- United States

- /

- Software

- /

- NasdaqGS:DOCU

Even after rising 7.2% this past week, DocuSign (NASDAQ:DOCU) shareholders are still down 59% over the past three years

DocuSign, Inc. (NASDAQ:DOCU) shareholders should be happy to see the share price up 18% in the last month. Meanwhile over the last three years the stock has dropped hard. In that time, the share price dropped 59%. So it's good to see it climbing back up. Perhaps the company has turned over a new leaf.

On a more encouraging note the company has added US$781m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

Check out our latest analysis for DocuSign

DocuSign wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years, DocuSign saw its revenue grow by 31% per year, compound. That's well above most other pre-profit companies. The share price has moved in quite the opposite direction, down 17% over that time, a bad result. This could mean hype has come out of the stock because the losses are concerning investors. But a share price drop of that magnitude could well signal that the market is overly negative on the stock.

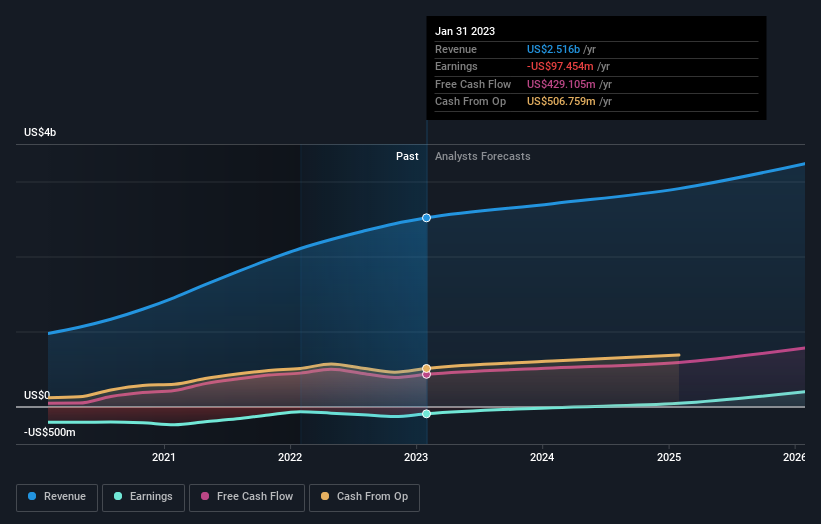

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

DocuSign is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling DocuSign stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

Investors in DocuSign had a tough year, with a total loss of 35%, against a market gain of about 0.8%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 0.4% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. If you would like to research DocuSign in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:DOCU

DocuSign

Provides electronic signature solution in the United States and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives