- United States

- /

- Software

- /

- NasdaqGS:CRWD

CrowdStrike Holdings (NasdaqGS:CRWD) Wins Dismissal Of Class Action Suit Over Software Outage

Reviewed by Simply Wall St

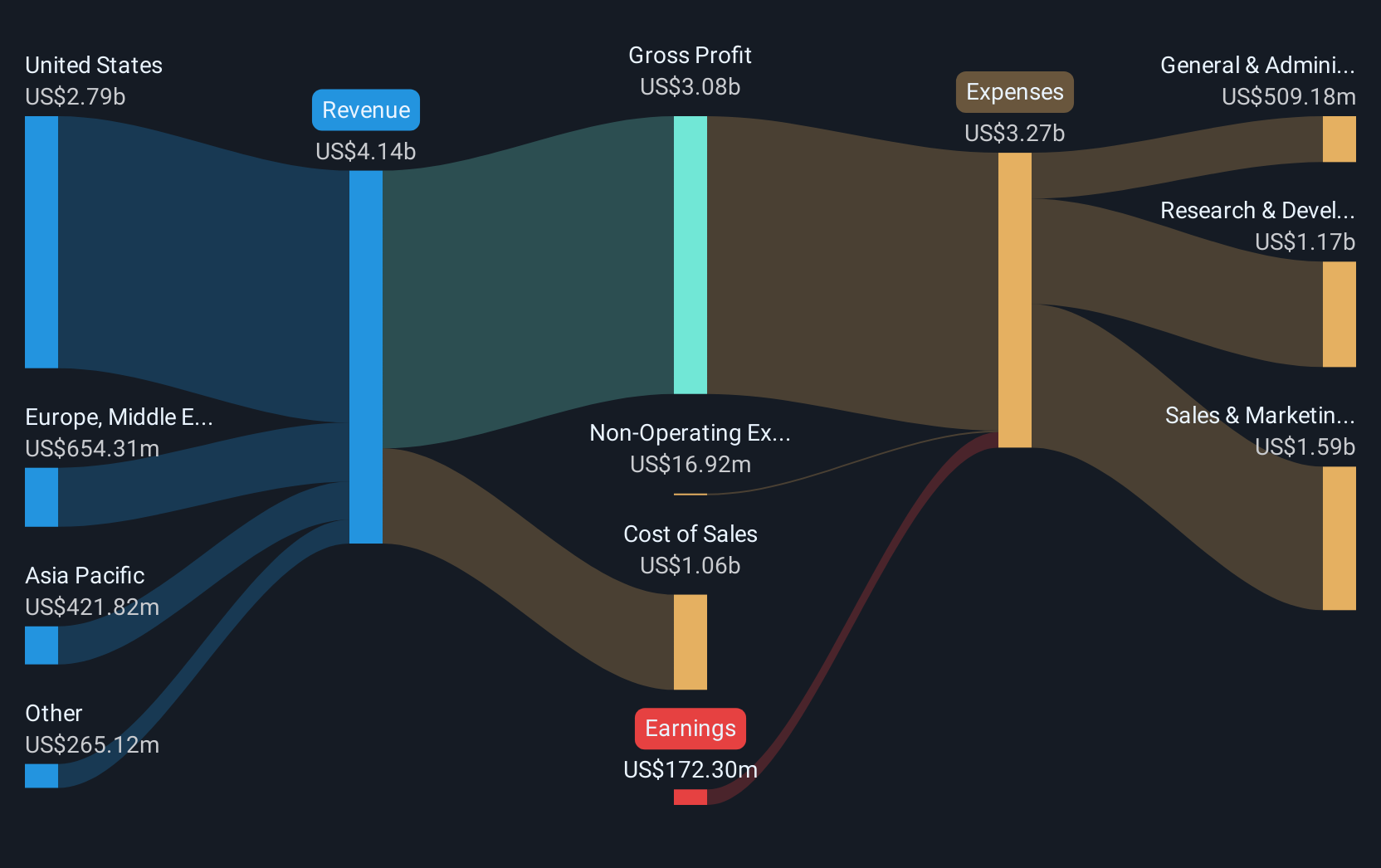

CrowdStrike Holdings (NasdaqGS:CRWD) recently experienced a 34% price increase over the past quarter. The company's legal victory in June, where a U.S. District Court dismissed a class-action suit, may have strengthened investor confidence. Additionally, significant client announcements, such as integrations with NVIDIA and Portnox, likely provided further positive momentum. The unveiling of new product innovations and a share repurchase program also contributed positively. While these developments aligned with the broader market's flat performance amidst geopolitical tensions and mixed economic forecasts, CrowdStrike's strategic initiatives in cybersecurity enhanced its attractiveness to investors.

Be aware that CrowdStrike Holdings is showing 1 risk in our investment analysis.

The developments mentioned in the introduction, such as the legal victory and new partnerships, have positively reinforced CrowdStrike's narrative focused on innovation and growth in the cloud security market. The introduction of Falcon Flex and AI capabilities are aligning well with enhanced customer relationships and operational efficiencies. The recent news could further bolster revenue forecasts, as these initiatives are anticipated to drive customer satisfaction and potentially increase market share.

CrowdStrike shares have soared over the past five years, achieving a total return of approximately 391.10%, showcasing considerable growth over this period. Compared to the market, the company's performance over the past year also surpassed the US Software industry, which returned 17.7%, indicating its relative strength in a competitive space.

The recent positive momentum from product and partnership announcements may support revenue and earnings projections, which analysts anticipate will grow by 23.0% annually over the next three years with potential profit margin improvements. However, since the company's current share price of US$443.21 is slightly above the analyst consensus price target of US$411.06, it suggests investors will closely watch future growth to justify the current valuation.

Learn about CrowdStrike Holdings' historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWD

CrowdStrike Holdings

Provides cybersecurity solutions in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)