- United States

- /

- Software

- /

- NasdaqGS:CRNC

Cerence (CRNC) Is Up 5.3% After Suzuki Partnership for AI Assistant in e VITARA – Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- Suzuki Motor Corporation recently announced a partnership with Cerence AI to deliver a custom conversational assistant for Suzuki’s first battery electric vehicle, the e VITARA, launching globally.

- This collaboration expands Cerence’s presence with Japanese automakers and highlights growing demand for advanced, voice-driven in-car experiences powered by conversational AI technology.

- We'll assess how this high-profile, global BEV integration with Suzuki could reshape Cerence's outlook for recurring automotive AI revenue growth.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Cerence Investment Narrative Recap

For investors considering Cerence, the big picture is a bet on growing demand for AI-powered, connected in-car experiences and the company's ability to secure global automotive partnerships that drive predictable, recurring revenue. The recent Suzuki collaboration certainly highlights Cerence’s strengthening appeal among top OEMs, but its true impact on immediate revenue and the company’s most pressing risks, such as revenue volatility and intense competition, remains to be seen. While this news draws attention, the near-term catalyst is still the shift toward usage-based contracts and platform integration progress, while risks from customer concentration and cyclical automotive demand linger in the background.

Separately, Cerence’s September launch of an expanded xUI platform at IAA Mobility 2025 stands out as especially relevant, underpinning its efforts to deepen multimodal AI integration across manufacturer lineups. This complements the Suzuki partnership, together reinforcing a broader strategy aimed at driving adoption, but with continued exposure to swings in OEM order timing and contract sizes.

However, in contrast to the headline wins, investors should pay close attention to the risk of uneven revenue from variable licensing as Cerence transitions away from upfront contracts...

Read the full narrative on Cerence (it's free!)

Cerence's outlook points to $282.6 million in revenue and $10.2 million in earnings by 2028. This assumes 4.7% annual revenue growth and a $36 million increase in earnings from the current level of -$25.8 million.

Uncover how Cerence's forecasts yield a $11.75 fair value, a 6% downside to its current price.

Exploring Other Perspectives

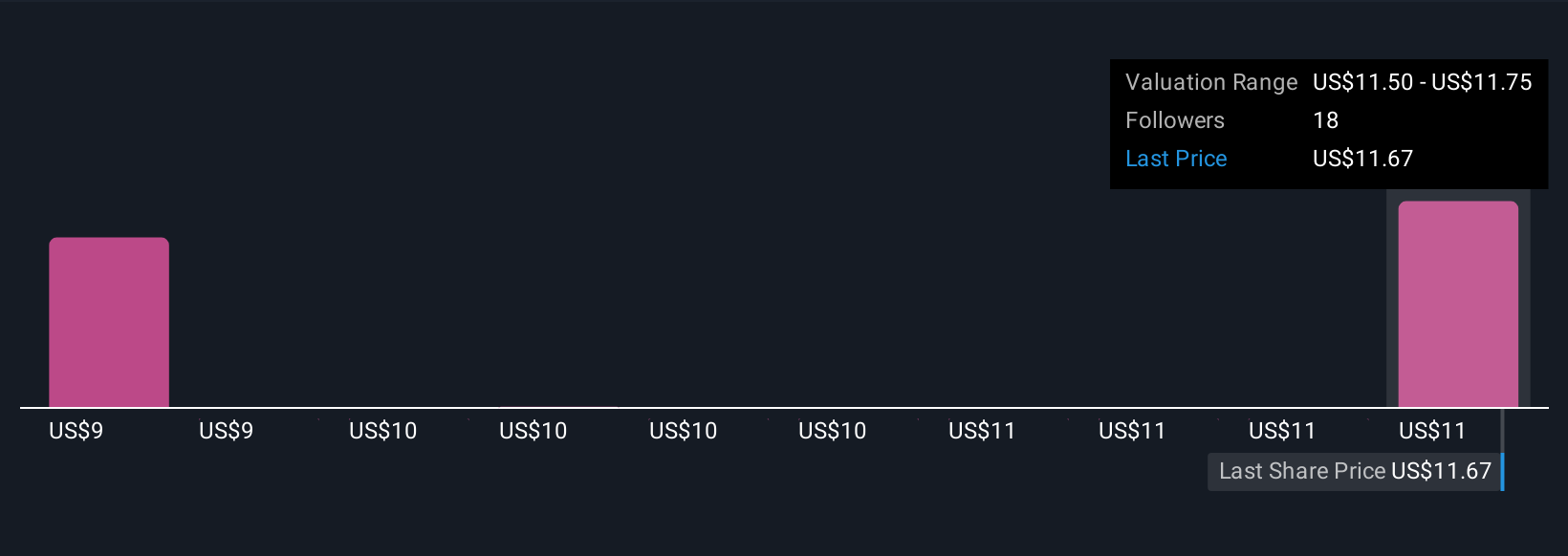

Fair value estimates from three Simply Wall St Community members for Cerence span a range from US$9.27 to US$11.75 per share. While opinions differ, the ongoing trend toward recurring AI revenue could play a key role in shaping Cerence’s earnings profile going forward, explore these varied viewpoints to see how your outlook compares.

Explore 3 other fair value estimates on Cerence - why the stock might be worth 26% less than the current price!

Build Your Own Cerence Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cerence research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cerence research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cerence's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 32 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRNC

Cerence

Provides AI powered virtual assistants for the mobility/transportation market in the United States, rest of the Americas, Germany, rest of Europe, the Middle East, Africa, Japan, and rest of the Asia-Pacific.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives