- United States

- /

- Software

- /

- NasdaqCM:CLSK

Imagine Holding CleanSpark (NASDAQ:CLSK) Shares While The Price Zoomed 443% Higher

While stock picking isn't easy, for those willing to persist and learn, it is possible to buy shares in great companies, and generate wonderful returns. When you buy and hold the right company, the returns can make a huge difference to both you and your family. For example, the CleanSpark, Inc. (NASDAQ:CLSK) share price rocketed moonwards 443% in just one year. In more good news, the share price has risen 24% in thirty days. This could be related to the recent financial results that were recently released - you could check the most recent data by reading our company report. However, the longer term returns haven't been so impressive, with the stock up just 19% in the last three years.

View our latest analysis for CleanSpark

CleanSpark isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

CleanSpark grew its revenue by 121% last year. That's stonking growth even when compared to other loss-making stocks. But the share price seems headed to the moon, up 443% as previously highlighted. Even the most bullish shareholders might be thinking that the share price might drop back a bit, after a gain like that. But if the share price does moderate a bit, there might be an opportunity for high growth investors.

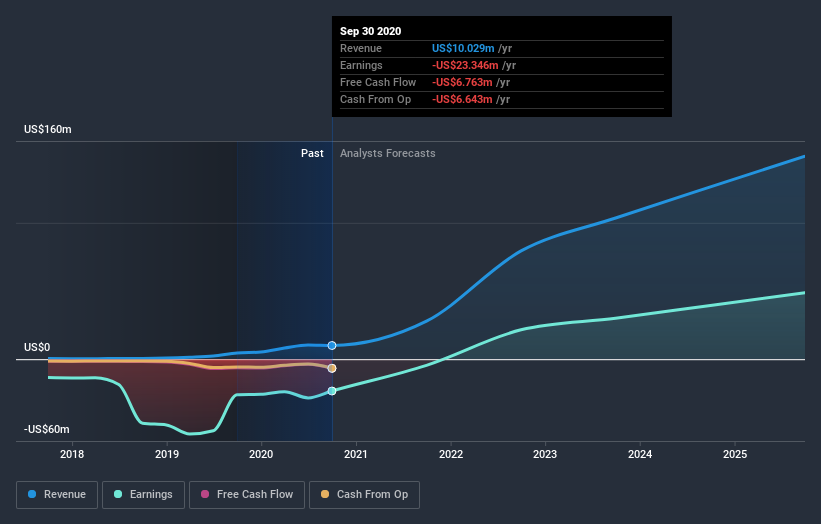

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at CleanSpark's financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that CleanSpark shareholders have received a total shareholder return of 443% over the last year. That certainly beats the loss of about 0.6% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand CleanSpark better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for CleanSpark you should be aware of, and 2 of them make us uncomfortable.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading CleanSpark or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:CLSK

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives