- United States

- /

- Interactive Media and Services

- /

- NYSE:VTEX

Exploring High Growth Tech Stocks In The United States

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet over the past 12 months, it has risen by an impressive 22%, with earnings anticipated to grow by 15% per annum in the coming years. In this environment of robust growth expectations, identifying high growth tech stocks requires a focus on companies with strong innovation potential and adaptability to evolving market trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.36% | 24.28% | ★★★★★★ |

| Ardelyx | 21.09% | 55.29% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Bitdeer Technologies Group | 51.06% | 122.94% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| Blueprint Medicines | 23.54% | 55.74% | ★★★★★★ |

| Travere Therapeutics | 30.46% | 62.05% | ★★★★★★ |

Click here to see the full list of 233 stocks from our US High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

CleanSpark (NasdaqCM:CLSK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CleanSpark, Inc. is a bitcoin mining company operating in the Americas with a market capitalization of $2.93 billion.

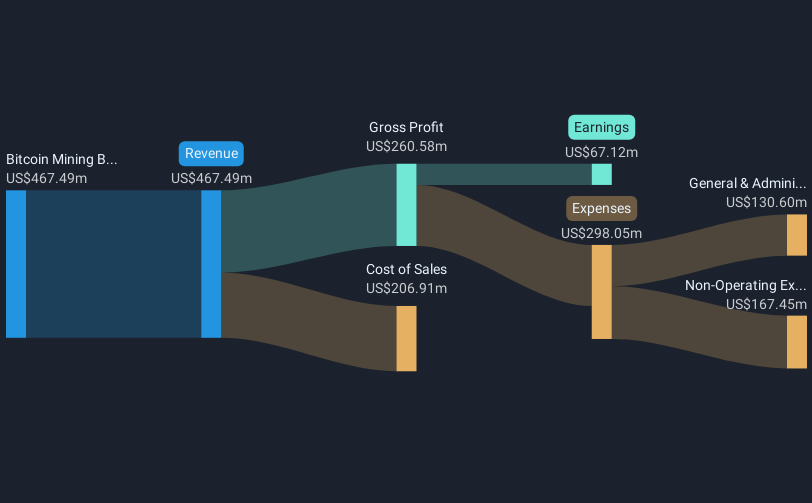

Operations: The company generates revenue primarily from its bitcoin mining business, which contributed $378.97 million.

CleanSpark, a player in the high-growth tech sector, is navigating a path toward profitability with expected earnings growth of 81.6% annually. Despite recent operational successes, including mining 668 Bitcoins in December and selling them at an average price of $101,246 each, the company faces challenges such as substantial shareholder dilution over the past year and less than one year of cash runway. Their aggressive R&D investment aligns with their revenue growth forecast of 30.5% per year, outpacing the US market average significantly. These financial maneuvers include issuing $650 million in zero-coupon senior convertible notes to strengthen its balance sheet amidst volatility and anticipated future growth trajectories.

- Dive into the specifics of CleanSpark here with our thorough health report.

Examine CleanSpark's past performance report to understand how it has performed in the past.

Similarweb (NYSE:SMWB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Similarweb Ltd. offers cloud-based digital intelligence solutions across various regions, including the United States, Europe, the Asia Pacific, the United Kingdom, and Israel, with a market capitalization of approximately $1.32 billion.

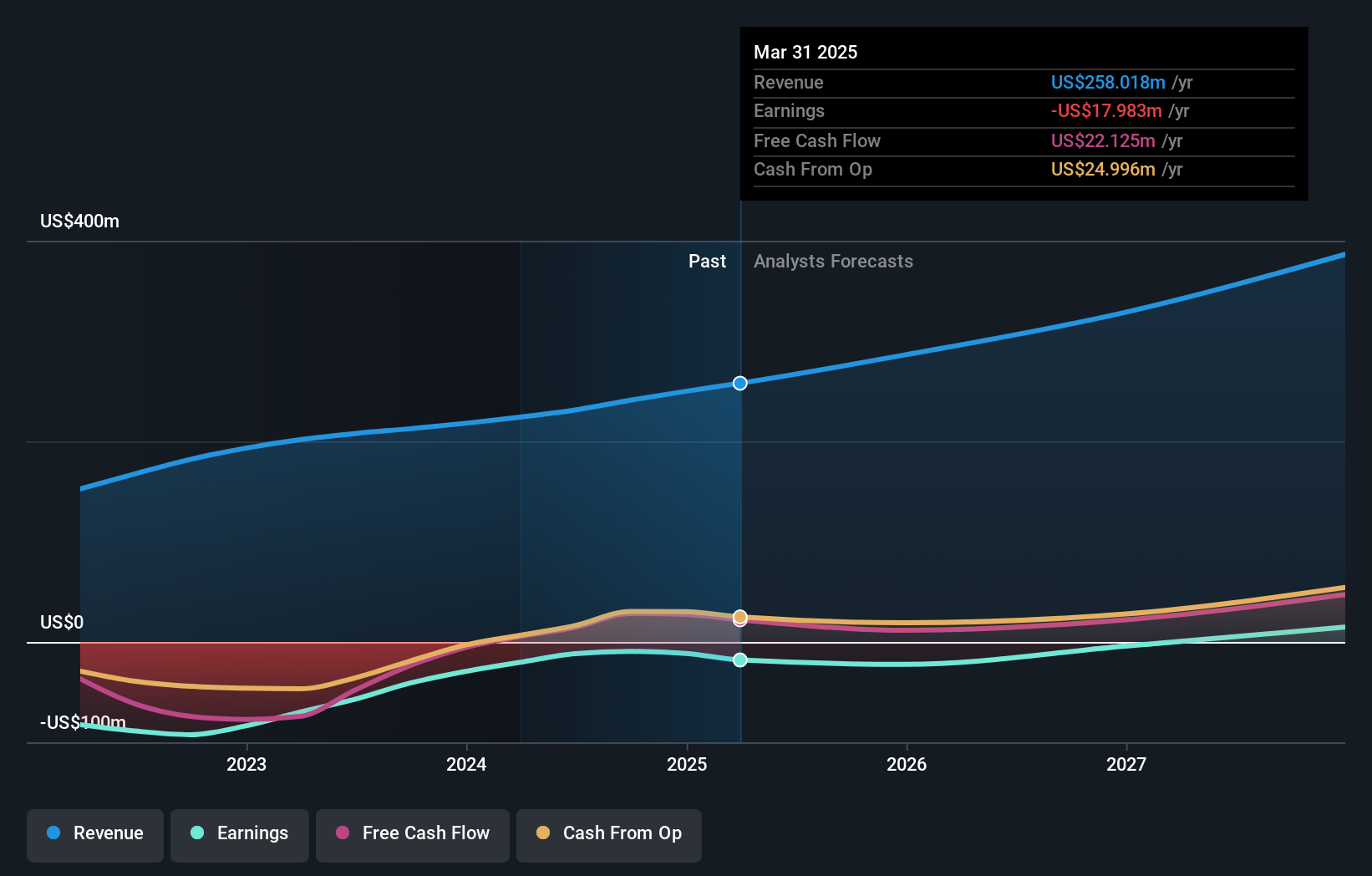

Operations: The company generates revenue primarily from its online financial information provider segment, amounting to $241.08 million. With a market capitalization of approximately $1.32 billion, Similarweb Ltd.'s operations span multiple regions globally.

Similarweb, amidst a competitive tech landscape, has demonstrated notable resilience and growth potential. With an annual revenue growth rate of 13.3%, the company is outpacing the US market average of 8.8%. Despite its current unprofitable status, earnings are projected to surge by an impressive 92.42% annually. The firm's commitment to innovation is evident in its strategic R&D investments, aligning with future profitability forecasts and a robust return on equity expected at 59.2% in three years. Recent engagements like presenting at significant industry conferences underscore its active role in shaping digital analytics landscapes and expanding its market influence through thought leadership and strategic insights.

- Click to explore a detailed breakdown of our findings in Similarweb's health report.

Understand Similarweb's track record by examining our Past report.

VTEX (NYSE:VTEX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: VTEX offers a software-as-a-service digital commerce platform tailored for enterprise brands and retailers, with a market cap of approximately $1.23 billion.

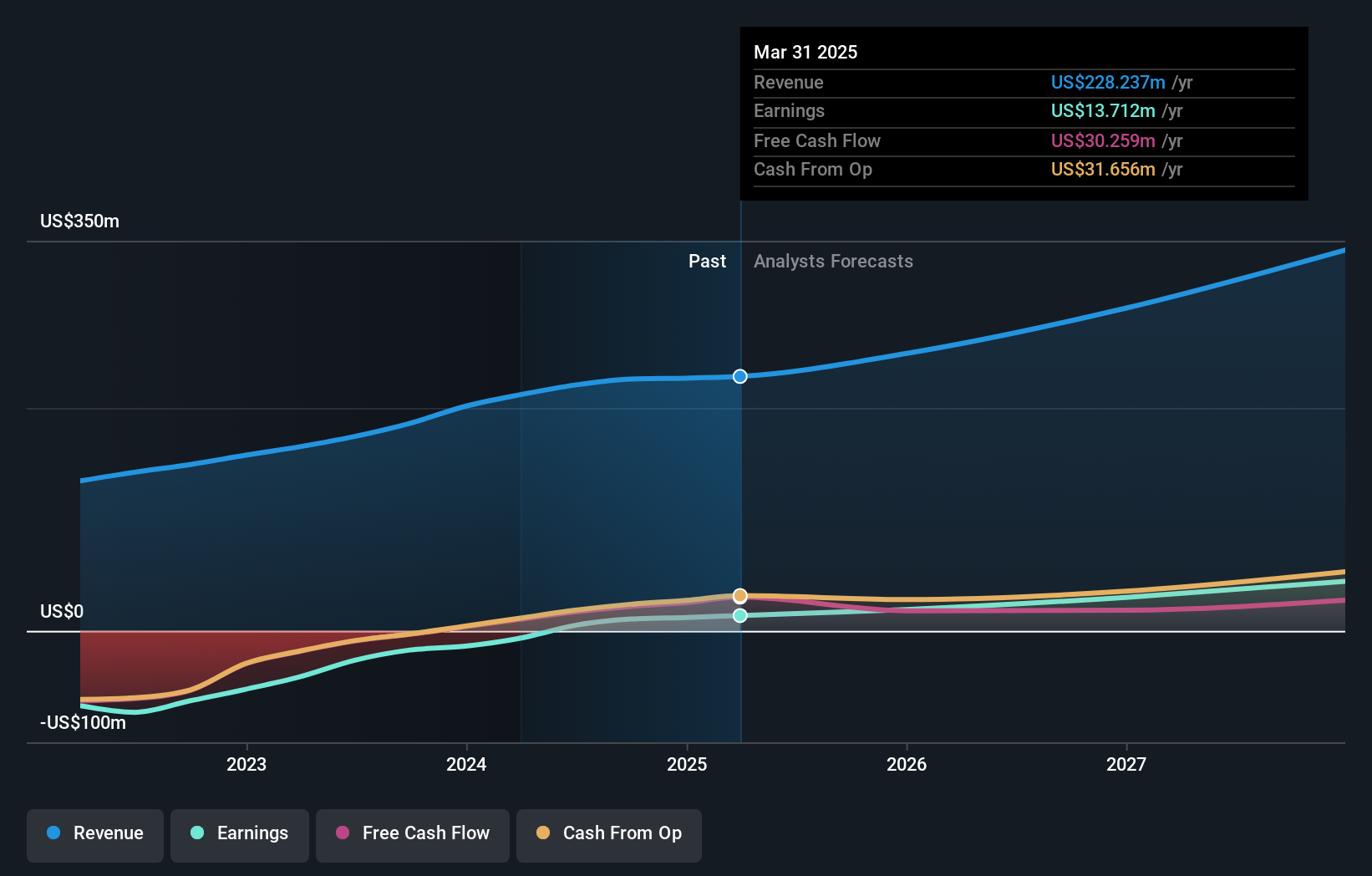

Operations: The company generates revenue primarily from its internet software and services segment, amounting to $225.91 million. The business focuses on providing a digital commerce platform designed for enterprise-level brands and retailers.

VTEX, now profitable, has shown a remarkable turnaround with earnings growth expected at 47.8% annually, outpacing the industry average of 11.6%. This growth is supported by strategic R&D investments that have positioned the company well within the competitive Interactive Media and Services sector. Additionally, VTEX's proactive share repurchase program announced on December 3, 2024, emphasizes its commitment to shareholder value, planning to buy back $30 million in shares. This move aligns with its robust revenue projections for 2024, targeting an FX neutral year-on-year increase of up to 19.5%, demonstrating confidence in its operational strategy and market position.

- Click here to discover the nuances of VTEX with our detailed analytical health report.

Gain insights into VTEX's historical performance by reviewing our past performance report.

Make It Happen

- Click here to access our complete index of 233 US High Growth Tech and AI Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VTEX

VTEX

Provides software-as-a-service digital commerce platform for enterprise brands and retailers.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives