- United States

- /

- Software

- /

- NasdaqGM:VERX

US High Growth Tech Stocks To Watch Now

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 9.4%, and over the past 12 months, it is down by 3.4%, yet earnings are expected to grow by 14% per annum in the coming years. In this environment, identifying high growth tech stocks involves looking for companies with strong fundamentals and innovative potential that can capitalize on anticipated earnings growth despite recent market volatility.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.44% | 29.79% | ★★★★★★ |

| TG Therapeutics | 26.03% | 37.60% | ★★★★★★ |

| Alkami Technology | 20.46% | 85.16% | ★★★★★★ |

| Travere Therapeutics | 28.45% | 65.05% | ★★★★★★ |

| Clene | 60.86% | 63.07% | ★★★★★★ |

| AVITA Medical | 27.47% | 56.12% | ★★★★★★ |

| TKO Group Holdings | 22.48% | 25.17% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.73% | 58.77% | ★★★★★★ |

| Lumentum Holdings | 21.61% | 120.49% | ★★★★★★ |

| Ascendis Pharma | 32.36% | 59.79% | ★★★★★★ |

Click here to see the full list of 235 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

CleanSpark (NasdaqCM:CLSK)

Simply Wall St Growth Rating: ★★★★★☆

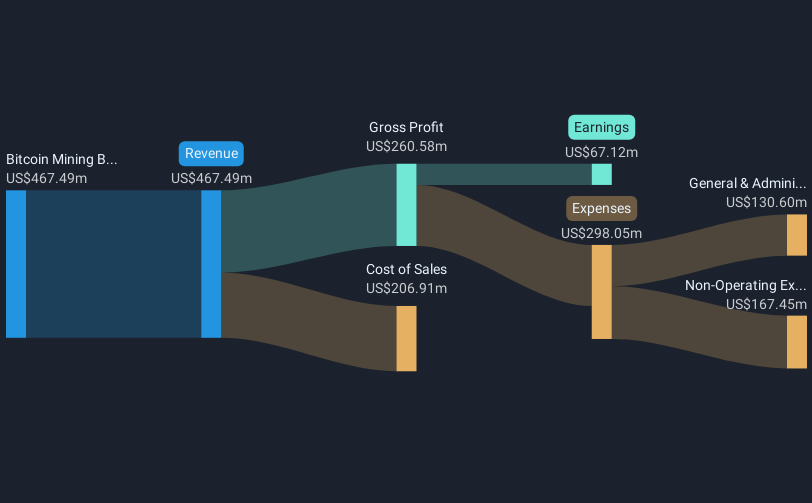

Overview: CleanSpark, Inc. is a bitcoin mining company operating in the Americas with a market cap of $2.06 billion.

Operations: The company generates revenue primarily through its bitcoin mining business, amounting to $467.49 million.

CleanSpark's recent induction into various S&P indices, including the S&P 1000 and S&P 600 Information Technology Sector, underscores its expanding influence in the tech landscape. This recognition coincides with a remarkable first-quarter net income surge to $246.79 million from just $25.91 million a year earlier, reflecting an earnings growth of over 850%. Such financial milestones are complemented by an aggressive revenue trajectory, with forecasts indicating a growth rate of 34.9% annually—outpacing the broader U.S. market average of 8.2%. Despite this high volatility in share price and significant insider selling recently, CleanSpark's strategic movements and robust earnings outlook suggest it is navigating its expansion within high-growth sectors adeptly, poised for continued operational scaling and market penetration.

- Navigate through the intricacies of CleanSpark with our comprehensive health report here.

Gain insights into CleanSpark's historical performance by reviewing our past performance report.

ARS Pharmaceuticals (NasdaqGM:SPRY)

Simply Wall St Growth Rating: ★★★★★☆

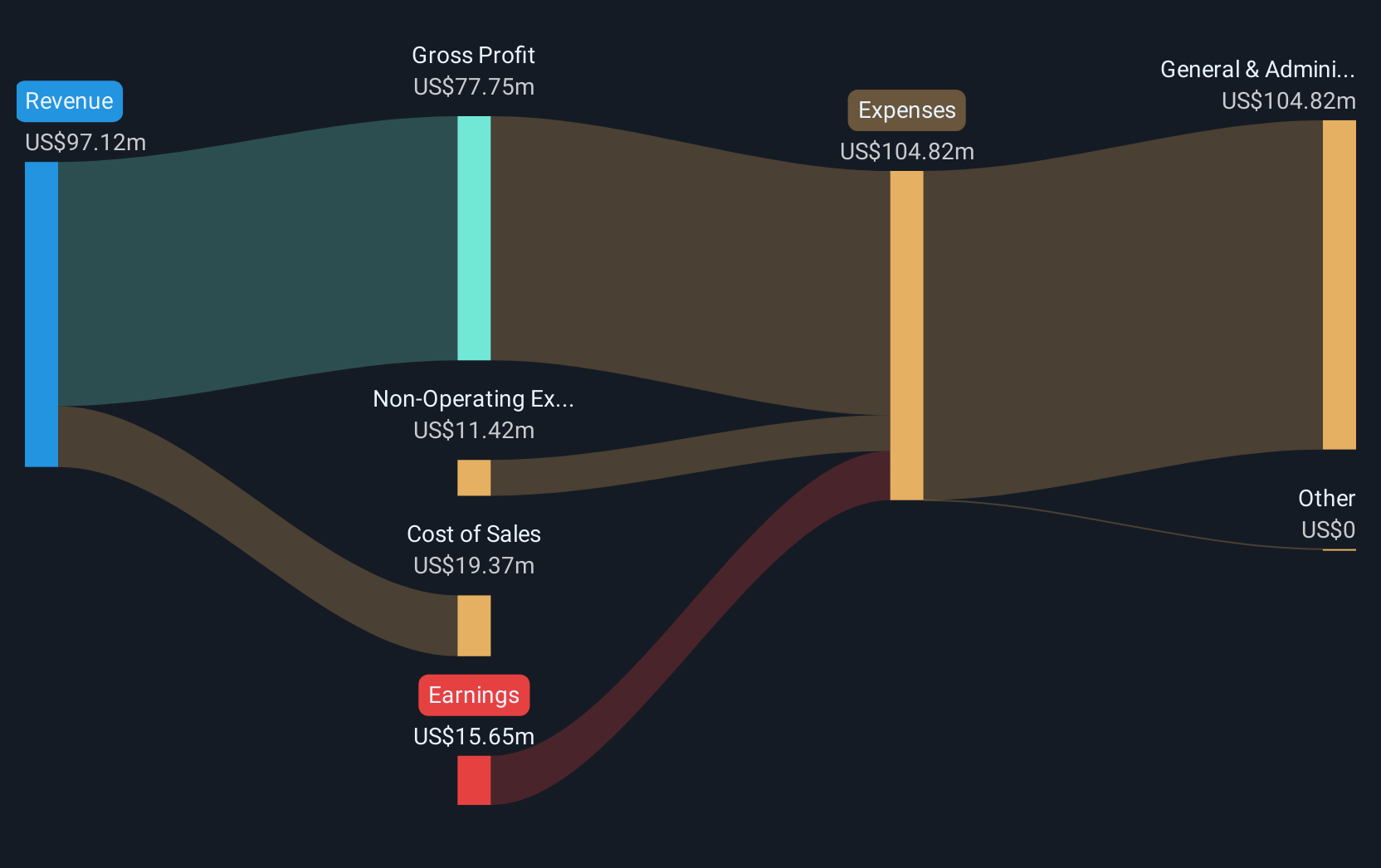

Overview: ARS Pharmaceuticals, Inc. is a biopharmaceutical company focused on developing treatments for severe allergic reactions, with a market cap of $1.26 billion.

Operations: ARS Pharmaceuticals generates revenue primarily from its pharmaceuticals segment, amounting to $89.15 million. The company is dedicated to advancing biopharmaceutical solutions for severe allergic reactions.

ARS Pharmaceuticals has demonstrated robust growth, with a revenue surge from $0.03 million to $89.15 million year-over-year and a swing to an $8 million net profit from a significant loss. This turnaround is underscored by the FDA approval of their innovative epinephrine nasal spray, Neffy, which represents a significant advancement in treating severe allergic reactions without needles. The company's strategic focus on R&D led to this breakthrough, positioning it well in the high-demand pediatric allergy market. With recent expansions into national formularies and comprehensive patient support programs, ARS is poised to capture substantial market share while enhancing access and affordability for its life-saving therapy.

- Unlock comprehensive insights into our analysis of ARS Pharmaceuticals stock in this health report.

Explore historical data to track ARS Pharmaceuticals' performance over time in our Past section.

Vertex (NasdaqGM:VERX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vertex, Inc. offers enterprise tax technology solutions to the retail, wholesale, and manufacturing sectors both in the United States and globally, with a market cap of $5.53 billion.

Operations: Vertex, Inc. generates revenue primarily from its Software & Programming segment, which contributes $666.78 million. The company focuses on providing tax technology solutions across various industries globally.

Vertex, despite facing a net loss of $52.73 million in 2024, up from $13.09 million the previous year, is steering towards profitability with an expected revenue increase to between $760 million and $768 million in 2025. This growth trajectory is bolstered by its strategic mergers and acquisitions aimed at expanding markets and developing complementary products for its customer base. Moreover, Vertex's recent enhancement of its e-invoicing solution underscores its commitment to simplifying global tax compliance—a critical need as digital tax mandates evolve worldwide. This innovation not only addresses immediate regulatory challenges but also positions Vertex favorably within the tech landscape by enhancing operational efficiencies for businesses globally.

- Delve into the full analysis health report here for a deeper understanding of Vertex.

Evaluate Vertex's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Gain an insight into the universe of 235 US High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VERX

Vertex

Provides enterprise tax technology solutions for retail trade, wholesale trade, and manufacturing industries in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives