- United States

- /

- Software

- /

- NasdaqGS:DBX

Dropbox (DBX): Fresh Earnings Optimism Sparks New Look at Valuation

Reviewed by Kshitija Bhandaru

Dropbox (DBX) has caught the market’s attention as several analysts recently raised their profit estimates. This reflects renewed optimism ahead of its upcoming earnings release. Investors are watching closely to see if the business momentum continues.

See our latest analysis for Dropbox.

Dropbox’s share price has seen some volatility in recent weeks, with a one-day drop of 3.57% and a 30-day decline of 8.4%, even as business expectations remain upbeat. Despite these short-term moves, its one-year total shareholder return stands at 8.61%. The three-year total return is an impressive 39.46%, highlighting momentum that’s persisted longer term.

If Dropbox’s performance has you rethinking your next move, now’s your chance to explore fast growing stocks with high insider ownership.

Yet with shares trading just below analyst price targets and profitability on the rise, the key question is whether Dropbox remains undervalued at these levels or if the market has already taken its future growth into account.

Most Popular Narrative: Fairly Valued

Dropbox’s last close of $28.13 sits almost exactly at the fair value calculated in the most-followed narrative, offering little room for mispricing. This sets up a clear case: does the current business transformation justify this equilibrium?

The planned expansion and deeper integration of AI-driven productivity tools (Dash), including upcoming self-serve offerings and seamless bundling with Dropbox's existing file sync-and-share product, position the company to capture higher ARPU and accelerate recurring revenue growth as digital transformation and hybrid work drive demand for intelligent, collaborative cloud platforms.

Want to uncover what’s really driving Dropbox’s rock-steady valuation? The real story here leans on bold assumptions about long-term user trends and new revenue streams. The numbers behind this narrative might catch you off guard. Find out what could tip the balance next.

Result: Fair Value of $28.13 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent revenue declines and intensifying competition from big tech rivals could quickly challenge Dropbox’s growth story and alter current expectations.

Find out about the key risks to this Dropbox narrative.

Another View: SWS DCF Model Shows a Different Story

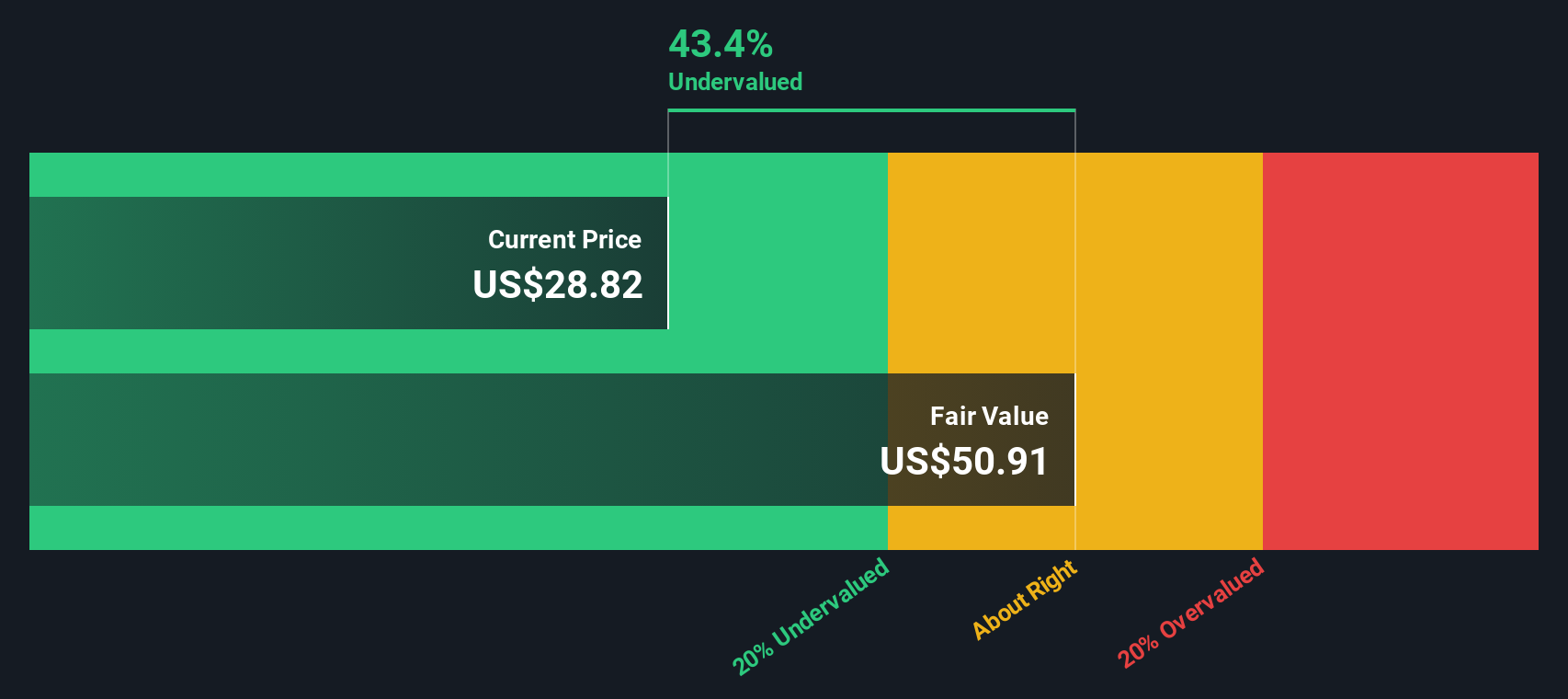

While multiples suggest Dropbox is fairly valued, our DCF model paints a sharply different picture. According to the SWS DCF model, Dropbox shares are trading nearly 45% below their estimated fair value. This deep disconnect raises the stakes: could the market be overlooking a real opportunity, or is there a reason for caution?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Dropbox Narrative

If you want to dig into the details or trust your own perspective over consensus, shaping your own take on Dropbox can be done in minutes. Why not Do it your way?

A great starting point for your Dropbox research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Expand your watchlist and give yourself a real edge by finding standout opportunities before the crowd does. Don’t let the next big winner slip away.

- Spot market underdogs with real turnaround potential as you browse these 904 undervalued stocks based on cash flows, delivering value that many overlook.

- Catch the AI-powered trend early by checking out these 24 AI penny stocks, positioned at the forefront of smart innovation and automation.

- Maximize income potential and ride steady growth with these 19 dividend stocks with yields > 3%, offering yields above the market average.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DBX

Dropbox

Provides a content collaboration platform in the United States and internationally.

Undervalued with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion