- United States

- /

- Software

- /

- NasdaqGS:CORZ

Core Scientific (CORZ): Reassessing Valuation After Recent Share Price Weakness and Strong Growth Prospects

Reviewed by Simply Wall St

Core Scientific (CORZ) has been under pressure lately, with the stock sliding about 8% in the past month and nearly 19% over the past 3 months, raising valuation questions for crypto-focused investors.

See our latest analysis for Core Scientific.

Zooming out, that recent volatility sits within a choppy year, with the latest 1 year total shareholder return of around minus 6 percent and year to date share price return also modestly negative. This suggests momentum has cooled even as revenue growth remains strong.

If Core Scientific’s swings have you reassessing your options, this could be a good moment to explore other high growth opportunities like fast growing stocks with high insider ownership.

With shares lagging despite rapid top line and earnings growth, and analysts seeing sizable upside from today’s price, investors face a key question: Is Core Scientific still undervalued or already reflecting its future potential?

Most Popular Narrative Narrative: 49.4% Undervalued

With Core Scientific last closing at $13.57 against a narrative fair value of $26.82, the most followed view implies the market is deeply discounting its long term potential.

Core Scientific secured a major HPC contract with CoreWeave, with a total revenue potential of $8.7 billion over a 12 year term, significantly boosting future revenue compared to their current levels. The company is expanding HPC infrastructure capacity by reallocating resources from Bitcoin mining, adding new sites, and extending existing ones, and expects this to drive future revenue growth as data center needs rise.

Curious how this contract heavy, power rich growth story turns a current loss maker into a cash engine with premium margins and a tech style earnings multiple? The full narrative unpacks the bold revenue ramp, profit swing, and valuation math that bridges today’s price to that higher fair value.

Result: Fair Value of $26.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps in the pivot to AI and HPC, or delays monetizing new capacity, could quickly undermine today’s upbeat growth and valuation assumptions.

Find out about the key risks to this Core Scientific narrative.

Another Take on Valuation

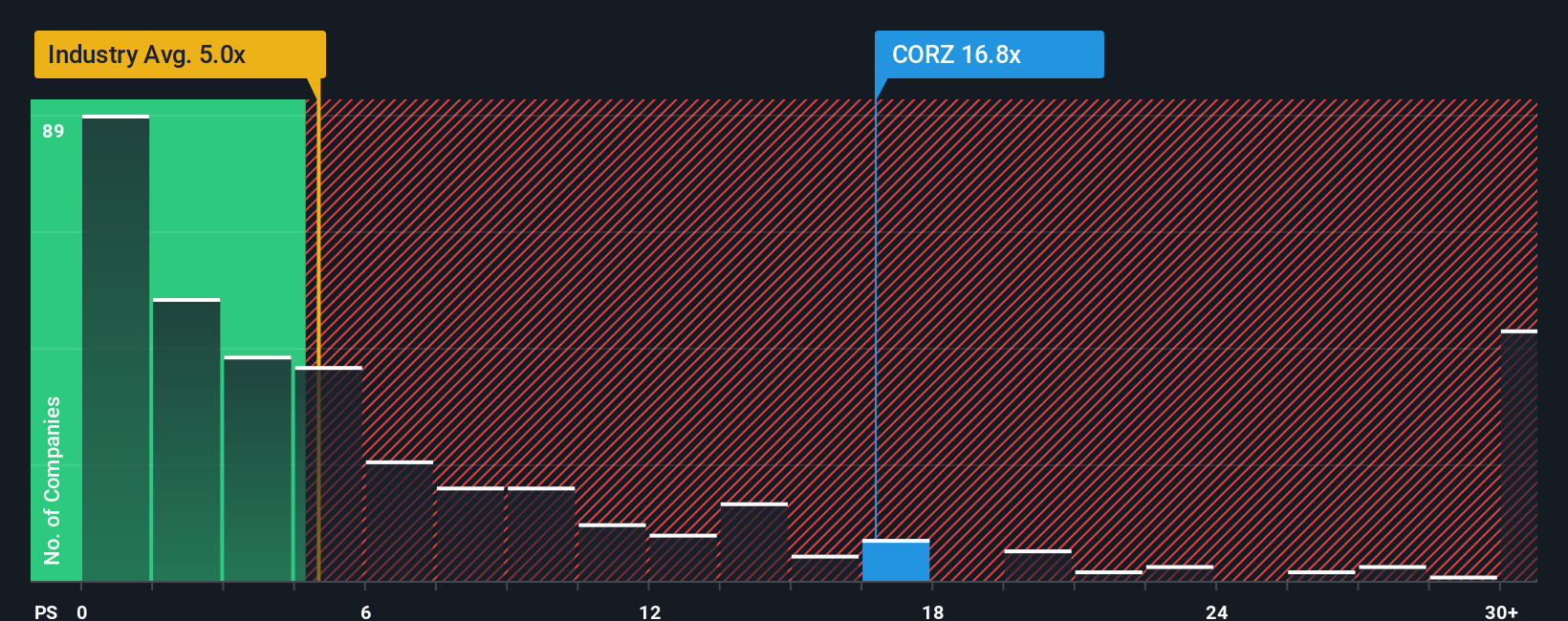

Looking past the bullish narrative, Core Scientific appears expensive on a simple price-to-sales basis. At around 12.6 times sales, it trades at more than triple peers on 3.6 times, and well above a fair ratio of 4.1 times. That kind of gap can mean notable downside if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Core Scientific Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized Core Scientific view in under three minutes. Start with Do it your way.

A great starting point for your Core Scientific research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If Core Scientific has sharpened your interest, do not stop here, let Simply Wall Street's powerful screener surface targeted opportunities that match your strategy.

- Supercharge your hunt for asymmetric upside by scanning these 3641 penny stocks with strong financials with solid financial foundations and room to run.

- Position yourself ahead of the next tech wave by tracking breakthrough innovators in these 26 AI penny stocks reshaping industries with machine learning and automation.

- Lock in potential bargains by filtering for these 911 undervalued stocks based on cash flows where prices lag behind what their cash flows suggest they are really worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CORZ

Core Scientific

Provides digital asset mining services in the United States.

High growth potential with very low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)