- United States

- /

- Software

- /

- NasdaqGS:CRWD

CrowdStrike (CRWD): Assessing Valuation After Recent Share Price Decline and Strong Yearly Gains

Reviewed by Simply Wall St

CrowdStrike Holdings (CRWD) has been making waves in the cybersecurity landscape, with its share price swinging nearly 8% lower over the past month despite strong gains in the past year.

See our latest analysis for CrowdStrike Holdings.

CrowdStrike’s share price has cooled off recently, but momentum is still notable over the longer term. While the last 30 days saw an 8% share price decline, the year-to-date share price return is a robust 44%, and the company boasts an impressive 45% total return over the past year. That kind of sustained performance signals strong long-term growth potential, even as short-term volatility reflects changing market sentiment around cybersecurity names.

If you’re watching what’s trending in software and digital security, it might be time to get ahead of the curve and explore See the full list for free.

With robust growth in revenue and profitability, but a recent dip in share price, the question now is whether CrowdStrike is trading at an attractive valuation for new investors or if the market has already factored in all future gains.

Most Popular Narrative: 3.4% Undervalued

Compared to the most popular narrative’s fair value estimate of $518.96, CrowdStrike’s latest close at $501.54 sits just below target, suggesting that the market has not fully reflected its growth story yet.

The company is viewed as increasingly entrenched in endpoint security and expanding its reach with differentiated offerings in AI, identity, and cloud security. Recent product innovations and large-scale industry events have reinforced its leadership status.

Want to uncover the bold assumptions powering this fair value? The narrative relies on breakthrough financial transformation and future profit multiples typically associated with sector leaders. Ready to see which surprising metrics support this optimistic target? Dive in for the story behind the valuation.

Result: Fair Value of $518.96 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainty around the success of emerging products and intense competition in cloud security could present challenges to CrowdStrike’s ability to maintain high growth.

Find out about the key risks to this CrowdStrike Holdings narrative.

Another View: Are Multiples Sounding a Caution?

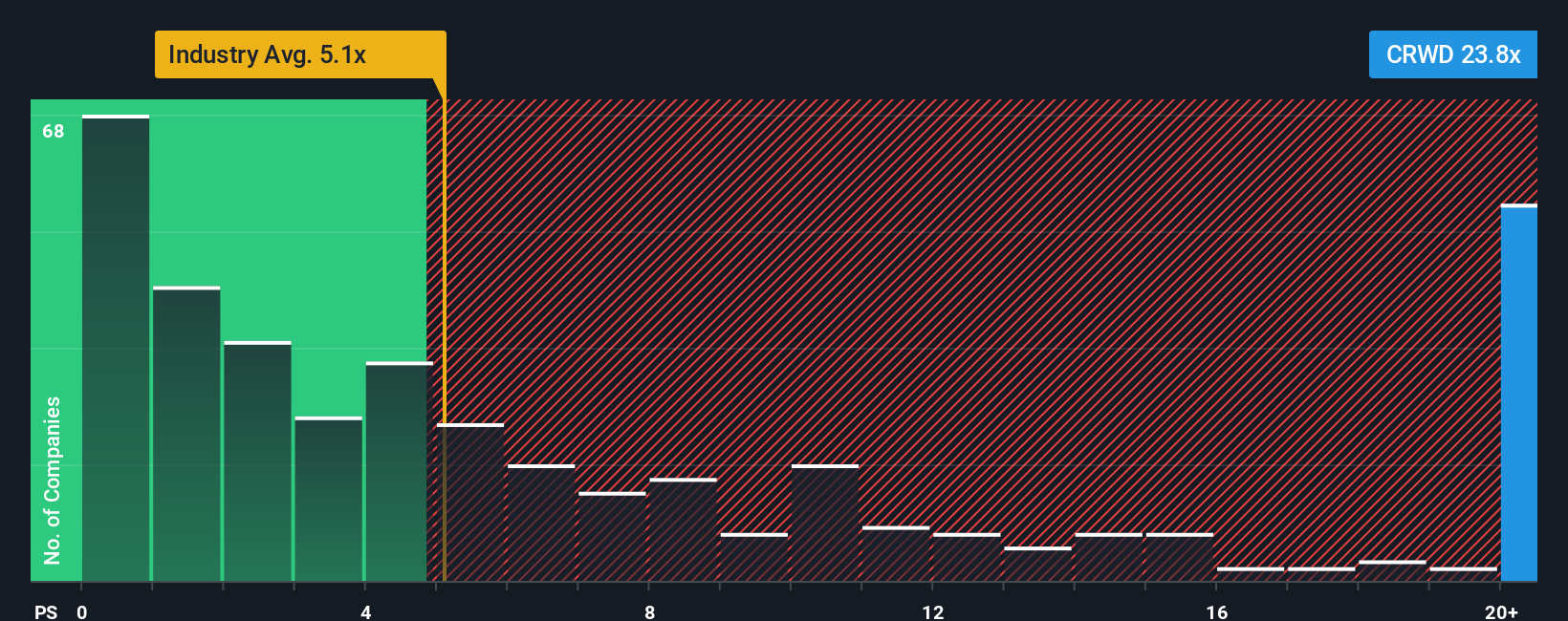

While a fair value estimate suggests CrowdStrike is undervalued, a closer look at its price-to-sales ratio paints a different picture. At 29x, CrowdStrike trades far above both the US Software industry average of 4.7x and the peer average of 12.5x. It also remains well above its fair ratio of 17.9x. This sizable gap signals valuation risk. Could the company’s strong growth keep justifying such a premium, or might the market re-rate it toward these lower benchmarks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CrowdStrike Holdings Narrative

If you have a different perspective or want to dive into the numbers yourself, it is quick and easy to craft your own view with Do it your way.

A great starting point for your CrowdStrike Holdings research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for More Smart Investing Opportunities?

Unlock fresh strategies with the Simply Wall Street Screener and take charge of your portfolio before the next wave of market movers leaves you behind.

- Grab an early advantage by checking out these 927 undervalued stocks based on cash flows to spot stocks that the market might be overlooking right now.

- Power up your watchlist with strong passive income by selecting these 15 dividend stocks with yields > 3% which boasts yields above 3%.

- Tap into the innovation surge and support companies at the forefront of artificial intelligence through these 25 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWD

CrowdStrike Holdings

Provides cybersecurity solutions in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.