- United States

- /

- Software

- /

- NasdaqGS:DOCU

DocuSign (DOCU) Is Up 7.9% After Announcing AI-Powered Customer Support Upgrade – What's Changed

Reviewed by Simply Wall St

- Earlier this week, DocuSign announced it will implement Coveo's AI-Search and Generative Answering solutions to enhance its customer support operations, aiming to improve self-service and workflow efficiency.

- This move signals a focused effort by DocuSign to optimize operational efficiency and customer satisfaction through advanced technology, following its recent achievement of profitability.

- We'll explore how DocuSign's AI-driven customer support transformation could influence its long-term growth prospects and investment narrative.

DocuSign Investment Narrative Recap

To be a DocuSign shareholder today, you need to believe the company can drive growth by deepening automation and AI in its agreement lifecycle platform, while maintaining operating discipline and finding new ways to scale globally. The recent announcement of integrating Coveo's AI solutions will likely strengthen customer support and operational efficiency, but does not directly impact the most important near-term catalyst: broader adoption and monetization of Intelligent Agreement Management (IAM). The core risk remains surrounding execution of new AI initiatives and their adoption in the market.

DocuSign's launch of AI-powered contract agents earlier this year stands out as a relevant move in its push toward AI-enabled workflow efficiency. This announcement paired with the partnership with Coveo highlights a continued emphasis on making agreement processes faster, smarter, and easier, which aligns with the focus on recurring revenue growth and improved customer experience.

However, it's worth noting that operational risks related to cloud migration could still affect near-term gross margins, so investors should keep an eye on…

Read the full narrative on DocuSign (it's free!)

DocuSign's narrative projects $3.7 billion revenue and $328.0 million earnings by 2028. This requires 7.4% yearly revenue growth and a $772 million decrease in earnings from $1.1 billion today.

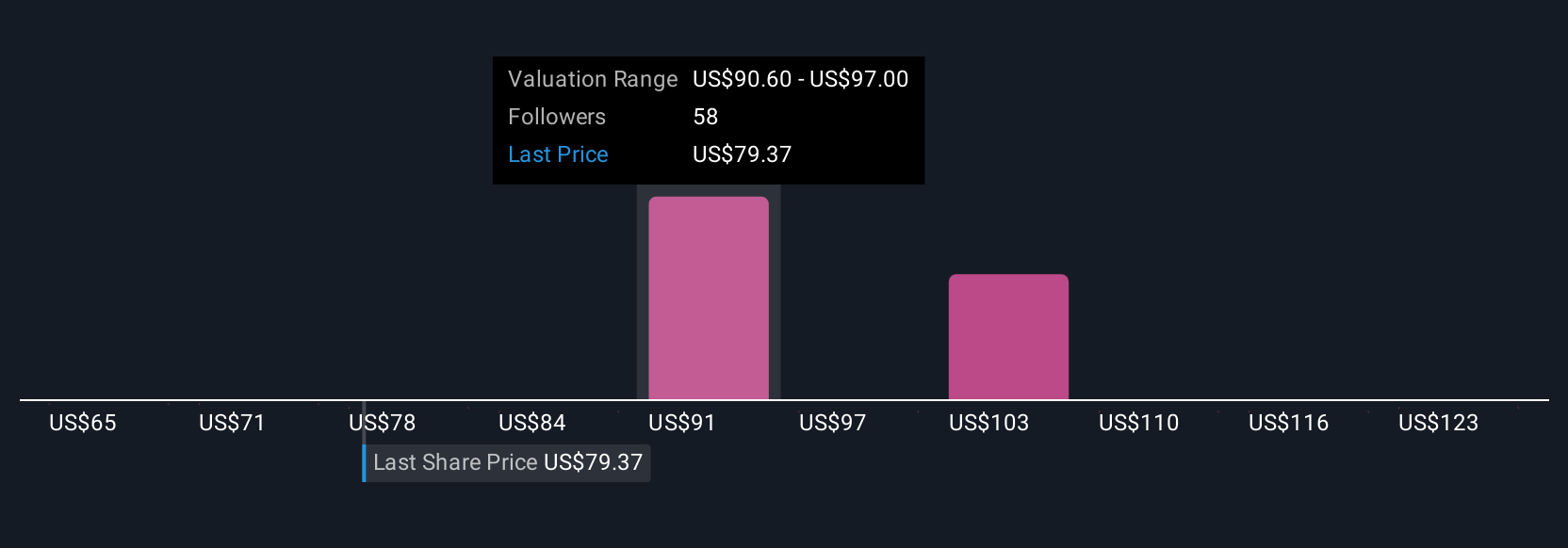

Uncover how DocuSign's forecasts yield a $93.16 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members put DocuSign’s fair value between US$65 and US$129, with 7 different estimates. While forecasts vary, the focus on accelerating IAM platform adoption could influence how new technology investments are received in the coming quarters, be sure to explore a range of perspectives before making up your mind.

Build Your Own DocuSign Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DocuSign research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free DocuSign research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DocuSign's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DOCU

DocuSign

Provides electronic signature solution in the United States and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives