- United States

- /

- Software

- /

- NasdaqGS:CORZ

Assessing Core Scientific (CORZ) Valuation Following Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

Core Scientific (CORZ) shares have moved recently, drawing new attention from investors. In the past month, the stock gained 17%. Additionally, performance over the past 3 months has been even stronger, highlighting a trend worth a closer look.

See our latest analysis for Core Scientific.

After a standout quarter, Core Scientific’s momentum appears to be gathering steam. The 30-day share price return of nearly 17% and a strong 1-year total shareholder return of 48% underscore growing investor interest and suggest renewed optimism about the company’s growth potential.

If you want to see what other stocks are capturing attention lately, it is a great time to expand your search and discover fast growing stocks with high insider ownership

With strong returns and recent momentum, the key question for investors is whether Core Scientific is still trading below its true value, or if the current price already reflects all of its future growth prospects.

Most Popular Narrative: 9% Undervalued

Core Scientific’s most widely followed narrative sets a fair value of $20.88, which sits above the recent closing price of $19. The stage is set for bold growth projections, backed by major strategic moves the company is making right now.

Core Scientific secured a major HPC contract with CoreWeave, with a total revenue potential of $8.7 billion over a 12-year term, significantly boosting future revenue compared to their current levels. The company is expanding HPC infrastructure capacity by reallocating resources from Bitcoin mining, adding new sites, and extending existing ones. The company expects to drive future revenue growth as data center needs rise.

Ready to unpack what’s behind the headline valuation? The narrative hinges on a dramatic business pivot, ambitious margin targets, and a future profit profile aiming to outshine industry averages. Want to know which assumptions are fueling this valuation? Dive in to see the crucial forecasts that drive the price target.

Result: Fair Value of $20.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks remain, especially if delays in HPC expansion or heavy reliance on a single client impact Core Scientific’s revenue outlook.

Find out about the key risks to this Core Scientific narrative.

Another View: Multiples Tell a Different Story

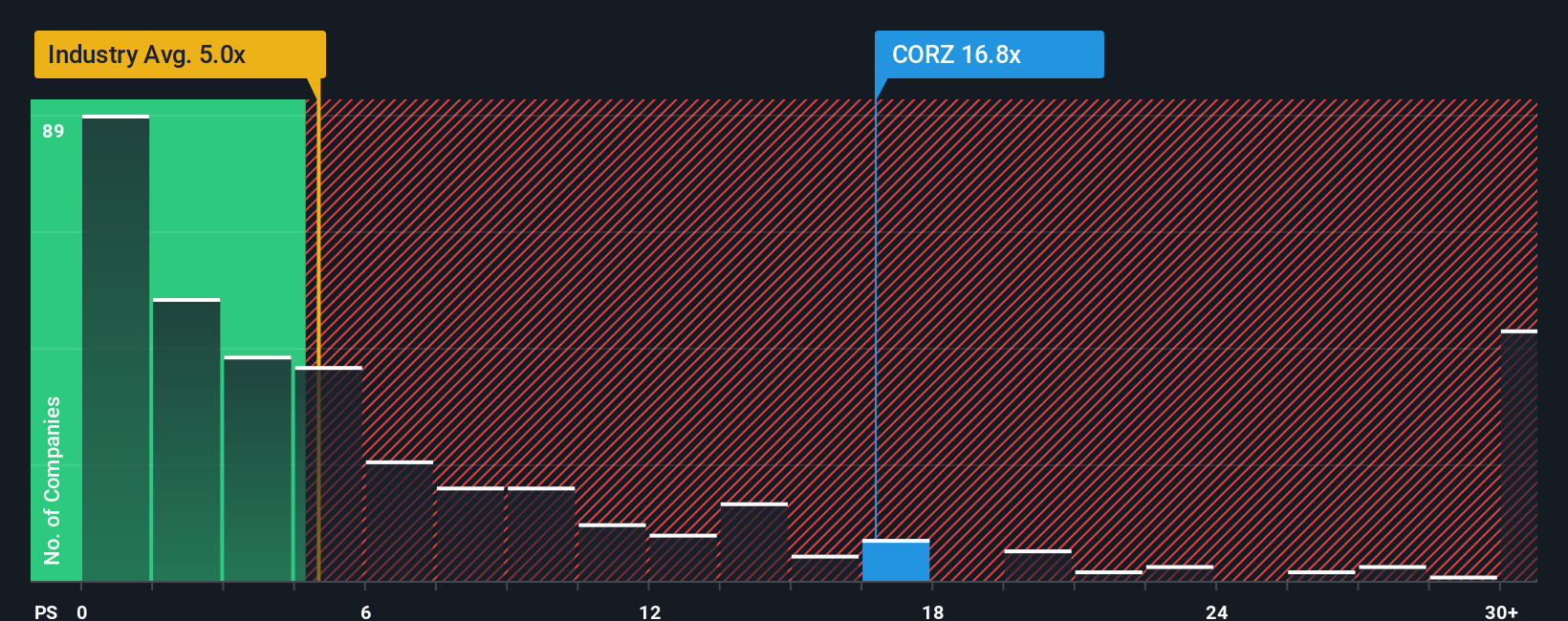

The market is valuing Core Scientific at a price-to-sales ratio of 16.8x, which is well above both the US Software industry average of 5x and its peer group average of 4.9x. Even the estimated fair ratio is lower at 5.6x. This gap suggests investors are paying a substantial premium and raises questions about potential valuation risks if enthusiasm fades or industry multiples revert. Are these high valuations justified by future growth, or could they set up for a pullback if expectations miss the mark?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Core Scientific Narrative

If the current analysis does not fully match your outlook or you enjoy conducting your own research, you have the tools to shape your own view of Core Scientific in just a few minutes. Do it your way

A great starting point for your Core Scientific research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take charge of your portfolio and seize the latest opportunities before others catch on. The right investment could be just one smart search away.

- Unlock potential gains by targeting real value with these 878 undervalued stocks based on cash flows, featuring stocks that may be trading below their worth right now.

- Capture growth from innovation as you scan these 24 AI penny stocks, packed with companies tapping into the booming artificial intelligence trend.

- Secure steady income streams when you explore these 18 dividend stocks with yields > 3%, offering stocks with yields above 3% for enhanced returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CORZ

Core Scientific

Provides digital asset mining services in the United States.

High growth potential with low risk.

Similar Companies

Market Insights

Community Narratives