- United States

- /

- Software

- /

- NasdaqCM:DJCO

US Market's Undiscovered Gems Three Small Caps With Potential

Reviewed by Simply Wall St

The United States market has shown positive momentum, with a 1.2% increase over the last week and a 7.7% rise over the past year, while earnings are projected to grow by 14% annually. In this environment, identifying small-cap stocks with strong fundamentals and growth potential can offer investors unique opportunities to capitalize on these trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Teekay | NA | -0.89% | 62.53% | ★★★★★★ |

| Solesence | 33.45% | 23.87% | -3.75% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Innovex International | 2.58% | 42.69% | 44.34% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Greenfire Resources | 39.33% | 22.94% | -38.12% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Daily Journal (NasdaqCM:DJCO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Daily Journal Corporation operates as a publisher of newspapers and websites in California, Arizona, Utah, and Australia with a market cap of $526.63 million.

Operations: Daily Journal Corporation generates revenue primarily from its Journal Technologies segment, contributing $54.61 million, and its Traditional Business segment, adding $17.03 million. The company's financial performance is reflected in its net profit margin trends over recent periods.

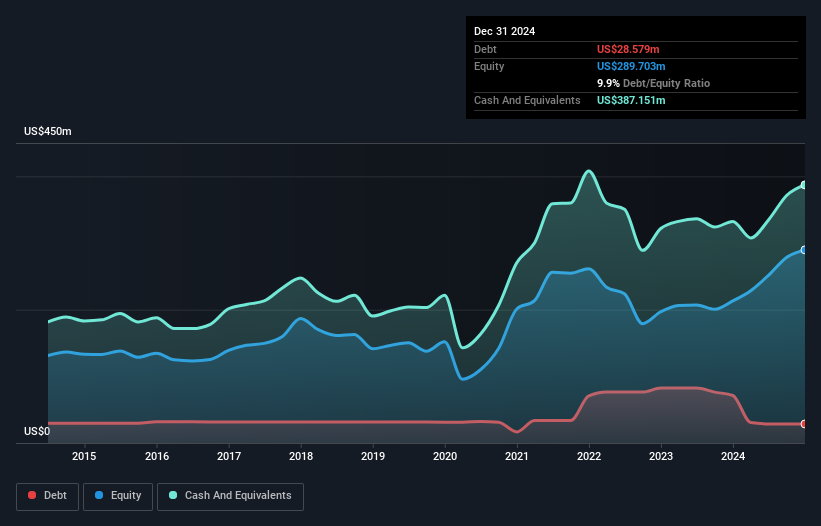

Daily Journal Corporation, a smaller player in the market, has shown significant financial shifts. Its price-to-earnings ratio of 7.1x is notably below the US market average of 17.2x, suggesting potential undervaluation. Over five years, DJCO's debt-to-equity ratio improved from 20.6% to 9.9%, indicating stronger financial positioning with more cash than total debt. Earnings surged by an impressive 370% last year, boosted by a $94.9M one-off gain which also impacted net income figures recently reported at $10.9M for Q1 compared to $12.62M previously; however, delayed SEC filings could raise some concerns about transparency and reporting timelines.

- Navigate through the intricacies of Daily Journal with our comprehensive health report here.

Review our historical performance report to gain insights into Daily Journal's's past performance.

Innovex International (NYSE:INVX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Innovex International, Inc. designs, manufactures, sells, and rents mission-critical engineered products to the oil and natural gas industry worldwide with a market capitalization of $1.04 billion.

Operations: Innovex International generates revenue through the design, manufacture, sale, and rental of engineered products for the oil and natural gas industry. The company's financial performance is influenced by its ability to manage production costs effectively while optimizing its revenue streams.

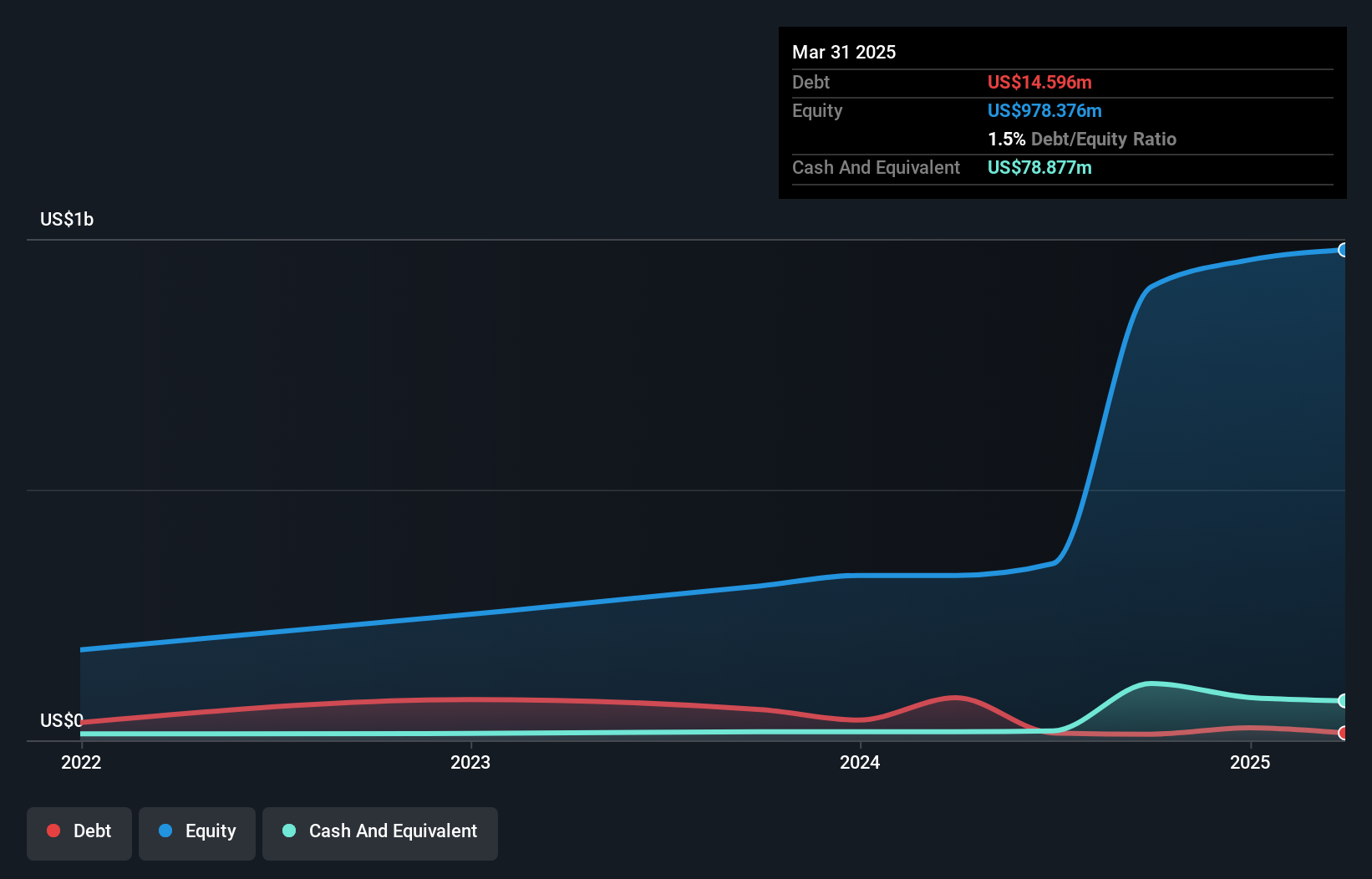

Innovex International, a nimble player in the energy services sector, reported impressive earnings growth of 97.3% over the past year, outpacing industry peers. The company enjoys a robust financial position with its interest payments well covered by EBIT at 37.9 times and more cash than total debt, indicating prudent fiscal management. Despite a one-off gain of US$51 million impacting recent results, Innovex's free cash flow turned positive at US$93.7 million as of March 2025. With shares trading significantly below estimated fair value and an active share repurchase program worth up to US$100 million underway, Innovex presents intriguing potential for investors seeking undervalued opportunities in the market.

- Click here to discover the nuances of Innovex International with our detailed analytical health report.

Evaluate Innovex International's historical performance by accessing our past performance report.

Oil-Dri Corporation of America (NYSE:ODC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Oil-Dri Corporation of America, along with its subsidiaries, specializes in the development, manufacturing, and marketing of sorbent products both domestically and internationally, with a market capitalization of approximately $643.28 million.

Operations: Oil-Dri's revenue primarily comes from its Retail and Wholesale Products segment, generating $298.43 million, while the Business to Business Products segment contributes $166.91 million.

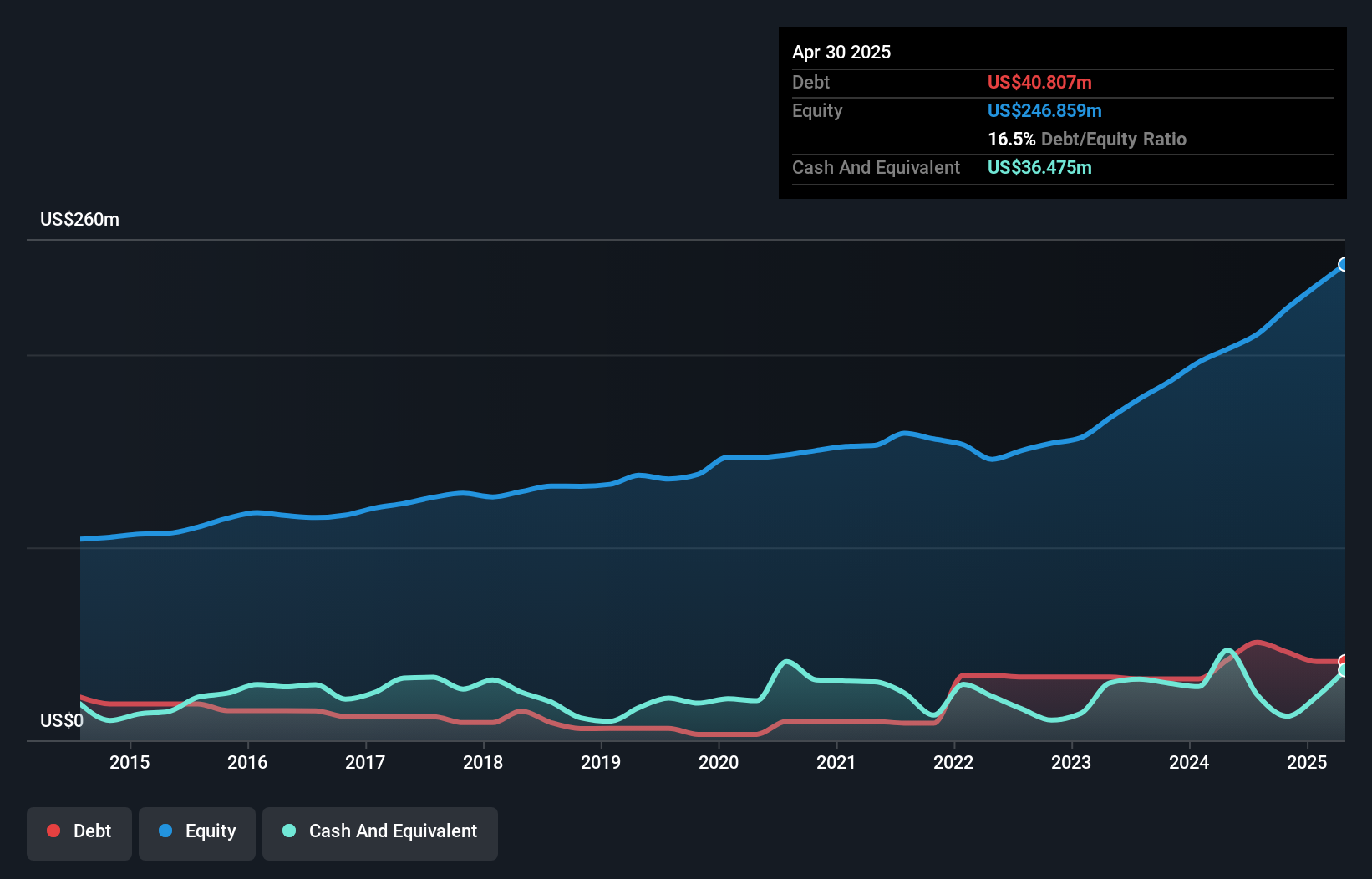

Oil-Dri Corporation of America, a compact player in the household products sector, is currently trading at 79.7% below its estimated fair value, suggesting potential undervaluation. Over the past year, its earnings grew by 6.5%, outpacing the industry average of 2.4%. The company’s net debt to equity ratio stands at a satisfactory 7.7%, with interest payments well covered by EBIT at a multiple of 34.8x. Recent executive changes include Jonathan Blake's appointment as Corporate Controller to bolster accounting and finance functions, while product innovations continue to drive growth in lightweight cat litter offerings like Cat’s Pride Micro Crystal Litter and Antibacterial Clumping Litter.

Where To Now?

- Click through to start exploring the rest of the 280 US Undiscovered Gems With Strong Fundamentals now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:DJCO

Daily Journal

Daily Journal Corporation publishes newspapers and websites covering in California, Arizona, Utah, and Australia.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion