- United States

- /

- Software

- /

- NasdaqCM:DGNX

Diginex (NasdaqCM:DGNX): Assessing Valuation as ESG Alliance Signals New Growth in Digital Asset Compliance

Reviewed by Simply Wall St

Diginex (NasdaqCM:DGNX) just made a move that might get investors talking. The company’s new alliance with Valuit Technology is more than a routine partnership. It signals Diginex’s entry into the growing world of sustainability project verification for digital assets. By integrating robust ESG metrics into tokenized securities, Diginex aims to improve transparency, risk mitigation, and compliance for blockchain-based investments, opening doors to a fresh segment of the market.

This development comes at a time when Diginex’s stock has been showing compelling growth. Over the past month, shares have risen more than 51%, and momentum is even more pronounced over the past three months with a 72% gain. Even with a nearly 10% jump since the start of the year, these numbers suggest investor interest is building, possibly fueled by recent forays into new verticals and technologies.

So, with Diginex expanding its reach and recent gains catching attention, the real question becomes whether this represents an undervalued opportunity or if the market has already factored in the company’s next phase of growth.

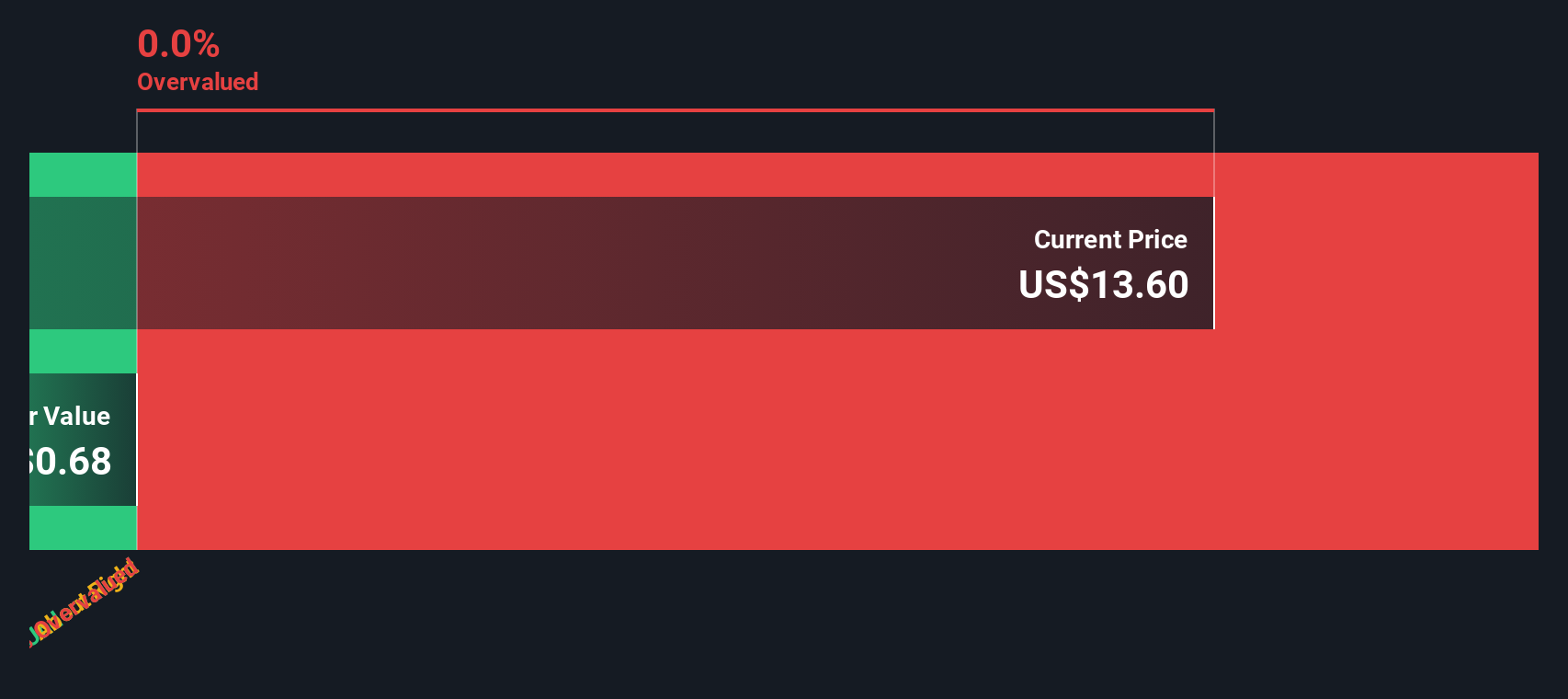

Price-to-Book of 403.6x: Is it justified?

Diginex stands out as significantly overvalued based on its price-to-book ratio, far exceeding typical valuation levels seen in the US Software industry.

The price-to-book ratio compares a company’s current market valuation to its book value, or net asset value. For technology and software companies, this metric highlights how much investors are willing to pay above the firm’s net assets, often reflecting growth prospects, profitability, and brand value.

With Diginex trading at a price-to-book multiple of 403.6x, compared to the industry average of 3.8x, the market is pricing in extremely optimistic expectations. This may not align with the company’s current unprofitable status and modest revenue base. Such a high multiple suggests that investors are either banking on a dramatic turnaround or are potentially overpaying for future growth that is not yet materialized.

Result: Fair Value of $2M (OVERVALUED)

See our latest analysis for Diginex.However, persistent losses and a limited revenue base remain key risks that could challenge expectations for Diginex's continued valuation growth.

Find out about the key risks to this Diginex narrative.Another View: What About Cash Flow?

Looking at Diginex through our DCF model, there simply is not enough data to estimate a fair intrinsic value. Without this cash flow perspective, are investors missing a hidden opportunity or a lurking pitfall?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Diginex Narrative

If you have your own perspective or want to interpret the numbers differently, you can shape a personalized view of Diginex with just a few clicks: Do it your way.

A great starting point for your Diginex research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Broaden your opportunity set beyond Diginex. If you want to stay ahead of trends and catch the next breakout, smart investors act before the crowd does. Check out these handpicked stock ideas designed to inspire your next move:

- Spot undervalued gems that could be flying under the radar by scanning the market for undervalued stocks based on cash flows trading well below their true worth.

- Take advantage of next-generation healthcare breakthroughs by tracking healthcare AI stocks at the intersection of artificial intelligence and medicine.

- Capture growth before it hits the mainstream by pinpointing penny stocks with strong financials with impressive financial strength and high upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:DGNX

Diginex

An investment holding company, engages in the provision of environmental, social, and governance (ESG) reporting solution services, advisory, and developing customization solutions in Hong Kong, the United Kingdom, and the United States.

Adequate balance sheet with low risk.

Market Insights

Community Narratives