- United States

- /

- Software

- /

- NasdaqGS:DBX

How Dropbox’s Major Share Buyback and Profit Gains Could Reshape Capital Strategy for DBX Investors

Reviewed by Simply Wall St

- Dropbox recently completed a repurchase of 23,942,239 shares for US$657.15 million under its buyback program announced in December 2024, while also releasing its second quarter results showing net income of US$125.6 million on revenue of US$625.7 million, compared to a year ago.

- This combination of strengthened profitability despite slightly lower revenue, along with significant share buybacks, marks a pivotal period for Dropbox’s capital allocation and operational focus.

- We'll explore how Dropbox’s improved earnings amid continued share repurchases influences the longer-term investment narrative for the business.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Dropbox Investment Narrative Recap

To own Dropbox stock, you need to believe that margin improvements and operational discipline can offset pressure from declining revenue and intense competition, while new AI and product initiatives gradually begin to add value. The recent share repurchases and profitability gains are positive signs, but they do not appear to materially shift the immediate catalyst of turning around user and revenue trends, nor do they address the risk of continued top-line pressure.

Among the recent announcements, Dropbox's Q2 2025 results stand out: net income improved to US$125.6 million despite revenue dipping marginally to US$625.7 million from a year ago. This reinforces the notion that efficiency and cost controls may be supporting earnings even as the company continues to grapple with subdued user and revenue momentum.

However, against these operational improvements, investors should be aware that pricing pressure and declining average revenue per user remain unresolved issues that could weigh on future growth if...

Read the full narrative on Dropbox (it's free!)

Dropbox's outlook anticipates $2.5 billion in revenue and $494.6 million in earnings by 2028. This reflects a 1.1% annual revenue decline and a modest $9.2 million increase in earnings from the current $485.4 million.

Uncover how Dropbox's forecasts yield a $28.12 fair value, in line with its current price.

Exploring Other Perspectives

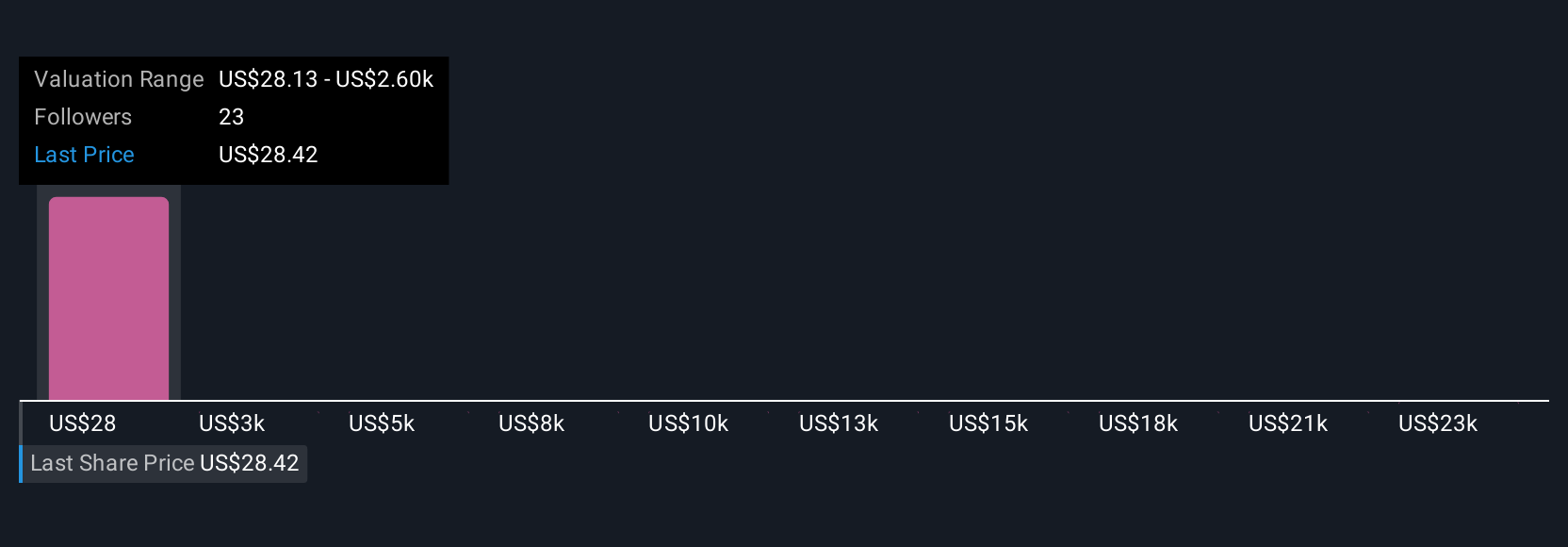

Community fair value estimates for Dropbox from Simply Wall St members span a broad range, from US$28.13 to US$25,709.96, reflecting four contrasting outlooks. With ongoing revenue headwinds and a shrinking user base among the core risks flagged by analysts, these diverse perspectives invite you to engage with a variety of alternative opinions on the company’s future.

Explore 4 other fair value estimates on Dropbox - why the stock might be a potential multi-bagger!

Build Your Own Dropbox Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dropbox research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Dropbox research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dropbox's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 26 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DBX

Dropbox

Provides a content collaboration platform in the United States and internationally.

Undervalued with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion