could Shape the Future of Intelligent Agreements

- DocuSign announced that its Intelligent Agreement Management (IAM) platform has been integrated into ChatGPT using the Model Context Protocol, allowing users and AI agents to seamlessly create, sign, and manage contracts within ChatGPT's interface.

- This collaboration significantly extends DocuSign's advanced agreement AI to ChatGPT's extensive global user base, potentially enhancing productivity and digital contract adoption across various industries.

- We'll explore how embedding DocuSign's IAM capabilities into ChatGPT could influence growth prospects in AI-powered agreement management.

Find companies with promising cash flow potential yet trading below their fair value.

DocuSign Investment Narrative Recap

To be a DocuSign shareholder, one needs confidence that adoption of digital workflows and agreement automation remains a persistent, long-term trend, and that DocuSign can successfully upsell customers from eSignature to its AI-native IAM platform. The ChatGPT collaboration aligns with this vision, potentially accelerating adoption, but it does not immediately offset the biggest short-term headwind: slowing revenue and billings growth as core markets mature. The most important risk remains the unclear pace and profitability of customer transition to IAM, now more important given intensifying competition.

The recent integration of Socure’s identity verification with DocuSign Identify directly supports the push for secure, seamless digital contracting, a key factor in customer confidence as AI tools proliferate. This effort is particularly relevant as regulatory scrutiny and data security expectations increase, reinforcing one of DocuSign’s clearest catalysts: enhanced compliance and risk management that can spur recurring revenue and higher retention as digital agreement management matures.

Yet, in contrast to early optimism, investors should also be aware that...

Read the full narrative on DocuSign (it's free!)

DocuSign's narrative projects $3.8 billion in revenue and $359.8 million in earnings by 2028. This requires 7.3% yearly revenue growth and an $78.8 million earnings increase from $281.0 million today.

Uncover how DocuSign's forecasts yield a $93.16 fair value, a 34% upside to its current price.

Exploring Other Perspectives

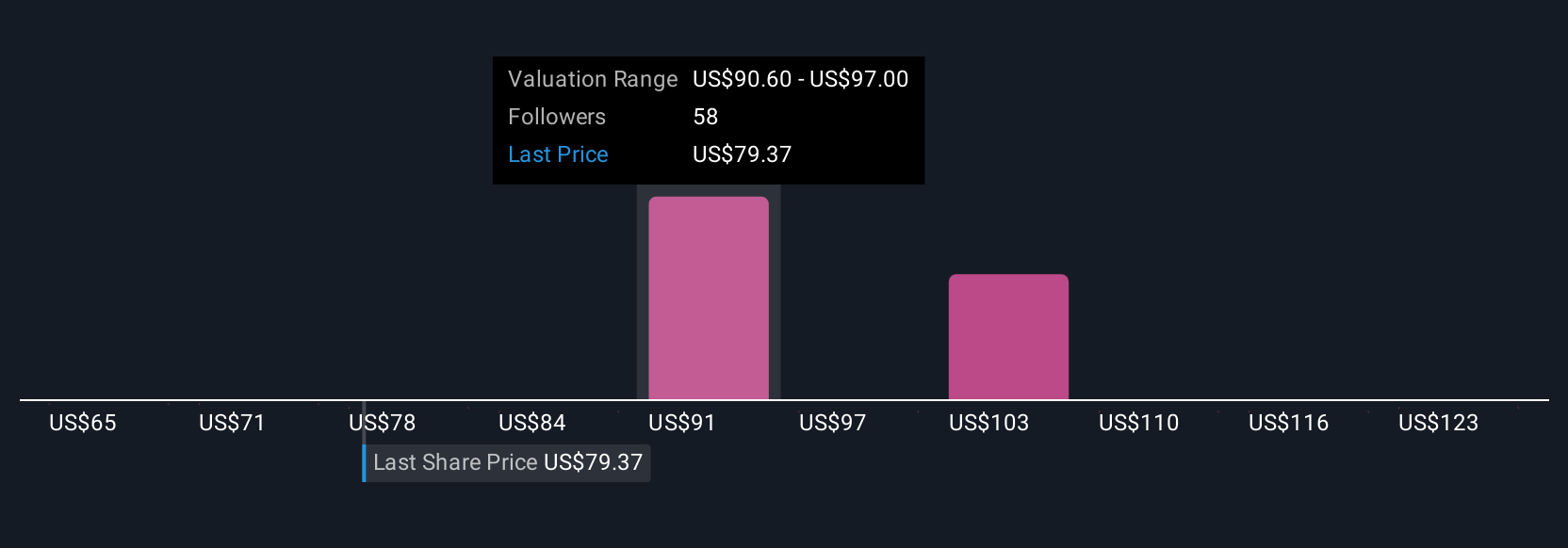

Six individual fair value estimates from the Simply Wall St Community put DocuSign’s range between US$77 and US$118 per share. While such diversity shows investor opinions can vary, slowing topline growth and tough competition remain top of mind for many weighing the company’s future performance.

Explore 6 other fair value estimates on DocuSign - why the stock might be worth just $77.00!

Build Your Own DocuSign Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DocuSign research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free DocuSign research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DocuSign's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DOCU

DocuSign

Provides electronic signature solution in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Lexaria Bioscience's Breakthrough with DehydraTECH to Revolutionize Drug Delivery

SIrios Resources (SOI) is significantly undervalued on a risk-adjusted basis.

BSX after Penumbra ?

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<b>Reported:</b> Revenue growth: 2024 → 2025 sharp increase of approx. 165%. Assuming moderate annual growth of 40%, a fair value in three years would be approx. $170. Given the customer base and the story, this should be possible. I find the most valuable “property” particularly interesting, as it solves the electricity problem.

Recent News (January 2026): The company has recently made headlines at CES 2026 for its claims regarding a revolutionary solid-state battery. While the tech has drawn significant investment and interest, it has also faced skepticism from some industry experts who are waiting for independent verification of their "miracle" battery performance. They are actually located in Vilnius and Kaunas, Lithuania.