- United States

- /

- Consumer Finance

- /

- NasdaqGS:SOFI

Dow Futures Dip as Rate Cut Hopes Meet Growth Worries

Reviewed by Sasha Jovanovic

The Morning Bull - US Market Morning Update Tuesday, Oct, 21 2025

US stock futures are leaning lower ahead of the open, as investors focus on hopes for a Federal Reserve rate cut next week and the mounting anticipation that a government shutdown deal is finally within reach. With bond yields still hovering near 4% and the market alert to tomorrow’s inflation data, the big question now is whether easing economic signals and improved US-China trade outlook will be enough to boost sentiment, or if concerns about growth will weigh the odds of a slowing economy.

If you're worried about growth and rate cut timing, don't miss our undervalued stocks based on cash flows before the next move.

Top Movers

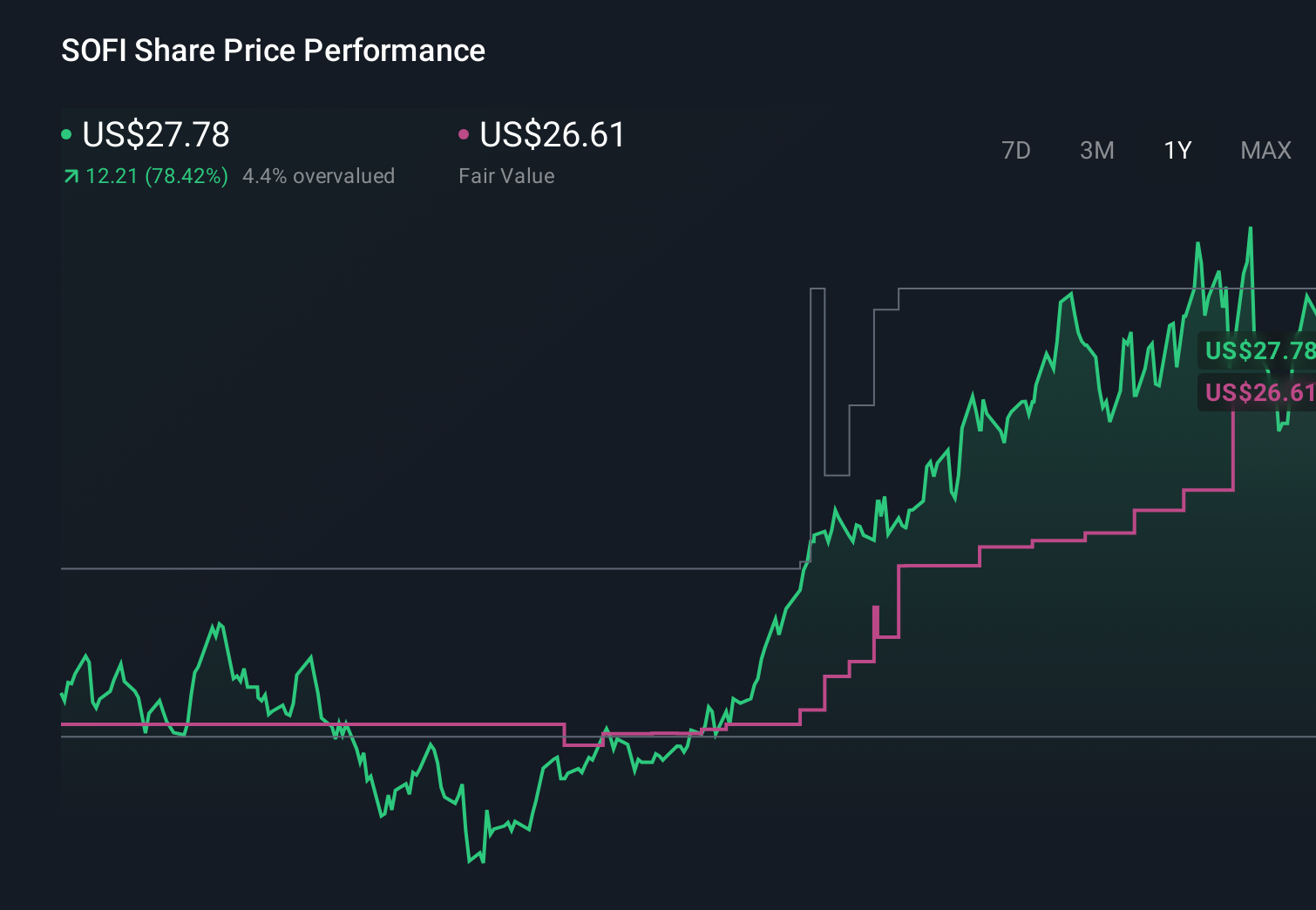

- SoFi Technologies (SOFI) surged 8.06% on positive sentiment as the company continues to expand its digital banking offerings.

- Affirm Holdings (AFRM) jumped 6.16% after announcing new payment partnerships with FreshBooks and Fanatics.

- Expand Energy (EXE) climbed 6.07% as analysts highlighted long-term demand growth for US natural gas markets.

Is Expand Energy still a smart investment or just hype? Read our most popular narrative and get all the answers you need.

Top Losers

- CoreWeave (CRWV) fell 7.17% after ISS recommended that Core Scientific holders reject its buyout offer.

- AppLovin (APP) slid 5.57% amid fresh privacy probe reports and increased regulatory scrutiny over data practices.

- Seagate Technology Holdings (STX) declined 4.88% even with positive analyst price target moves.

Look past the noise - uncover the top narrative that explains what truly matters for Seagate Technology Holdings' long-term success.

On The Radar

Earnings season accelerates as blue-chip names and economic bellwethers reveal Q3 results, setting the pace for sector trends and sentiment.

- Netflix (NFLX) releases Q3 earnings on Tuesday. This will offer a snapshot into global streaming growth and profit outlook.

- General Motors (GM) reports third-quarter results on Tuesday. The focus will be on auto sector demand and pricing power trends.

- Coca-Cola (KO) delivers Q3 numbers pre-market Tuesday, providing insight into consumer spending resilience and global beverage demand.

- Federal Reserve Rate Decision is expected next week, with expectations of a 25 basis-point rate cut influencing market positioning.

Use our Portfolio or Watchlist features to track market-moving events like these and get alerts for the companies you own, free!

Find Stocks Poised To Move

Look beneath the headlines and you'll find clear breakout potential, but only for a limited window. Our research uncovers penny stocks with strong financials that match high-quality fundamentals, each positioned for big moves this quarter.

Want to find your own winners? Use our stock screener for custom searches that fit your unique strategy and receive timely alerts on new stock opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SOFI

SoFi Technologies

Provides various financial services in the United States, Latin America, Canada, and Hong Kong.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion