- United States

- /

- Software

- /

- NasdaqGS:CRNC

Cerence (NASDAQ:CRNC) Is Looking To Continue Growing Its Returns On Capital

There are a few key trends to look for if we want to identify the next multi-bagger. In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. With that in mind, we've noticed some promising trends at Cerence (NASDAQ:CRNC) so let's look a bit deeper.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Cerence, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.056 = US$49m ÷ (US$987m - US$107m) (Based on the trailing twelve months to March 2024).

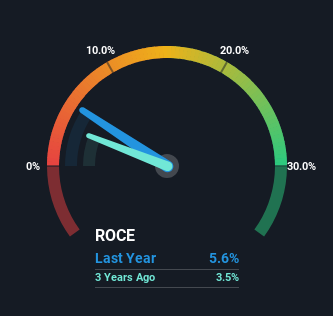

So, Cerence has an ROCE of 5.6%. In absolute terms, that's a low return and it also under-performs the Software industry average of 7.5%.

View our latest analysis for Cerence

In the above chart we have measured Cerence's prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free analyst report for Cerence .

The Trend Of ROCE

You'd find it hard not to be impressed with the ROCE trend at Cerence. The figures show that over the last five years, returns on capital have grown by 88%. That's not bad because this tells for every dollar invested (capital employed), the company is increasing the amount earned from that dollar. Interestingly, the business may be becoming more efficient because it's applying 31% less capital than it was five years ago. If this trend continues, the business might be getting more efficient but it's shrinking in terms of total assets.

What We Can Learn From Cerence's ROCE

In summary, it's great to see that Cerence has been able to turn things around and earn higher returns on lower amounts of capital. Although the company may be facing some issues elsewhere since the stock has plunged 97% in the last three years. Regardless, we think the underlying fundamentals warrant this stock for further investigation.

Since virtually every company faces some risks, it's worth knowing what they are, and we've spotted 3 warning signs for Cerence (of which 1 can't be ignored!) that you should know about.

While Cerence isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRNC

Cerence

Provides AI-powered assistants for the mobility/transportation market in the United States, the rest of the Americas, Germany, the rest of Europe, the Middle East, Africa, Japan, and the rest of the Asia-Pacific.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Realty Income - A Fundamental and Historical Valuation

A Structured Counter‑Analysis of "The Leaking Dreadnought"

Alphabet Inc. (GOOG): The Gemini Era – Consolidating AI Dominance in 2026.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Nu holdings will continue to disrupt the South American banking market