- United States

- /

- Software

- /

- NYSE:TUYA

Exploring US High Growth Tech Stocks In The Market

Reviewed by Simply Wall St

The United States market has been closely monitoring developments on tariffs, with stocks inching higher amid uncertainty in trade policy and notable milestones like Nvidia reaching a $4 trillion market cap. In this landscape, identifying high growth tech stocks involves looking for companies that not only capitalize on technological advancements but also demonstrate resilience against economic headwinds such as tariff impacts and inflation concerns.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.71% | 39.09% | ★★★★★★ |

| Circle Internet Group | 30.78% | 60.64% | ★★★★★★ |

| Ardelyx | 21.16% | 61.58% | ★★★★★★ |

| Mereo BioPharma Group | 50.84% | 58.22% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| AVITA Medical | 27.42% | 61.04% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.86% | 59.49% | ★★★★★★ |

| Alkami Technology | 20.53% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.07% | 59.83% | ★★★★★★ |

| Lumentum Holdings | 23.14% | 103.97% | ★★★★★★ |

Click here to see the full list of 228 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

CleanSpark (CLSK)

Simply Wall St Growth Rating: ★★★★★☆

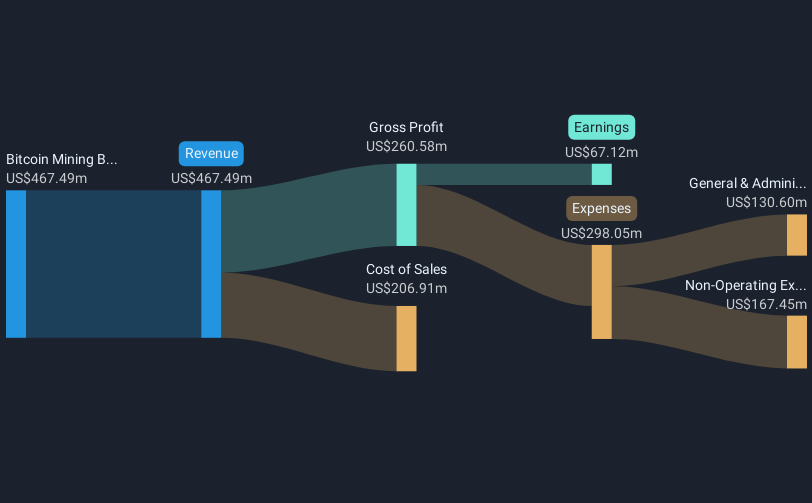

Overview: CleanSpark, Inc. is a bitcoin mining company operating in the Americas with a market capitalization of $3.18 billion.

Operations: The company generates revenue primarily through its bitcoin mining business, which contributed $537.40 million. The focus on bitcoin mining is central to its operations in the Americas.

Despite recent volatility, CleanSpark's strategic focus on Bitcoin production and sales underscores its adaptability in the high-tech sector. In June 2025, the company sold 578.51 bitcoins at an average price of approximately $105,860 each, reflecting robust operational output and market engagement. However, their removal from several Russell growth indices while being added to value benchmarks could signal a market perception shift towards viewing CleanSpark as a value-oriented play rather than purely growth-focused. This repositioning might influence investor sentiment but also highlights the fluid dynamics within tech valuations influenced by performance metrics and market trends.

- Take a closer look at CleanSpark's potential here in our health report.

Review our historical performance report to gain insights into CleanSpark's's past performance.

So-Young International (SY)

Simply Wall St Growth Rating: ★★★★★☆

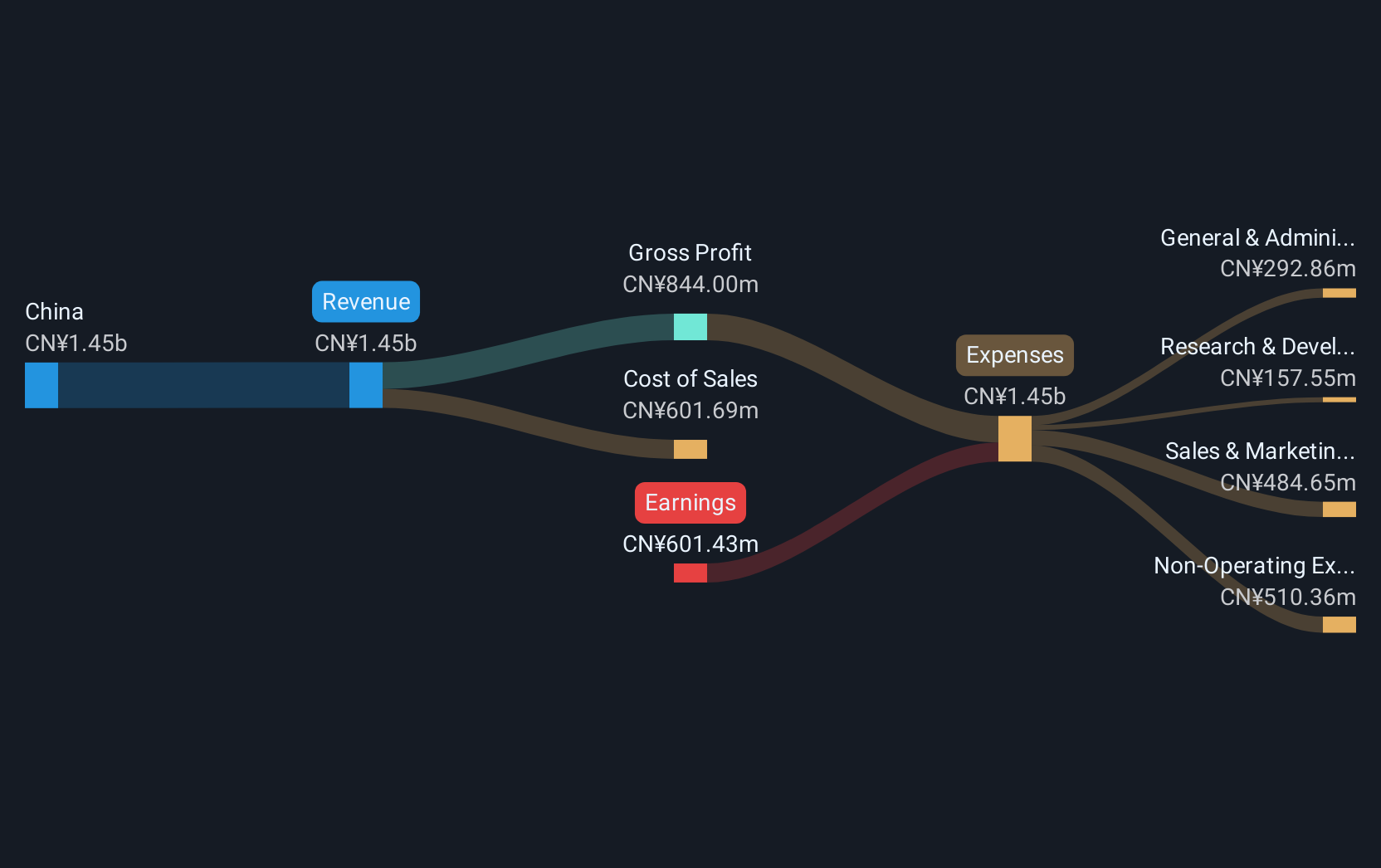

Overview: So-Young International Inc. operates an online platform for consumption healthcare services in the People’s Republic of China, with a market cap of $430.95 million.

Operations: The company generates revenue primarily through its online platform, which connects consumers with healthcare services in China. Its financial performance is marked by a notable gross profit margin of 78.5%, reflecting efficient cost management relative to revenue.

So-Young International, navigating a turbulent phase, reported a Q1 revenue dip to CNY 297.27 million from CNY 318.28 million year-over-year and widened its net loss to CNY 33.14 million. Despite these challenges, the firm is optimistic about its aesthetic treatment services, projecting revenues between USD 16.5 million and USD 19.3 million for Q2 2025—a significant leap of up to 410%. This growth expectation mirrors the company's aggressive R&D investment strategy aimed at enhancing service offerings and market reach, crucial for maintaining competitiveness in the dynamic tech-driven healthcare sector.

- Click here to discover the nuances of So-Young International with our detailed analytical health report.

Gain insights into So-Young International's past trends and performance with our Past report.

Tuya (TUYA)

Simply Wall St Growth Rating: ★★★★☆☆

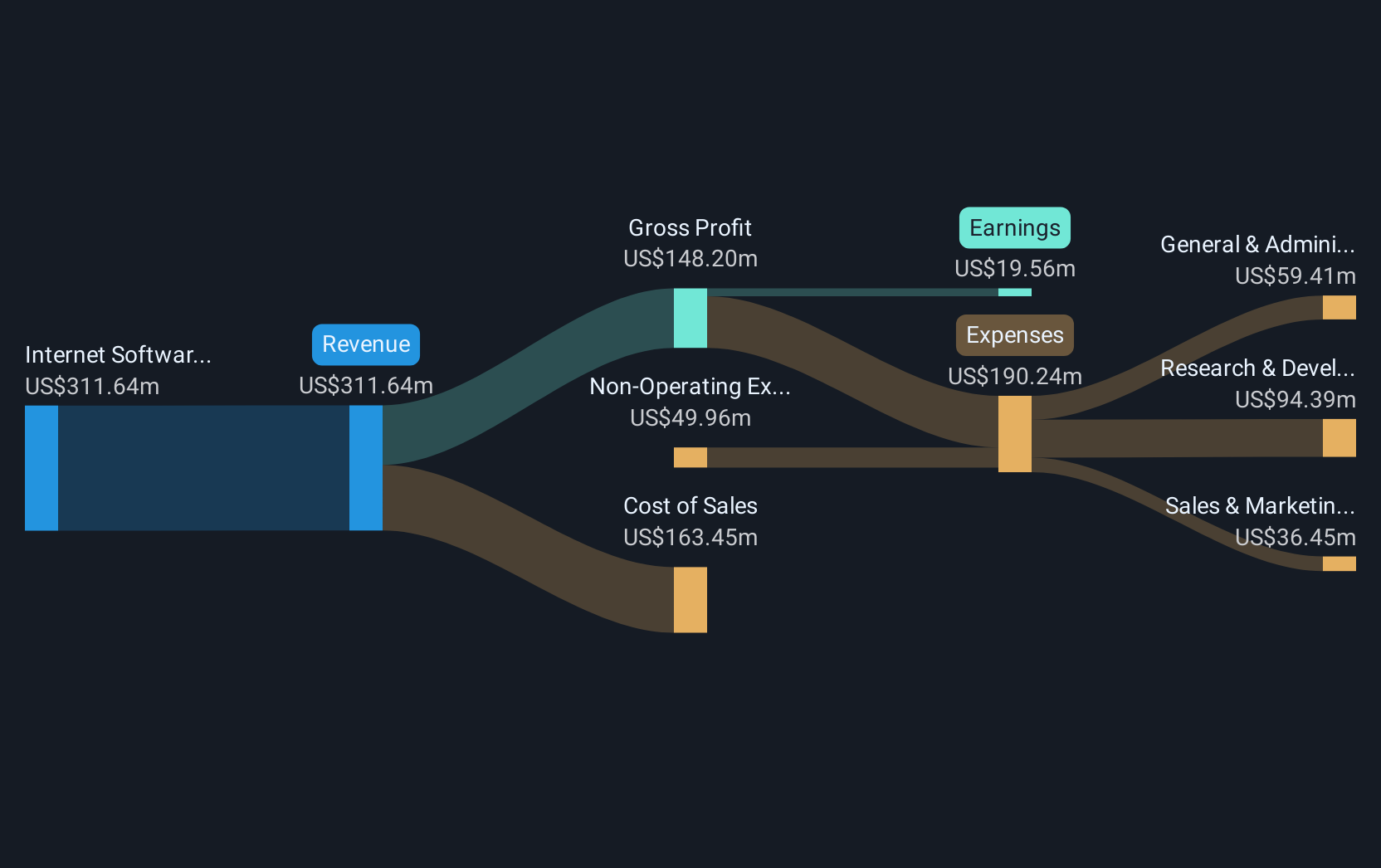

Overview: Tuya Inc. offers AI cloud platform services both in China and globally, with a market cap of approximately $1.62 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $311.64 million.

Tuya Inc. has recently demonstrated a significant turnaround, transitioning from a net loss to reporting a net income of $11.02 million in Q1 2025, up from a loss of $3.54 million the previous year, with sales rising to $74.69 million from $61.66 million. This growth is underpinned by strategic R&D investments that are central to its innovation-driven approach, notably at the TUYA Global Developer Summit where it launched new AIoT technologies aimed at reshaping smart device interactions and functionality. These initiatives not only enhance Tuya's product offerings but also secure its position in the competitive tech landscape by accelerating the commercialization of AI technologies and fostering robust data security through its HEDV platform for diverse enterprise needs.

- Click to explore a detailed breakdown of our findings in Tuya's health report.

Evaluate Tuya's historical performance by accessing our past performance report.

Where To Now?

- Click through to start exploring the rest of the 225 US High Growth Tech and AI Stocks now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tuya might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TUYA

Tuya

Provides AI cloud platform services in the People’s Republic of China and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives