- United States

- /

- Software

- /

- NasdaqGS:DBX

What Dropbox (DBX)'s New $1.5 Billion Buyback and Debt Refi Reveal for Shareholders

Reviewed by Sasha Jovanovic

- Dropbox recently announced its third-quarter 2025 financial results reporting date and disclosed that its Chief Accounting Officer sold 1,066 shares of company stock last week under a pre-arranged plan.

- A standout insight is Dropbox’s introduction of a US$1.5 billion buyback program and the securing of up to US$700 million in credit to refinance upcoming debt, following financial results that exceeded analyst expectations.

- We'll consider how Dropbox's large-scale share buyback plan and debt refinancing shape the company’s investment narrative moving forward.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Dropbox Investment Narrative Recap

Dropbox’s investment case centers on whether the company can offset ongoing user and revenue declines by growing its newer productivity tools and increasing monetization of its large free user base. The announcement of a US$1.5 billion buyback program and the securing of up to US$700 million in credit do not materially impact the most important short-term catalyst, the successful adoption and monetization of AI-driven products, nor do they address the key risk of user and ARPU contraction from market saturation and competition.

Of the recent news, the buyback plan stands out as most relevant, reflecting the company's focus on returning capital to shareholders as it manages through revenue pressure. While this supports share price in the short term, it does not directly affect the core challenge of revitalizing user growth or mitigating competitive headwinds in the cloud storage and productivity space.

By contrast, investors should also be aware that shrinking ARPU and ongoing pricing pressure could become a bigger issue as...

Read the full narrative on Dropbox (it's free!)

Dropbox's outlook anticipates $2.5 billion in revenue and $494.6 million in earnings by 2028. This implies a -1.1% annual revenue decline and a $9.2 million increase in earnings from the current level of $485.4 million.

Uncover how Dropbox's forecasts yield a $28.12 fair value, a 3% downside to its current price.

Exploring Other Perspectives

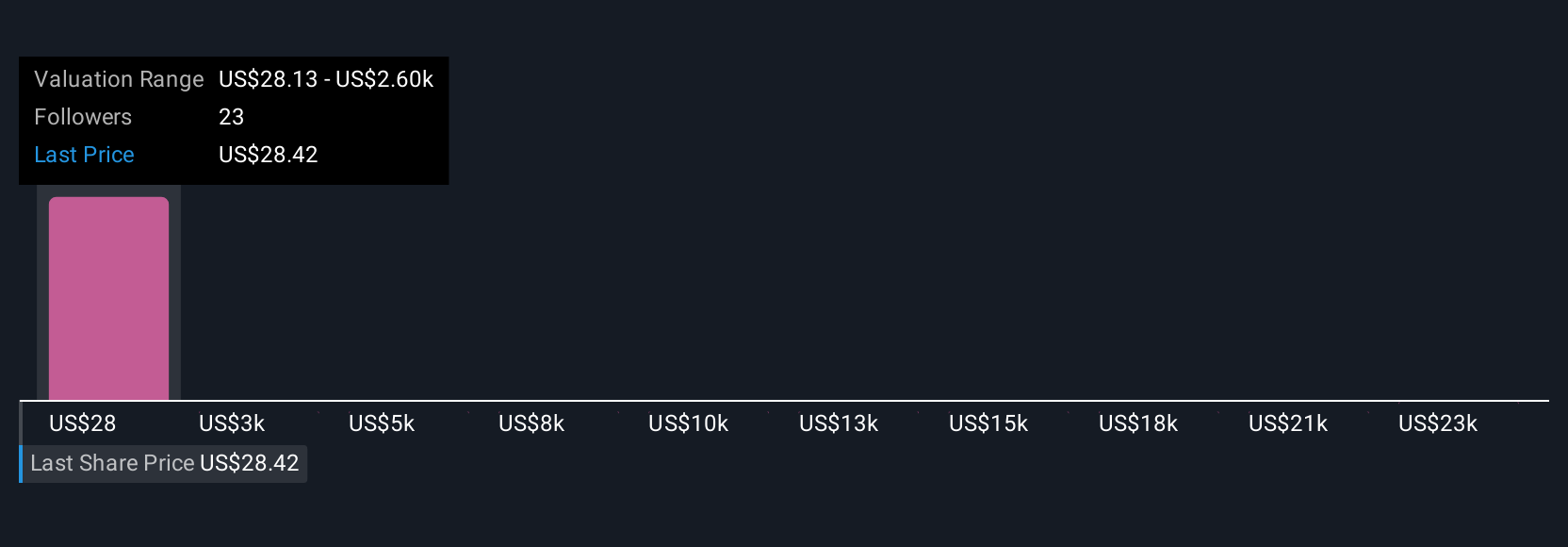

Four fair value estimates from the Simply Wall St Community range from US$28.13 up to an extreme US$25,709.96 per share. While you weigh such varied views, consider that ongoing declines in paying users and ARPU may shape Dropbox’s performance more than any single financial maneuver, explore how others are seeing the risks and opportunities today.

Explore 4 other fair value estimates on Dropbox - why the stock might be a potential multi-bagger!

Build Your Own Dropbox Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dropbox research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Dropbox research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dropbox's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DBX

Dropbox

Provides a content collaboration platform in the United States and internationally.

Undervalued with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion