- United States

- /

- Software

- /

- NasdaqGS:DDOG

Growth may not be Enough: How Datadog (DDOG) Is Ahead of Competitors in both Good and Bad Metrics

Reviewed by Michael Paige

Summary:

- Datadog has an amazing 79%+ growth and great profitability fundamentals.

- The company is priced at a 12.2x forward Price to Sales, while competitors range from 3.6x to 8x.

- In order for the valuation to hold, the company may need to become the market leader and stave off competition from large cloud providers.

Datadog (NASDAQ:DDOG) is captivating investors with its high 79% revenue growth rate, and an estimated total addressable market (TAM) value of $53b by 2025. However, the company has a forward price to sales ratio of 14.3x, which is ahead of the 7.9x industry average ratio. In order for this to work for investors, the company must keep up its high performance for more than 6 quarters to reach the average, when it can afford to have lower growth rates.

Today, we will review Datadog's fundamentals and compare it with some key competitors.

View our latest analysis for Datadog

The Business

Datadog is a monitoring service for cloud-based applications, providing visibility into the performance and health of systems. It offers features such as performance monitoring, alerts, and dashboards. Datadog's business model is to provide a cloud-based monitoring and analytics platform. The platform includes a hosted SaaS service, an on-premises software agent, and a public API. In practical terms, this is what businesses can use to see if all systems are operational, and address incidents across their IT infrastructure.

Fundamentals

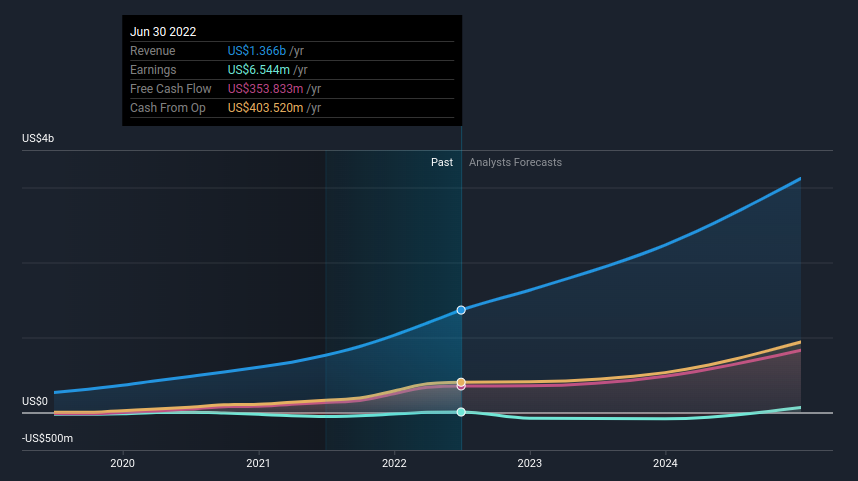

The company has $1.366b revenue in the last 12 months, with analysts estimating that number to reach $2.232 in 2024. The company has a gross margin of 79%, an operating cash flow margin of 29.5%, and a free cash flow margin of 25.8%. This indicates the possibility for high potential future profitability, as analysts are hoping that the net margin converges close to the FCF margin in the future.

The chart below shows how analysts envision the future of Datadog's income:

Competition

The business model of Datadog isn't new, and the company has competition. Here is a rundown of some of the key peers involved in the app and data observability segment:

Splunk Inc. (NASDAQ:SPLK)

Splunk is a $13.2b market cap company, trading at a 3.6x forward price to sales ratio.

It delivers and operationalizes insights from the data generated by digital systems. The company uses the Splunk Platform, a real-time data collection, analytics and management solution.

New Relic (NYSE:NEWR)

New Relic is a $3.7b market cap company, trading at a 3.8x forward price to sales ratio.

It provides a platform for developers to monitor the performance of their web applications. It gives them insight into how applications are performing in real time and provides tools for troubleshooting and optimization.

Dynatrace (NYSE:DT)

Dynatrace is $9.3b market cap stock, trading at a 7.9x forward price to sales ratio.

It provides detailed insights into the performance of applications and helps troubleshoot issues. Dynatrace also provides information on the health of applications and the overall system performance.

PagerDuty (NYSE:PD)

The $2b market cap company is trading at a forward Price to Sales ratio of 4.9x.

PagerDuty is an on-call management and incident response platform that helps organizations improve their agility and resilience. It provides a single platform for coordinating all of an organization's response efforts. The company also offers a comprehensive set of features for managing incidents, such as incident escalation policies, response playbooks, and post-incident reviews.

What This Means For Investors

When we compare Datadog to other companies, we see that it is comparatively overpriced at a 14.3x forward price to sales ratio, vs closer peers that range from 3.6x to 8x. With a TAM of $53b, Datadog has to not only grow, but take future market share from these competitors and become a 10%+ market leader in the observability space. Additionally, it must find a way to stave off large cloud competitors such as AWS, G-Cloud, and Azure, which may decide to offer observability solutions at more competitive prices.

Datadogs answer to these risks is innovation, as the company hopes to enact barriers to entry by creating hard to replicate and valuable software for businesses. When evaluating the company, investors need to ask how replicable the software really is, before getting caught up in the high growth rates.

With all that in mind, while it is great seeing the company over perform on growth, it may have an expensive and risky valuation. Investors that are bullish on the industry, may consider a better risk allocation or possibly a better entry point for the stock.

Taking an in-depth view of risks, we've identified 3 warning signs for Datadog that you should be aware of before investing.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:DDOG

Datadog

Operates an observability and security platform for cloud applications in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives