- United States

- /

- Software

- /

- NasdaqGS:CVLT

Commvault Systems (CVLT): Evaluating Valuation After Recent Share Price Decline

See our latest analysis for Commvault Systems.

Commvault Systems’ share price has retreated noticeably over the past month, with a 1-month share price return of -11.29% and a year-to-date decline of -18.81%, reflecting softer momentum after last year’s run. Even so, its long-term story remains strong, with the 3-year total shareholder return up 90.32% and an impressive 148.89% total return for those who held on for five years. This pattern suggests recent caution around growth or risk, though the company’s fundamental progress has fueled substantial gains for long-term investors.

If you’re looking for the next potential outperformers, now is a good time to broaden your investing horizons and discover fast growing stocks with high insider ownership

So the question for investors now is clear: with long-term gains but a substantial recent pullback, is Commvault Systems trading at a bargain, or are investors already anticipating the company’s future growth in its share price?

Most Popular Narrative: 36% Undervalued

Compared to Commvault Systems’ last close of $123.50, the consensus narrative assigns a much higher fair value, signaling significant potential upside if those projections hold true. The narrative’s thesis is rooted in the company’s momentum in subscription-based revenue and its position as a cyber resilience platform, but the story is far from straightforward.

Rapid expansion and successful cross-sell/upsell momentum within the SaaS (Metallic) platform, as evidenced by 63% SaaS ARR growth, a 45% increase in multi-product customers, and 125% SaaS net dollar retention, point to continued improvement in the quality and predictability of future revenues. This directly supports margin expansion and higher earnings visibility.

Want to know what’s driving this bullish outlook? There is one striking revenue and margin trajectory at the core of the narrative, seen only by digging into future projections. Explore the full analysis to see the key assumptions behind this remarkable valuation.

Result: Fair Value of $193.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shorter contract durations and pressure on profit margins could challenge Commvault Systems’ ability to sustain its current rate of growth and earnings predictability.

Find out about the key risks to this Commvault Systems narrative.

Another View: High Valuation Risk on Earnings Ratio

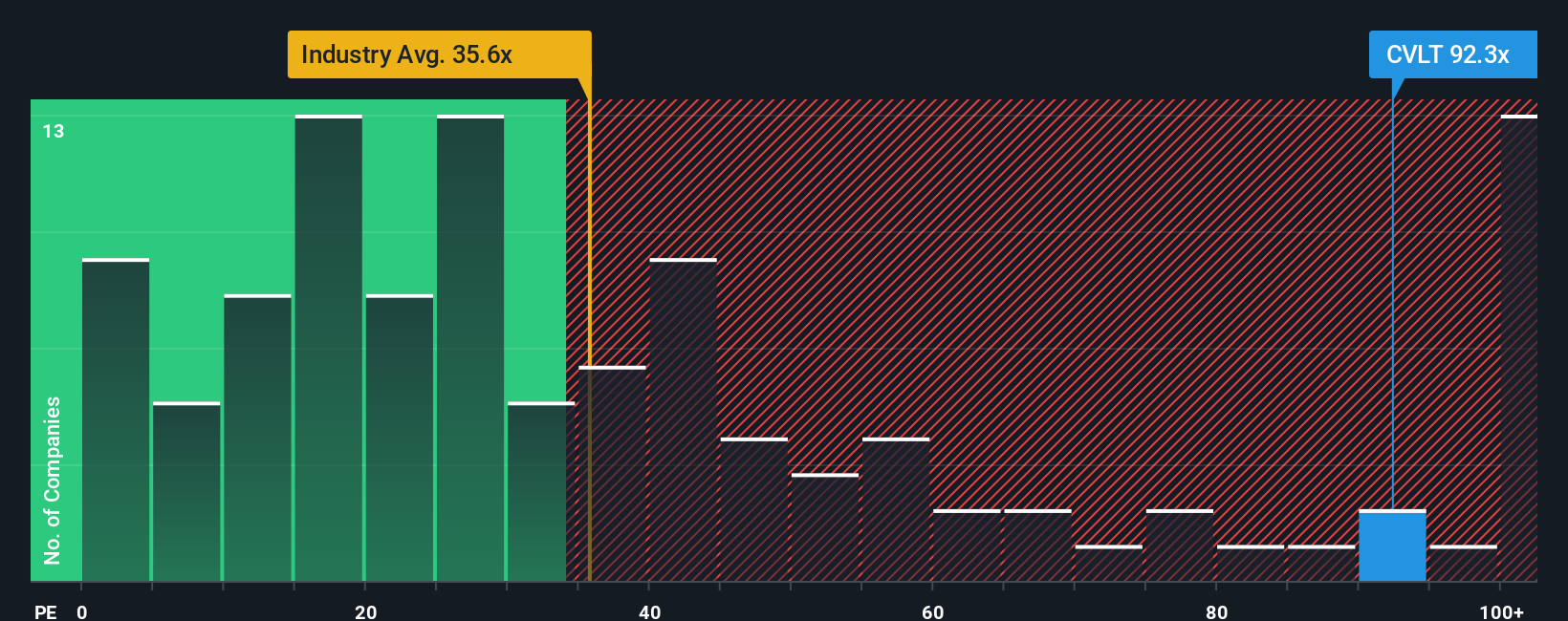

Looking from a different angle, Commvault Systems trades at a price-to-earnings ratio of 67.9x, which is much higher than both the industry average of 31.8x and the peer average of 47.1x. The fair ratio, which is what the market could eventually move towards, is 33x. This large gap suggests current investors may be paying a premium that could compress if expectations soften, raising the stakes for anyone betting on more growth ahead.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Commvault Systems Narrative

If you'd rather investigate the figures and form your own conclusions, you have the tools to build a personalized view in just a few minutes. Do it your way

A great starting point for your Commvault Systems research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you want to stay ahead of the curve, use the power of the Simply Wall Street Screener and tap into fresh opportunities others could miss.

- Spot companies at the forefront of artificial intelligence by tapping into these 25 AI penny stocks to see which innovators are reshaping the tech landscape.

- Boost your portfolio's yield and security by selecting from these 15 dividend stocks with yields > 3% with solid financials and payouts above 3%.

- Uncover undervalued gems poised for strong growth by sifting through these 914 undervalued stocks based on cash flows based on robust cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CVLT

Commvault Systems

Provides a cyber resilience platform for protecting and recovering data and cloud-native applications in the Americas and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Delta loses shine after warning of falling travel demand, but still industry leader

Project Ixian Accelerated Rollout will Drive Valuation Expansion to £0.0150.

EU#5 - From Industrial Giant to the Digital Operating System of the Real World

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The Strategic Revaluation of Adobe: A Critical Analysis of Market Sentiment

Trending Discussion