- United States

- /

- Software

- /

- NasdaqGS:CVLT

How Investors May Respond To Commvault Systems (CVLT) $785 Million Convertible Note Offering and Funding Strategy

Reviewed by Simply Wall St

- Commvault Systems recently completed a US$785 million convertible zero-coupon senior unsecured note offering due September 15, 2030, with BofA Securities, MUFG Securities, Morgan Stanley, and Mizuho Securities joining as co-lead underwriters.

- The addition of multiple leading financial institutions as co-lead underwriters underscores the market's willingness to support Commvault's funding strategy and signals confidence in the company's long-term business objectives.

- We'll now explore how this significant convertible bond issuance may shape Commvault's investment narrative, especially its impact on capital structure and growth plans.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Commvault Systems Investment Narrative Recap

To be a Commvault Systems shareholder today, you have to believe that accelerating enterprise demand for cyber resilience, particularly in hybrid and cloud-centric data protection, can translate into sustainable revenue and ARR expansion, despite the near-term risk of margin compression as the business shifts to SaaS and absorbs acquisitions. The recent US$785 million convertible zero-coupon note issuance appears to strengthen the balance sheet but does not materially change the primary short-term catalyst of sustained ARR growth or the biggest risk around future net margin pressure from the subscription transition.

Among the company's latest product launches, the introduction of HyperScale Edge and Flex is particularly interesting, given Commvault’s push to expand its addressable market in hybrid and edge environments, closely tied to the current narrative about securing new areas of growth and recurring revenue, even as the subscription/SaaS mix pressures profitability.

Yet, on the other hand, investors should not overlook the margin impact of...

Read the full narrative on Commvault Systems (it's free!)

Commvault Systems' outlook anticipates $1.5 billion in revenue and $173.1 million in earnings by 2028. This is based on an annual revenue growth rate of 12.2% and an earnings increase of $92 million from the current earnings of $81.1 million.

Uncover how Commvault Systems' forecasts yield a $208.09 fair value, a 12% upside to its current price.

Exploring Other Perspectives

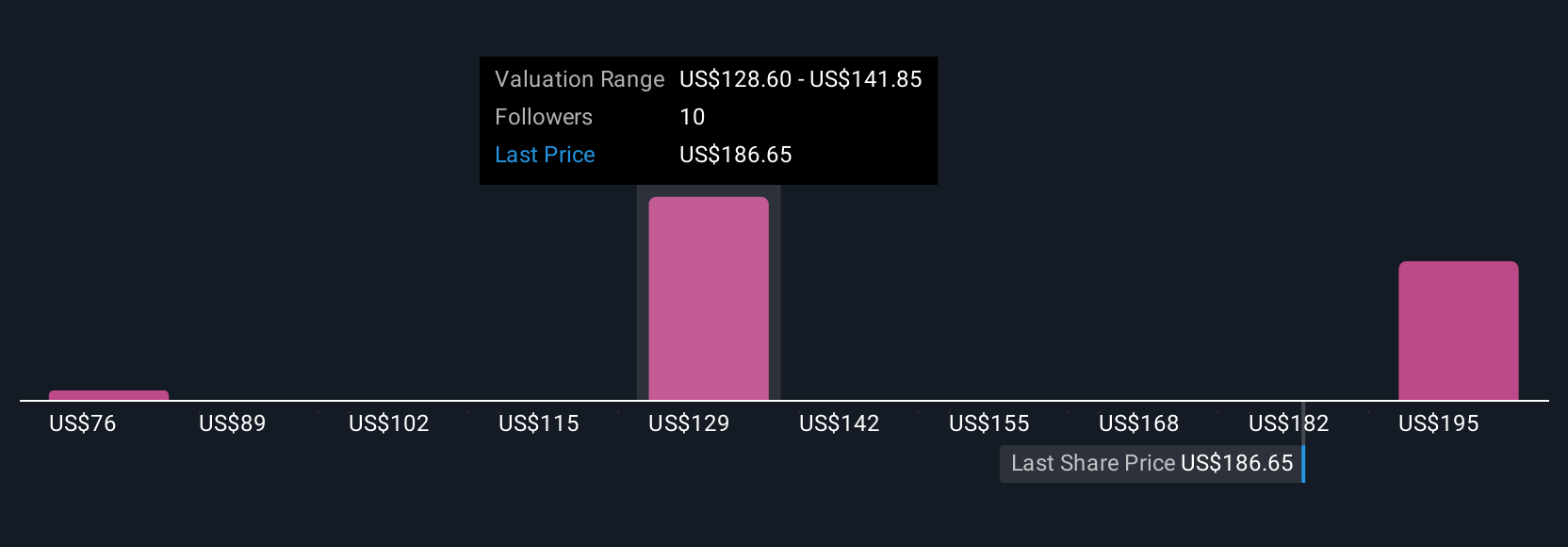

Fair value estimates from the Simply Wall St Community span from US$75.61 to US$208.09, across 4 viewpoints. Many expect robust ARR growth to persist, but opinions vary widely, reminding you to explore alternative views.

Explore 4 other fair value estimates on Commvault Systems - why the stock might be worth less than half the current price!

Build Your Own Commvault Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Commvault Systems research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Commvault Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Commvault Systems' overall financial health at a glance.

No Opportunity In Commvault Systems?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CVLT

Commvault Systems

Provides a cyber resilience platform for protecting and recovering data and cloud-native applications in the Americas and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives