- United States

- /

- Software

- /

- NasdaqGS:DOCU

DocuSign (NasdaqGS:DOCU) Appoints New Chief Information Security Officer

Reviewed by Simply Wall St

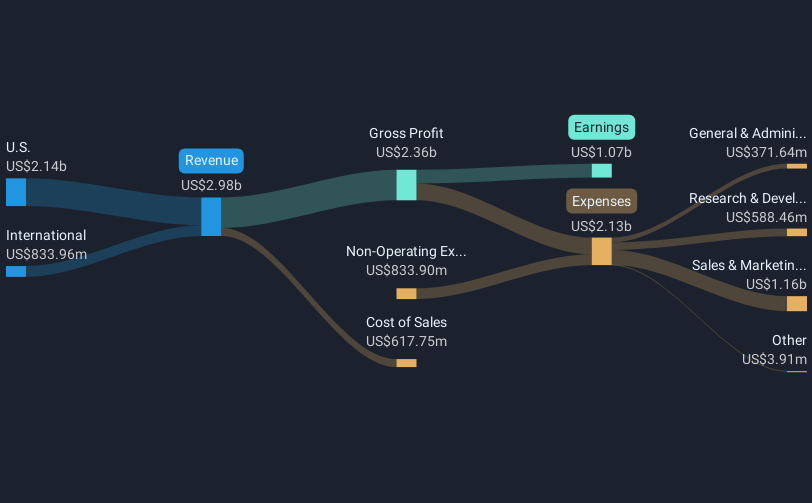

DocuSign (NasdaqGS:DOCU) recently launched the DocuSign CLM Connector for Coupa and appointed Michael Adams as the new Chief Information Security Officer. These updates coincide with the company experiencing a 22% share price increase last month. While these developments likely enhanced investor confidence, the company's price movement mirrors broader market trends, which have seen a 12% climb over the past year and a 4% increase in the last seven days. DocuSign's innovations and strategic leadership changes may have supported its ascent, harmonizing with the generally positive market momentum.

We've identified 2 risks for DocuSign that you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

DocuSign's recent initiatives, including the launch of its CLM Connector for Coupa and Michael Adams' appointment as Chief Information Security Officer, could enhance operational capabilities and investor sentiment. Over the past year, the company's shares posted a total return of 51.25%, showcasing strength and potential resilience, especially compared to the broader market's 11.6% return. This indicates a strong rebound in DocuSign's stock, outpacing its industry peers, which recorded a 17.8% return over the same period.

The introduction of Intelligent Agreement Management is anticipated to significantly impact revenue and earnings forecasts, as analysts expect international markets and SMB segments to see enhanced growth. However, projected challenges, such as fluctuating profit margins and operational impacts, remain a concern. With a current share price of US$81.65, closely aligned with but still 11% below the consensus price target of US$91.74, the potential for upward movement remains, reflecting cautious optimism among analysts. Investors are advised to keep a watchful eye on these developments and how they might alter future valuations and forecasts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade DocuSign, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DOCU

DocuSign

Provides electronic signature solution in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives