- United States

- /

- Software

- /

- NasdaqGS:CRNC

Further weakness as Cerence (NASDAQ:CRNC) drops 9.0% this week, taking five-year losses to 89%

Cerence Inc. (NASDAQ:CRNC) shareholders should be happy to see the share price up 26% in the last month. But will that heal all the wounds inflicted over 5 years of declines? Unlikely. Five years have seen the share price descend precipitously, down a full 89%. While the recent increase might be a green shoot, we're certainly hesitant to rejoice. The important question is if the business itself justifies a higher share price in the long term. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

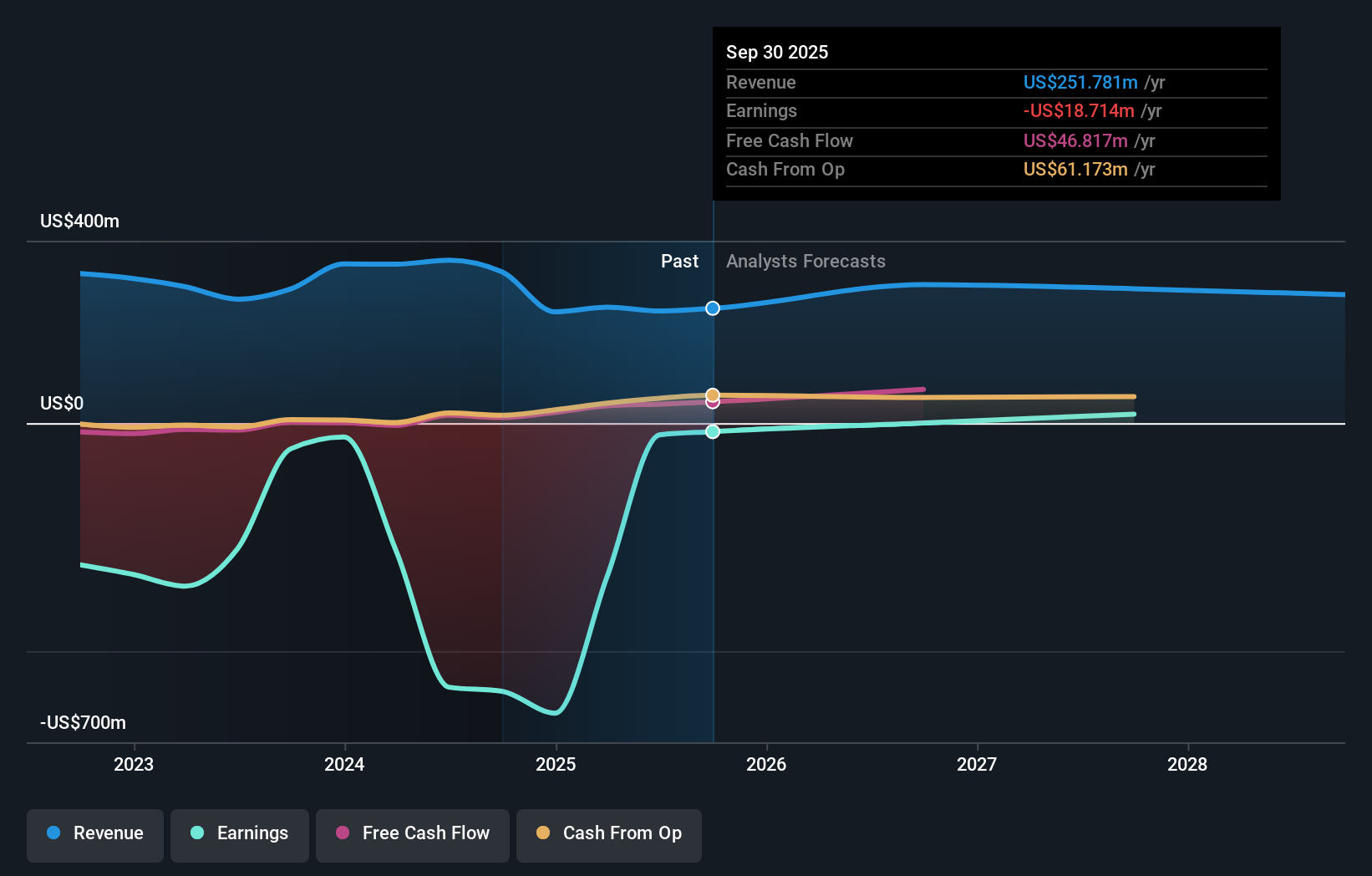

Because Cerence made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last five years Cerence saw its revenue shrink by 6.8% per year. While far from catastrophic that is not good. If a business loses money, you want it to grow, so no surprises that the share price has dropped 14% each year in that time. It takes a certain kind of mental fortitude (or recklessness) to buy shares in a company that loses money and doesn't grow revenue. Fear of becoming a 'bagholder' may be keeping people away from this stock.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Cerence's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that Cerence has rewarded shareholders with a total shareholder return of 56% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 14% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Cerence , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CRNC

Cerence

Provides AI-powered assistants for the mobility/transportation market in the United States, the rest of the Americas, Germany, the rest of Europe, the Middle East, Africa, Japan, and the rest of the Asia-Pacific.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Rare Pure High Grade Silver with 35% Insider (Near Producer)

Swedens Constellation Software

Inotiv NAMs Test Center

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.