- United States

- /

- Software

- /

- NasdaqGS:CRWD

CrowdStrike (NASDAQ:CRWD) is Starting to look Attractive as Demand for Cybersecurity Products Remains Strong

Shares of CrowdStrike Holdings, Inc. ( NASDAQ:CRWD ) surged more than 12% on Thursday after the company reported fourth-quarter earnings and revenue. The results were better than expected, but as has often been the case recently, the market is taking its cue from CrowdStrike’s upbeat guidance for the current quarter and full year.

Quarterly Highlights:

- Revenue: Quarterly revenue of $431 mln was $18.6 mln better than expected and 63% higher than a year earlier.

- Earnings: Fourth-quarter net loss widened from $19 mln ($0.19 per share) a year earlier to $42 mln ($0.18 per share). This was slightly lower than analysts expected. Adjusted EPS which excludes stock-based compensation improved from $0.13 a year earlier to $0.30 and was $0.10 better than expected.

- Annual Recurring Revenue: Ending ARR up 65% to $1.7 bln. Net new ARR of $217 mln.

- Guidance : First quarter adjusted EPS of $0.22 to $0.24 a share now expected vs analyst estimates of $0.17. Revenue of $458.9 to $465.4 mln now expected vs consensus of $440 mln. Full-year EPS and revenue are also expected to be substantially higher than expected.

These results were solid, but the market was also pleased to hear the company is continuing to see strong demand. CEO George Kurtz said, "We think there is a tremendous amount of demand. There is tremendous opportunity, and we're going forward, so I think that when we guide, we took all of that into consideration." The current situation in Ukraine has also put cybersecurity back in the spotlight.

In November we had a look at CrowdStrike’s valuation when the stock was trading at $219. Since then, the stock price has fallen as much as 38%, so we decided to revisit the valuation and growth forecasts.

Check out our latest analysis for CrowdStrike Holdings

Is CrowdStrike Holdings cheap?

Over the last few years, cybersecurity stocks have traded on some of the highest price-to-sales ratios in the market. This is no doubt a reflection of the increasing number of cyberattacks as much as business fundamentals. However, the leading companies in the industry have been keeping up with expectations and recent price weakness has brought valuations back to more reasonable levels.

Back in November when we estimated CrowdStrike’s valuation we came to a fair value of $319, implying the stock was trading at a 20% discount. Analyst forecasts haven’t changed since then, so the estimate is still at roughly the same level, and the discount has now widened to 41%.

At least two analysts have already upgraded their price targets, so it’s likely that cash flow forecasts will also rise in the next week. This means the discount could be even wider than 41%.

What kind of growth will CrowdStrike Holdings generate?

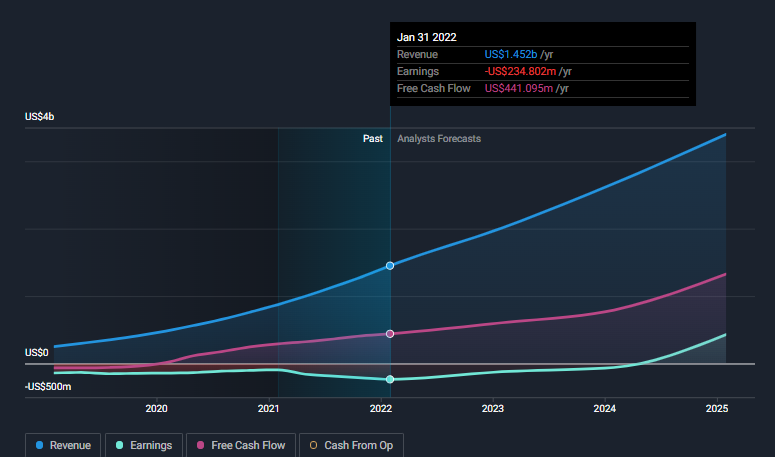

As the chart above illustrates, CrowdStrike’s cash flows are a lot stronger than the negative earnings numbers suggest. This is due to non-cash items like stock-based compensation. While this may result in shareholder dilution in the future, the free cash margin is quite high at about 30%.

Our fair value estimate of $319 is very much dependent on the company delivering revenue growth in line with analyst forecasts. CrowdStrike’s top-line growth has slowed from 125% + a few years ago to 66% over the last year. This growth rate is expected to drift to around 22% by the end of 2025. If demand for cybersecurity products remains strong, these forecasts seem reasonable.

What this means for you:

CrowdStrike is a market leader in a key growth industry. Shares traded at a substantial premium when it was listed in 2019 and maintained that premium until October last year. It’s now trading at a modest discount relative to current forecasts. While the valuation seems reasonable, the stock price may remain under pressure while growth stocks are out of favor.

As mentioned, shareholders do need to be aware of potential dilution going forward.

It’s also worth noting that cybersecurity stocks tend to rally whenever there is a major cyberattack or increased focus on cybersecurity, and then drift back as those concerns fade. Long-term investors don’t need to chase these stocks when everyone else is buying them.

If you are interested in CrowdStrike, you should also keep an eye on insider selling. You can track that by referring to our full analysis of the CrowdStrike .

If you are no longer interested in CrowdStrike Holdings, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

If you're looking to trade CrowdStrike Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NasdaqGS:CRWD

CrowdStrike Holdings

Provides cybersecurity solutions in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives