- United States

- /

- Biotech

- /

- NasdaqGS:IBRX

US High Growth Tech Stocks to Watch in March 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 3.1%, yet it remains up by 13% over the past year with earnings anticipated to grow by 14% per annum in the coming years. In this dynamic environment, identifying high growth tech stocks involves focusing on companies that demonstrate strong innovation potential and adaptability to maintain momentum amidst fluctuating market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 25.26% | 29.10% | ★★★★★★ |

| TG Therapeutics | 26.19% | 37.78% | ★★★★★★ |

| Alkami Technology | 21.95% | 85.17% | ★★★★★★ |

| Travere Therapeutics | 28.43% | 65.01% | ★★★★★★ |

| AVITA Medical | 27.78% | 55.33% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.90% | 58.64% | ★★★★★★ |

| Applied Optoelectronics | 58.93% | 141.15% | ★★★★★★ |

| Zai Lab | 28.38% | 65.73% | ★★★★★★ |

| Lumentum Holdings | 21.24% | 119.37% | ★★★★★★ |

Click here to see the full list of 236 stocks from our US High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Rhythm Pharmaceuticals (NasdaqGM:RYTM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rhythm Pharmaceuticals, Inc. is a commercial-stage biopharmaceutical company dedicated to developing therapies for rare neuroendocrine diseases, with a market capitalization of approximately $3.31 billion.

Operations: Rhythm Pharmaceuticals focuses on developing and commercializing therapies for patients with rare neuroendocrine diseases, generating $130.13 million in revenue from these activities.

Rhythm Pharmaceuticals, despite its current unprofitability, is on a trajectory to profitability within three years, with an impressive forecasted annual revenue growth rate of 39.2%. This growth is significantly higher than the US market average of 8.5% per year and outpaces the Biotech industry's earnings growth rate of 40.2%. The company's strategic focus on rare genetic disorders of obesity has led to the FDA approval expansion for IMCIVREE® for younger patients, highlighting its commitment to addressing unmet medical needs. Moreover, recent filings indicate plans for a $132 million Shelf Registration, suggesting potential future capital raising activities to fuel ongoing research and development efforts.

- Unlock comprehensive insights into our analysis of Rhythm Pharmaceuticals stock in this health report.

Explore historical data to track Rhythm Pharmaceuticals' performance over time in our Past section.

Datadog (NasdaqGS:DDOG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Datadog, Inc. provides an observability and security platform for cloud applications globally, with a market capitalization of approximately $38.79 billion.

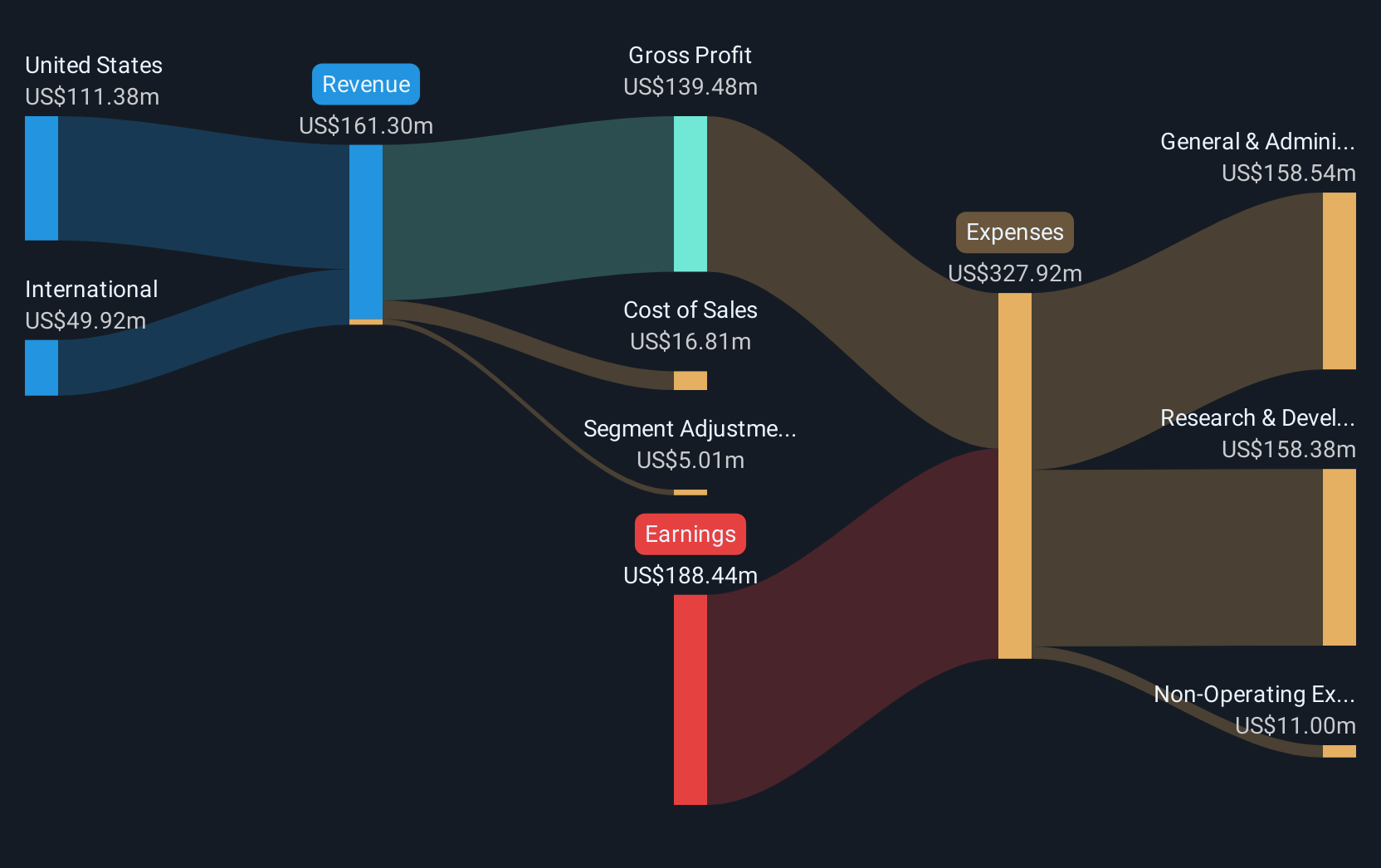

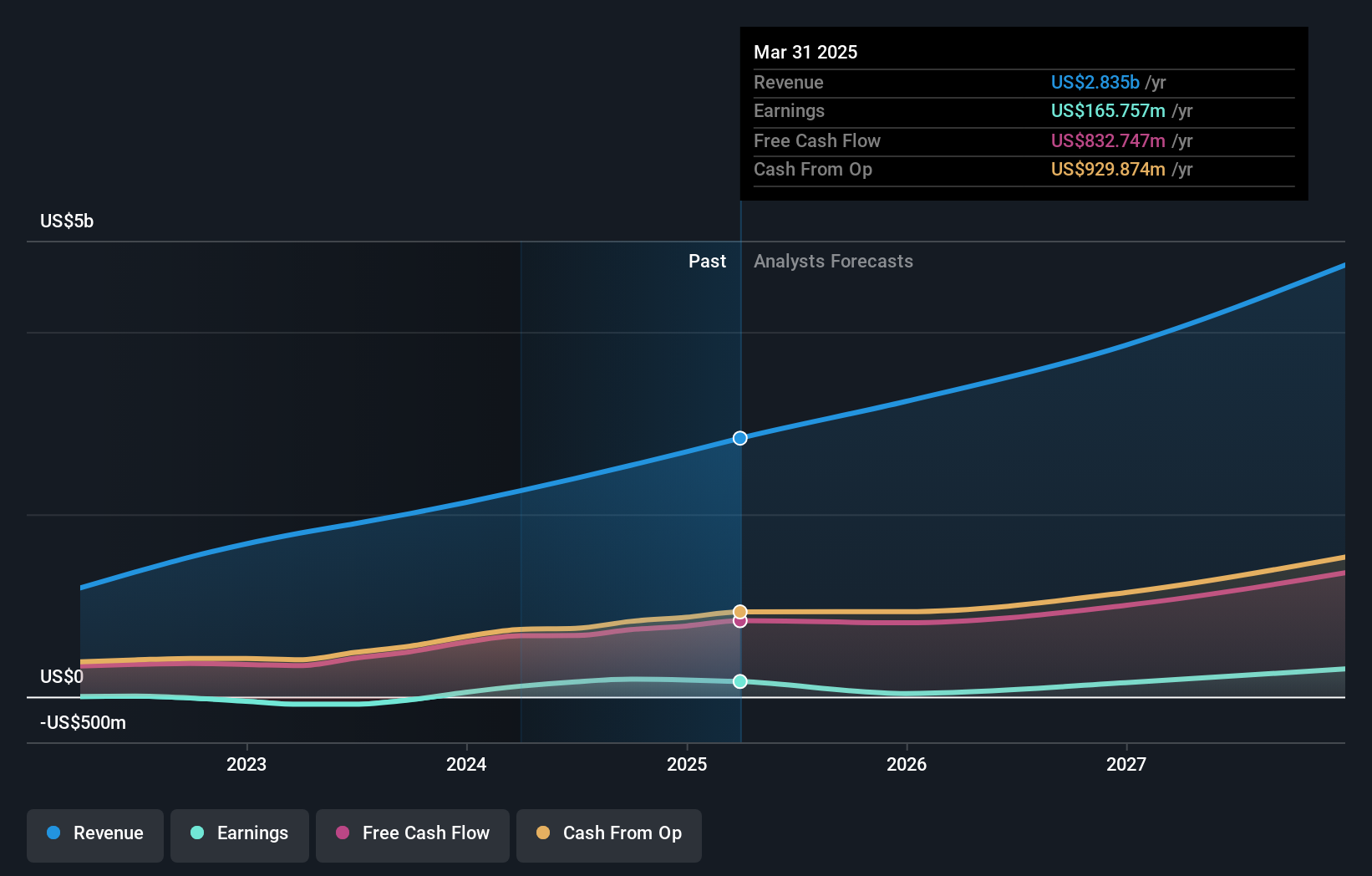

Operations: The company generates revenue primarily from its IT Infrastructure segment, amounting to $2.68 billion. The business focuses on providing a comprehensive platform for cloud application observability and security across various regions.

Datadog has demonstrated robust growth with a notable 278.3% increase in earnings over the past year, outstripping the software industry's average of 28.2%. This performance is underpinned by significant R&D investments, which have fueled innovations and enhancements in their monitoring and analytics platform. With expected annual revenue growth of 15.4%, surpassing the US market's 8.5%, and projected earnings growth of 19.6% per year, Datadog continues to expand its market presence aggressively. Recent strategic moves include a substantial fixed-income offering totaling $870 million, positioning them for further expansion and technological advancements within the competitive tech landscape.

- Click to explore a detailed breakdown of our findings in Datadog's health report.

Gain insights into Datadog's historical performance by reviewing our past performance report.

ImmunityBio (NasdaqGS:IBRX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ImmunityBio, Inc. is a clinical-stage biotechnology company focused on developing therapies and vaccines to enhance the immune system against cancers and infectious diseases, with a market cap of approximately $2.43 billion.

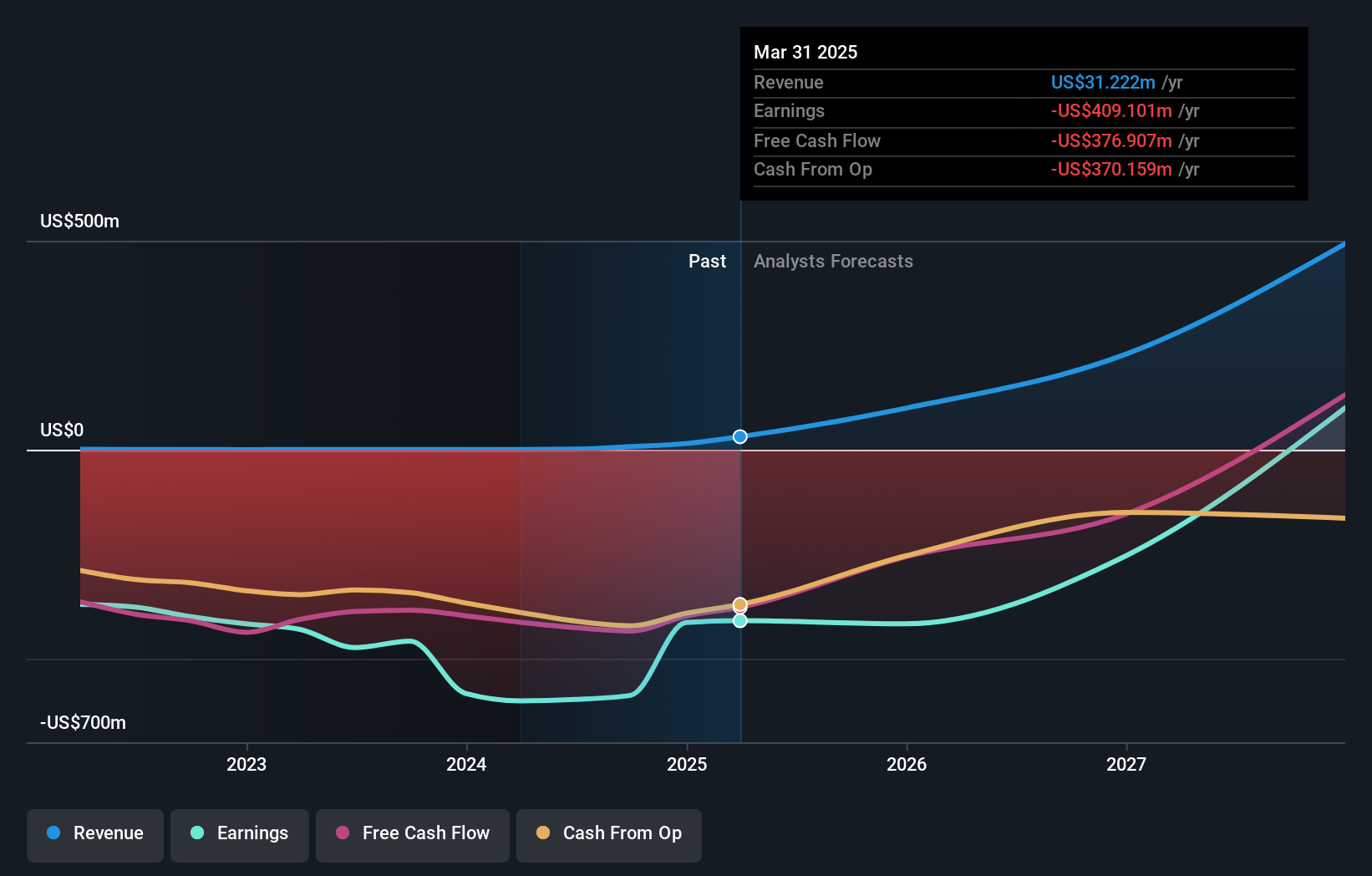

Operations: ImmunityBio focuses on developing immune-enhancing therapies and vaccines for cancer and infectious diseases, generating revenue primarily from its biotechnology segment, which reported $14.75 million.

ImmunityBio has shown a significant turnaround, with its annual revenue surging from $0.622 million to $14.75 million, marking an impressive growth trajectory in the biotech sector. This leap is underpinned by strategic FDA approvals and expanded access programs that enhance its market presence in oncological treatments. Despite a substantial net loss reduction from $583.2 million to $413.56 million year-over-year, the company maintains robust investment in R&D to innovate and advance their pipeline, crucial for long-term success in highly competitive therapeutic areas like bladder cancer and NSCLC (non-small cell lung cancer). These efforts are poised to potentially transform patient outcomes through novel immunotherapies that stimulate immune responses at multiple stages of disease progression.

- Click here to discover the nuances of ImmunityBio with our detailed analytical health report.

Understand ImmunityBio's track record by examining our Past report.

Where To Now?

- Embark on your investment journey to our 236 US High Growth Tech and AI Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IBRX

ImmunityBio

A commercial stage biotechnology company, develops next-generation therapies that bolster the natural immune systems to defeat cancers and infectious diseases.

High growth potential low.

Similar Companies

Market Insights

Community Narratives