- United States

- /

- Electronic Equipment and Components

- /

- NasdaqGS:CGNX

High Growth Tech Stocks In The US Market April 2025

Reviewed by Simply Wall St

The United States market has experienced a notable upswing, climbing 5.2% in the last week and showing a 9.9% increase over the past year, with earnings projected to grow by 14% annually in the coming years. In this dynamic environment, identifying high growth tech stocks involves focusing on companies that demonstrate robust innovation and adaptability to capitalize on these favorable market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.27% | 29.79% | ★★★★★★ |

| Alkami Technology | 20.46% | 85.16% | ★★★★★★ |

| Travere Therapeutics | 28.65% | 66.06% | ★★★★★★ |

| TG Therapeutics | 26.06% | 37.39% | ★★★★★★ |

| Arcutis Biotherapeutics | 26.11% | 58.46% | ★★★★★★ |

| Clene | 62.08% | 64.01% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.14% | 58.85% | ★★★★★★ |

| AVITA Medical | 27.81% | 55.17% | ★★★★★★ |

| Lumentum Holdings | 21.34% | 120.49% | ★★★★★★ |

| Ascendis Pharma | 32.75% | 59.64% | ★★★★★★ |

Click here to see the full list of 237 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Cognex (NasdaqGS:CGNX)

Simply Wall St Growth Rating: ★★★★☆☆

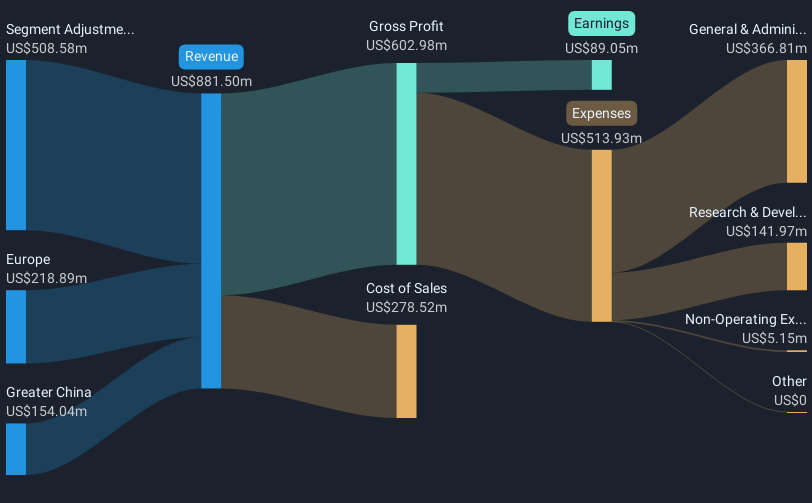

Overview: Cognex Corporation specializes in machine vision products that capture and analyze visual information to automate manufacturing and distribution tasks globally, with a market capitalization of $4.56 billion.

Operations: The company generates revenue primarily from its Machine Vision Technology segment, amounting to $914.52 million.

Cognex, a notable player in the tech sector, demonstrates robust growth prospects with an 8.3% annual revenue increase and a significant 20% expected annual earnings growth, outpacing the US market average. This performance is underpinned by strategic moves such as the recent promotion of Matthew Moschner to COO, enhancing leadership in key business areas like global engineering and product operations. The company's commitment to innovation is evident from its R&D expenditure trends which are crucial for maintaining competitive advantage in dynamic markets like logistics and semiconductor sectors. With recent executive changes and strategic acquisitions like Moritex, Cognex is poised to leverage its enhanced management capabilities and integrated technologies to tap into new market opportunities, ensuring sustained growth amidst evolving industry demands.

- Delve into the full analysis health report here for a deeper understanding of Cognex.

Gain insights into Cognex's historical performance by reviewing our past performance report.

Commvault Systems (NasdaqGS:CVLT)

Simply Wall St Growth Rating: ★★★★★☆

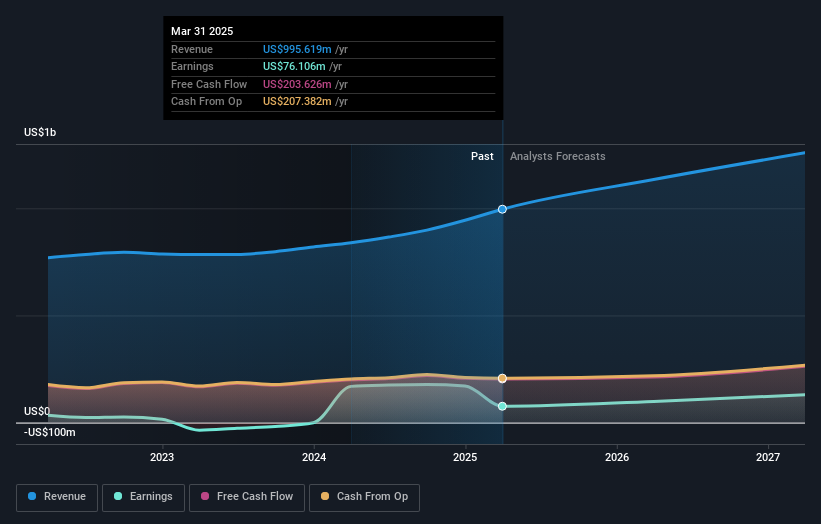

Overview: Commvault Systems, Inc. offers a platform focused on enhancing cyber resiliency through data protection services both in the United States and internationally, with a market cap of $7.30 billion.

Operations: Commvault Systems, Inc. specializes in data protection services that bolster cyber resiliency across global markets. The company operates with a market cap of approximately $7.30 billion, focusing on delivering solutions that safeguard critical information for businesses worldwide.

Amidst a challenging backdrop where Commvault Systems reported a net income drop to $76.11 million from the previous year's $168.91 million, its strategic maneuvers in cybersecurity paint a brighter picture for its trajectory. The firm's R&D focus is evident with significant investments leading to innovations like the Cleanroom Recovery technology, enhancing cyber resilience capabilities crucial in today’s digital landscape. Furthermore, partnerships like that with CrowdStrike amplify Commvault’s market position by integrating cutting-edge incident response services, which are vital as cyber threats escalate globally. With revenue expected to hit between $1,130 million and $1,140 million next fiscal year and earnings growth projected at 24% annually, Commvault is strategically poised to capitalize on growing demand for robust cyber defense mechanisms while navigating current financial headwinds effectively.

- Take a closer look at Commvault Systems' potential here in our health report.

Gain insights into Commvault Systems' past trends and performance with our Past report.

AbbVie (NYSE:ABBV)

Simply Wall St Growth Rating: ★★★★☆☆

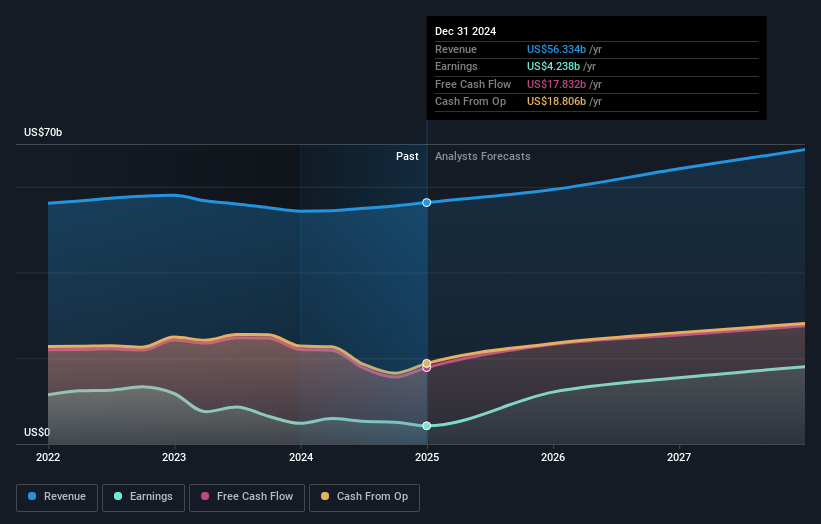

Overview: AbbVie Inc. is a research-based biopharmaceutical company that focuses on the research, development, manufacture, commercialization, and sale of medicines and therapies globally, with a market cap of approximately $340.25 billion.

Operations: AbbVie's primary revenue stream is derived from its Innovative Medicines and Therapies segment, generating $57.37 billion. The company operates globally in the biopharmaceutical sector, focusing on developing and commercializing medicines and therapies.

AbbVie's recent FDA approval for RINVOQ in treating giant cell arteritis underscores its commitment to expanding treatment landscapes, evidenced by a robust pipeline including the promising TrenibotE for aesthetic medicine. Despite a slight dip in Q1 earnings to $1.286 billion from last year's $1.369 billion, the company maintains strong sales growth, up significantly to $13.343 billion. This resilience is mirrored in their strategic R&D allocation, enhancing their competitive edge in biopharmaceuticals amidst dynamic market challenges and evolving healthcare needs.

- Click here and access our complete health analysis report to understand the dynamics of AbbVie.

Evaluate AbbVie's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Navigate through the entire inventory of 237 US High Growth Tech and AI Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Cognex, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CGNX

Cognex

Provides machine vision products that capture and analyze visual information to automate manufacturing and distribution tasks worldwide.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives