- United States

- /

- IT

- /

- NasdaqGS:CTSH

Did Cognizant's (CTSH) Third Forbes Best Employer Win Subtly Strengthen Its Competitive Edge?

Reviewed by Sasha Jovanovic

- In the past week, Cognizant was recognized by Forbes as one of the World's Best Employers for 2025 for the third consecutive year, highlighting the company's strong workplace reputation and commitment to employee support. This consistent external recognition demonstrates Cognizant's sustained focus on ethical standards and its ability to attract and retain global talent.

- This positive employer branding, bolstered by international accolades, can drive increased interest from both investors and prospective employees, supporting Cognizant's market position and growth initiatives.

- We'll explore how Cognizant's repeated recognition by Forbes as a top employer influences its investment narrative and competitive advantage.

Find companies with promising cash flow potential yet trading below their fair value.

Cognizant Technology Solutions Investment Narrative Recap

To invest in Cognizant, you need to believe in its ability to balance steady growth via technology-driven services with ongoing challenges from automation and fierce competition. The recent Forbes "World’s Best Employers" accolade is a positive brand indicator but does not materially shift the immediate investment catalysts or top risks, such as AI automation disrupting legacy services or heightened pricing pressure from rivals.

The partnership announcement with SmartestEnergy, focused on advanced cybersecurity services and a 24/7 Security Operations Centre, stands out as especially timely. While this move supports Cognizant's ambition to capture a larger share of digital transformation deals, it does not significantly alter the primary catalysts or core risks highlighted for investors today.

However, investors should be alert to margin pressures that may intensify if automation outpaces Cognizant’s ability to adapt, especially as...

Read the full narrative on Cognizant Technology Solutions (it's free!)

Cognizant Technology Solutions' outlook points to $23.5 billion in revenue and $2.9 billion in earnings by 2028. This is based on a 4.7% annual revenue growth rate and a $0.5 billion increase in earnings from the current $2.4 billion.

Uncover how Cognizant Technology Solutions' forecasts yield a $86.95 fair value, a 32% upside to its current price.

Exploring Other Perspectives

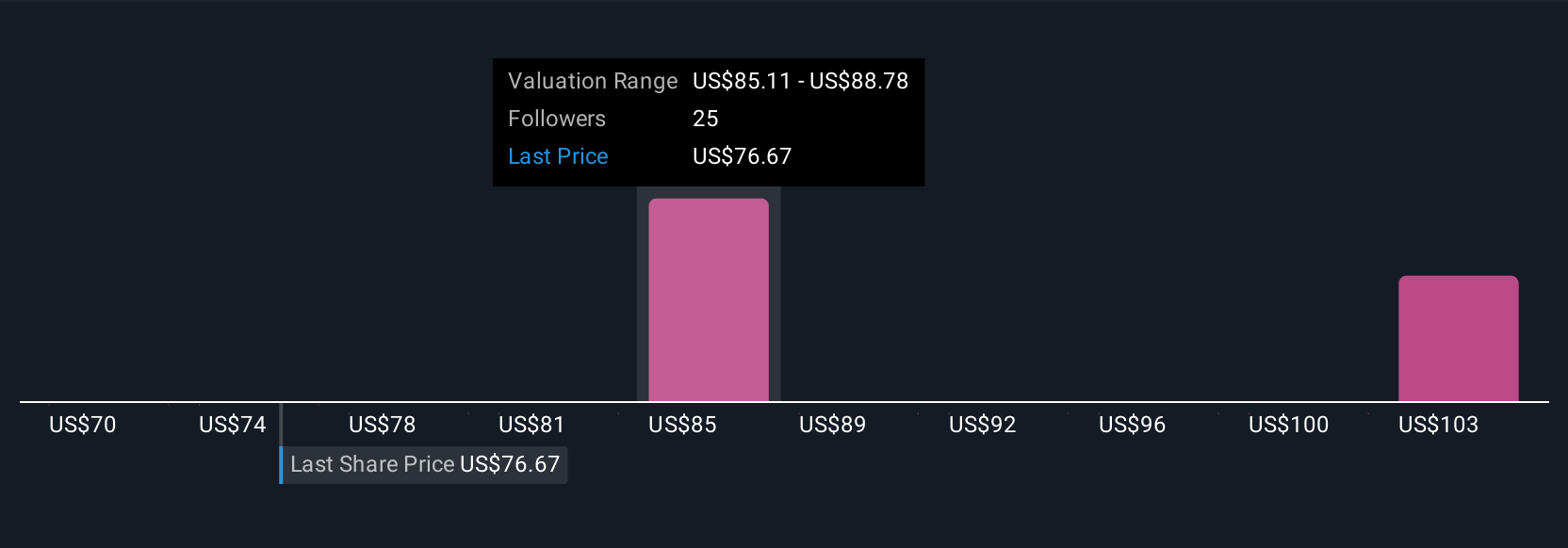

Eight members of the Simply Wall St Community valued Cognizant between US$66.06 and US$117.51 per share, showing highly varied expectations. Given the risk of client adoption of AI accelerating, it's important to consider how differing opinions may impact your view on Cognizant’s growth and resilience.

Explore 8 other fair value estimates on Cognizant Technology Solutions - why the stock might be worth as much as 79% more than the current price!

Build Your Own Cognizant Technology Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cognizant Technology Solutions research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cognizant Technology Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cognizant Technology Solutions' overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CTSH

Cognizant Technology Solutions

A professional services company, provides consulting and technology, and outsourcing services in North America, Europe, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives