- United States

- /

- Software

- /

- NasdaqGS:CVLT

Examining Commvault Systems (CVLT) Valuation as Shares Hold Recent Gains

Reviewed by Kshitija Bhandaru

See our latest analysis for Commvault Systems.

Commvault Systems' share price has quietly built momentum in 2024, with a 19% year-to-date gain reflecting optimism around the company's execution and fundamentals. Over the longer term, the 1-year total shareholder return of 17.7% shows steady progress, suggesting that the recent dip may be a pause rather than a reversal in sentiment.

If you’re wondering what other fast-growing companies with strong insider ownership are catching attention lately, now is a perfect time to discover fast growing stocks with high insider ownership

With Commvault’s shares holding steady despite solid gains and analysts still projecting further upside, the key question is whether the market has already factored in future growth or if a genuine buying opportunity remains for investors.

Most Popular Narrative: 13.4% Undervalued

According to the most widely followed narrative, Commvault’s fair value is set at $208.09, which is notably above the recent closing price of $180.30. This creates a gap that raises questions about whether the market is underestimating the company’s future earnings potential.

Rapid expansion and successful cross-sell and upsell momentum within the SaaS (Metallic) platform, evidenced by 63% SaaS ARR growth, a 45% increase in multi-product customers, and 125% SaaS net dollar retention, point to continued improvement in the quality and predictability of future revenues. This directly supports margin expansion and higher earnings visibility.

Want to uncover what’s powering this ambitious valuation? The narrative’s bold projections rest on a blend of high-octane earnings forecasts, explosive recurring revenue momentum, and a future profitability level typically reserved for elite tech platforms. Curious how these assumptions stack up and what unique number drives this calculation? Dive deeper to see which fierce combination of growth factors puts Commvault in the crosshairs of strategic bulls.

Result: Fair Value of $208.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing margin compression from SaaS expansion and reliance on large, existing-customer deals could disrupt Commvault's promising trajectory.

Find out about the key risks to this Commvault Systems narrative.

Another View: Market Ratios Raise Questions

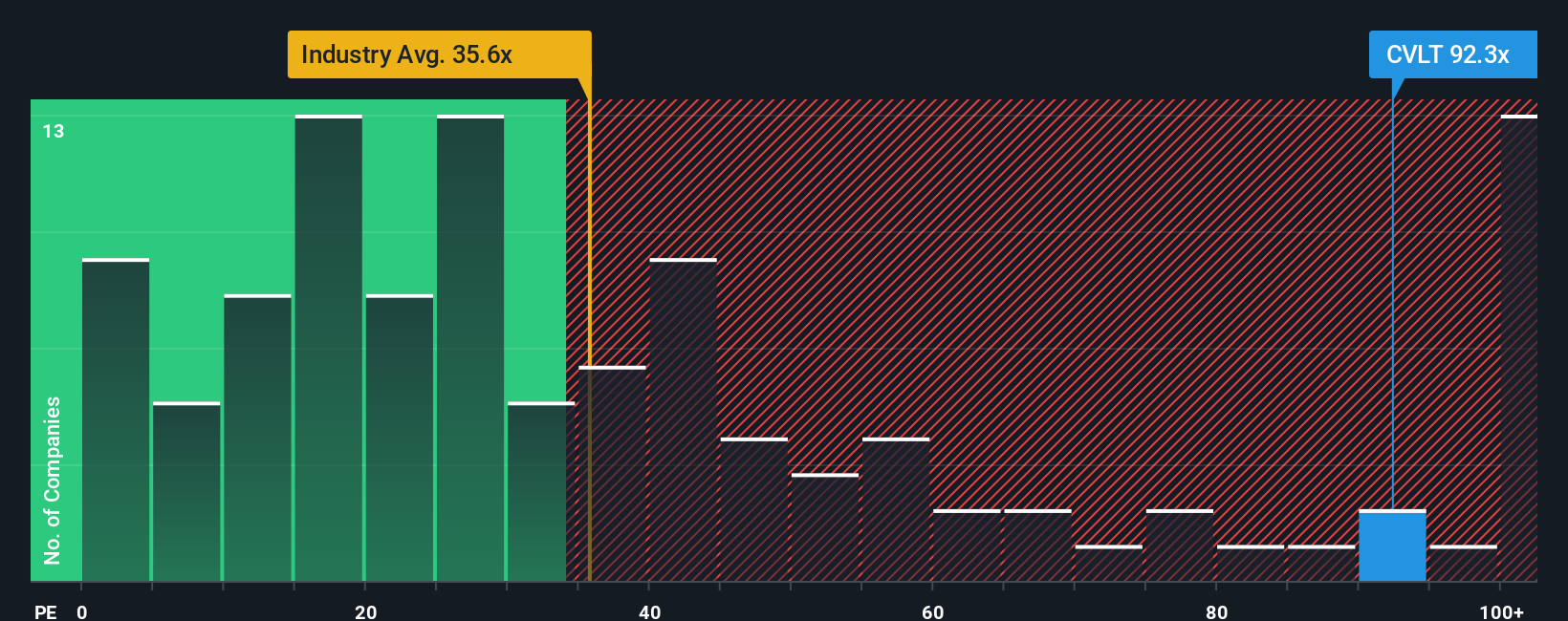

Looking at Commvault's valuation through the lens of its price-to-earnings ratio tells a different story. The shares currently trade at 98.9 times earnings, much higher than both the US Software industry average of 35.6 and peer average of 26.3. Even compared to its fair ratio of 40.4, the premium stands out and suggests cautious optimism from the market.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Commvault Systems Narrative

If the numbers above don't quite fit your outlook, take a look at the data for yourself and build your own story in just minutes. Do it your way

A great starting point for your Commvault Systems research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Expand your horizons beyond Commvault Systems by tapping into hand-picked stocks that match strong growth, innovation, and smart fundamentals. Don't miss out on top opportunities. See what else could transform your portfolio today.

- Tap into powerful long-term returns with resilient income plays by checking out these 19 dividend stocks with yields > 3% that offer yields above 3%.

- Capture the next wave of healthcare breakthroughs and AI-powered advancement by starting with these 31 healthcare AI stocks reshaping medical technology.

- Seize your chance to spot value before the market catches on by exploring these 901 undervalued stocks based on cash flows driven by real underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CVLT

Commvault Systems

Provides a cyber resilience platform for protecting and recovering data and cloud-native applications in the Americas and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives