- United States

- /

- IT

- /

- NasdaqGS:CTSH

Cognizant Technology Solutions (NasdaqGS:CTSH) Partners With TestHuset For On-Site TaaS Expansion In Denmark

Reviewed by Simply Wall St

Cognizant Technology Solutions (NasdaqGS:CTSH) recorded a 3.92% price increase over the last quarter, a movement likely influenced by its recent partnership with TestHuset announced on March 5, aimed at advancing software testing services in Denmark. The company also declared an increased quarterly dividend of $0.31 per share and executed a substantial share repurchase program amounting to $140 million. Additionally, its earnings update on February 5 reported higher year-over-year sales for both the quarter and entire fiscal year, although net income saw a slight decline for the quarter. Against a backdrop of wavering market conditions, with the major indexes experiencing mixed results and a recent 3.1% overall market drop, Cognizant's strategic expansions, alongside steady financial performance, appear to have positively contributed to its share price move in an otherwise volatile economic climate.

See the full analysis report here for a deeper understanding of Cognizant Technology Solutions.

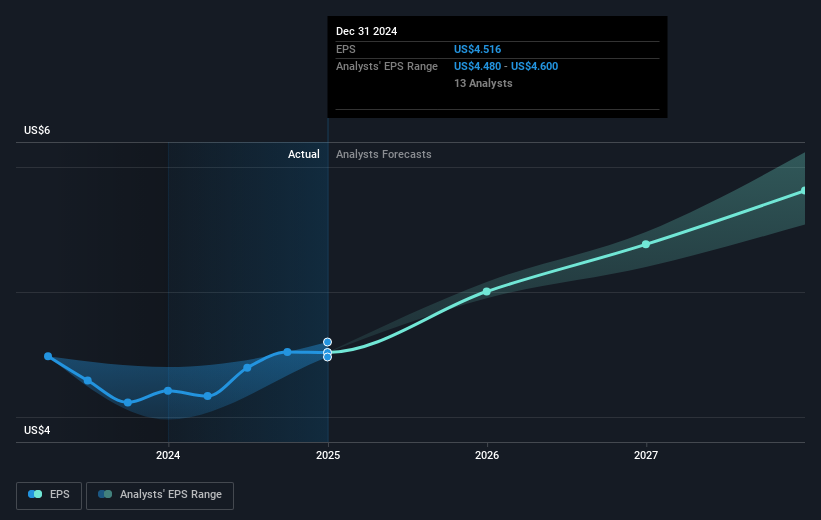

Over the past five years, Cognizant Technology Solutions has delivered a total return of 61.83% for its shareholders, incorporating both share price appreciation and dividends. This performance reflects a period marked by strategic adjustments and solid growth initiatives. Notably, the company reported an average earnings growth of 7.4% annually, which bolstered investor confidence despite a recent decline in its annual growth rate. This sustained growth, combined with its ability to leverage partnerships, such as the integration with Elektrobit and collaboration with Etex for GenAI solutions, has underpinned its long-term success.

While the US IT industry posted negative annual earnings growth recently, Cognizant's outperforming 5.4% earnings growth highlights its resilience in a challenging sector. Additionally, the company capitalized on market-driven valuation opportunities, trading well below its estimated fair value and presenting itself as good value compared to peers. These factors, along with a commitment to shareholder returns through dividends and share buybacks, have contributed to its strong five-year performance record.

- Learn how Cognizant Technology Solutions' intrinsic value compares to its market price with our detailed valuation report.

- Gain insight into the risks facing Cognizant Technology Solutions and how they might influence its performance—click here to read more.

- Is Cognizant Technology Solutions part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Cognizant Technology Solutions, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CTSH

Cognizant Technology Solutions

A professional services company, provides consulting and technology, and outsourcing services in North America, Europe, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives