- United States

- /

- Software

- /

- NasdaqGS:CRNC

Cerence Inc. (NASDAQ:CRNC) Shares Fly 36% But Investors Aren't Buying For Growth

Cerence Inc. (NASDAQ:CRNC) shareholders would be excited to see that the share price has had a great month, posting a 36% gain and recovering from prior weakness. The last 30 days were the cherry on top of the stock's 404% gain in the last year, which is nothing short of spectacular.

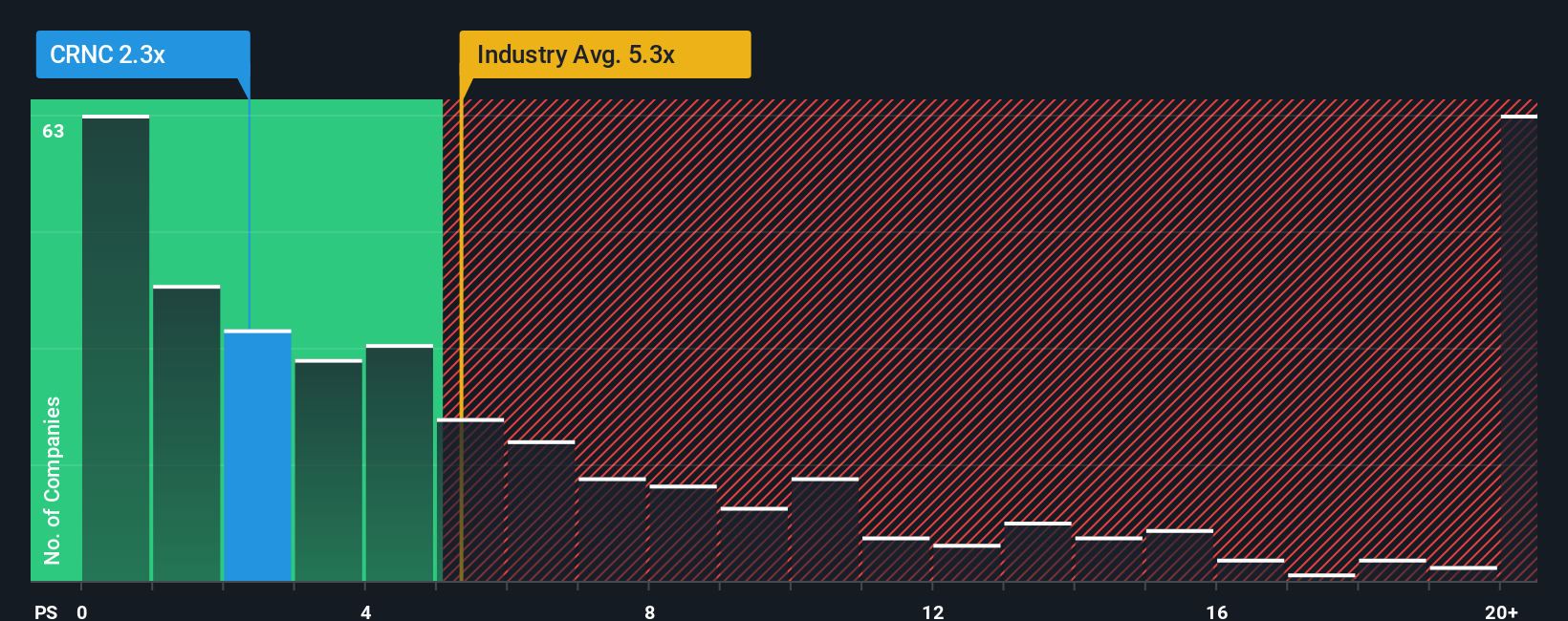

Even after such a large jump in price, Cerence may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 2.3x, considering almost half of all companies in the Software industry in the United States have P/S ratios greater than 5.3x and even P/S higher than 13x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Cerence

What Does Cerence's Recent Performance Look Like?

Cerence could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Cerence will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as depressed as Cerence's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a frustrating 31% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 33% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 3.8% over the next year. That's shaping up to be materially lower than the 21% growth forecast for the broader industry.

In light of this, it's understandable that Cerence's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Cerence's P/S Mean For Investors?

Even after such a strong price move, Cerence's P/S still trails the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of Cerence's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Cerence, and understanding should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CRNC

Cerence

Provides AI-powered assistants for the mobility/transportation market in the United States, the rest of the Americas, Germany, the rest of Europe, the Middle East, Africa, Japan, and the rest of the Asia-Pacific.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success