- United States

- /

- Software

- /

- NasdaqGS:DBX

Dropbox, Inc. Beat Analyst Estimates: See What The Consensus Is Forecasting For This Year

Last week saw the newest first-quarter earnings release from Dropbox, Inc. (NASDAQ:DBX), an important milestone in the company's journey to build a stronger business. Revenues were US$631m, approximately in line with whatthe analysts expected, although statutory earnings per share (EPS) crushed expectations, coming in at US$0.39, an impressive 60% ahead of estimates. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on Dropbox after the latest results.

See our latest analysis for Dropbox

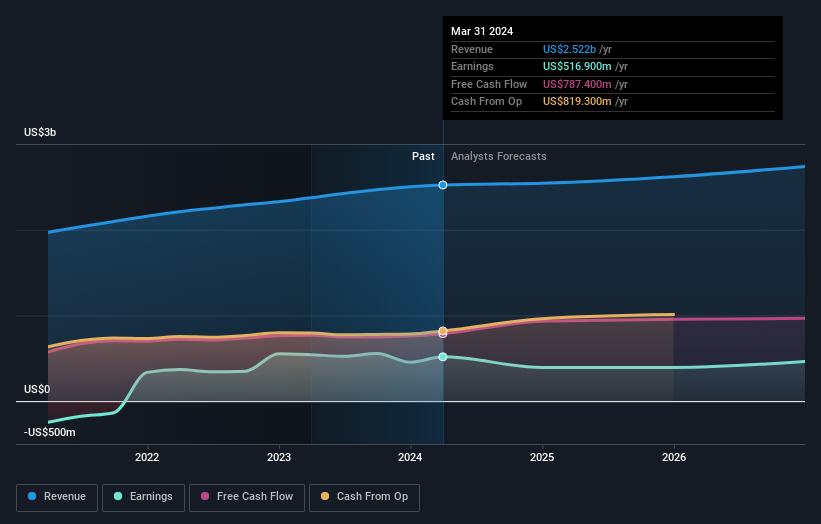

Following last week's earnings report, Dropbox's eleven analysts are forecasting 2024 revenues to be US$2.54b, approximately in line with the last 12 months. Statutory earnings per share are expected to tumble 23% to US$1.18 in the same period. In the lead-up to this report, the analysts had been modelling revenues of US$2.55b and earnings per share (EPS) of US$0.97 in 2024. Although the revenue estimates have not really changed, we can see there's been a sizeable expansion in earnings per share expectations, suggesting that the analysts have become more bullish after the latest result.

The consensus price target was unchanged at US$29.00, implying that the improved earnings outlook is not expected to have a long term impact on value creation for shareholders. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on Dropbox, with the most bullish analyst valuing it at US$36.00 and the most bearish at US$22.00 per share. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. We would highlight that Dropbox's revenue growth is expected to slow, with the forecast 1.1% annualised growth rate until the end of 2024 being well below the historical 11% p.a. growth over the last five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 13% per year. So it's pretty clear that, while revenue growth is expected to slow down, the wider industry is also expected to grow faster than Dropbox.

The Bottom Line

The biggest takeaway for us is the consensus earnings per share upgrade, which suggests a clear improvement in sentiment around Dropbox's earnings potential next year. Fortunately, the analysts also reconfirmed their revenue estimates, suggesting that it's tracking in line with expectations. Although our data does suggest that Dropbox's revenue is expected to perform worse than the wider industry. The consensus price target held steady at US$29.00, with the latest estimates not enough to have an impact on their price targets.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have forecasts for Dropbox going out to 2026, and you can see them free on our platform here.

You still need to take note of risks, for example - Dropbox has 3 warning signs (and 1 which is significant) we think you should know about.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:DBX

Dropbox

Provides a content collaboration platform in the United States and internationally.

Undervalued with questionable track record.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Superintelligence Pivot: Meta’s $135 Billion Bet on the Energy-Compute Nexus

The Privacy Fortress: Apple’s Lean AI Path and the $100 Billion Buyback Engine

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.