- United States

- /

- Software

- /

- NasdaqCM:CLSK

CleanSpark Stock Soars 72% in a Month—Is the Momentum Backed by Fundamentals?

Reviewed by Bailey Pemberton

If you’ve been tracking CleanSpark’s wild ride lately, you are definitely not alone. Investors are watching closely, wondering if this is the moment to jump in, ride the momentum, or maybe step back. Just in the past month, CleanSpark’s stock price surged 72.5%—yes, over seventy percent—with a tidy 7.2% bump in the past week alone. Year-to-date gains? An impressive 68.7%. Go even further back and the stock has rocketed up over 447% across three years, signaling long-term optimism and a changing perception of risk in this corner of the market.

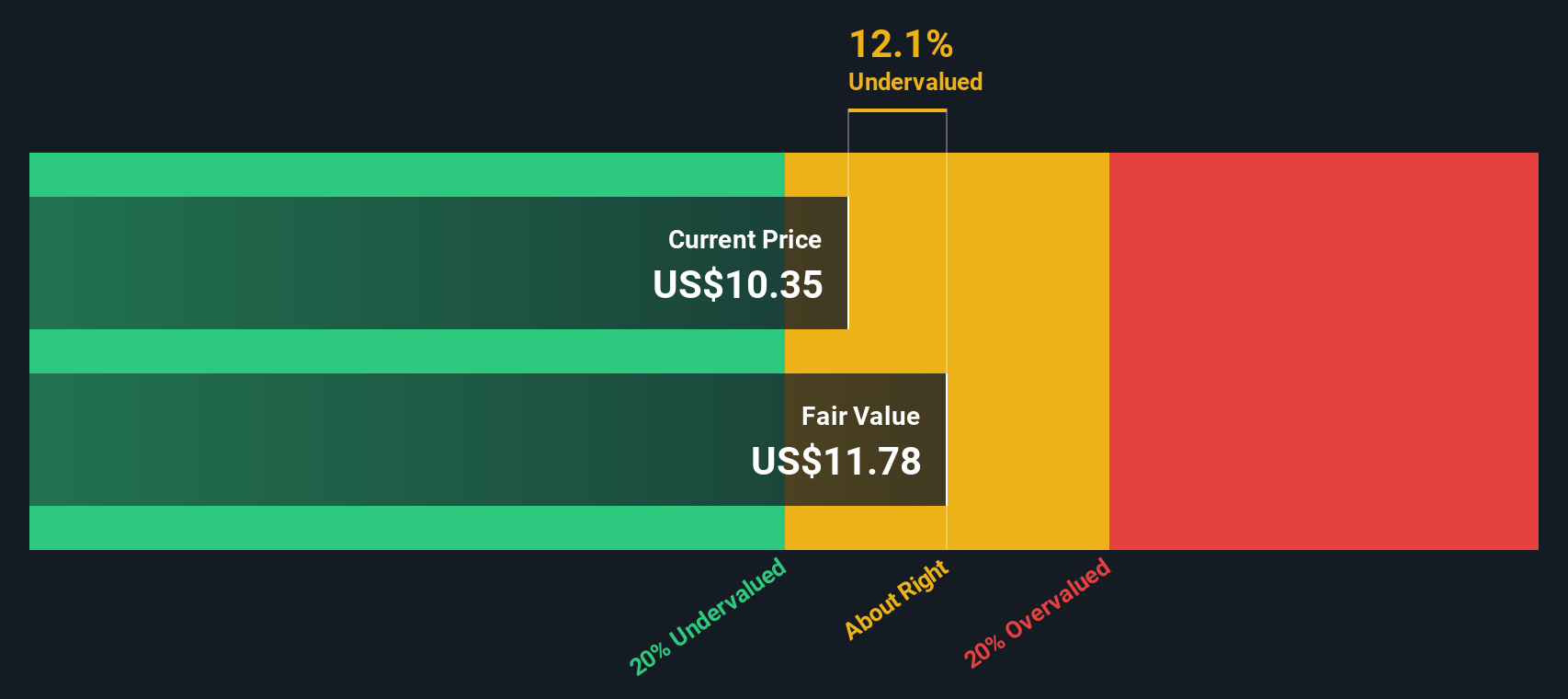

It’s not just hype, though. CleanSpark’s valuation score sits at 3 out of 6 right now, meaning the company is considered undervalued in three key areas by traditional analysis. Some recent price action was fueled by market developments including shifts in renewable energy policy and a growing interest in innovative crypto-mining solutions, both areas where CleanSpark is turning heads. All this movement naturally raises the question: is CleanSpark still a bargain, or has the bus already left the station?

Next, let’s break down the standard valuation playbook, look at how CleanSpark stacks up by the usual measures, and explore why the real answer might lie beyond basic ratios. Stick around for a perspective that may change how you view valuation altogether.

Approach 1: CleanSpark Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth today by projecting its future cash flows and discounting them back to their present value. For CleanSpark, this involves analyzing expected free cash flows ($) over the next decade and translating those future numbers into a present-day intrinsic value.

Currently, CleanSpark’s latest twelve months have shown a free cash flow of -$565.1 million. Analysts expect this to turn positive by 2026 with $244 million, still growing and gradually normalizing to about $85.3 million by 2035. The projections beyond the first five years are extrapolated, as standard analyst estimates taper off after that period. All calculations are in US dollars.

Running the numbers using the two-stage Free Cash Flow to Equity method, the DCF model estimates CleanSpark’s fair value at $5.14 per share. With the current price substantially higher, this suggests the market’s optimism may be ahead of fundamentals. Specifically, the implied discount indicates the stock is about 210.4% overvalued compared to the DCF valuation.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CleanSpark may be overvalued by 210.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: CleanSpark Price vs Earnings

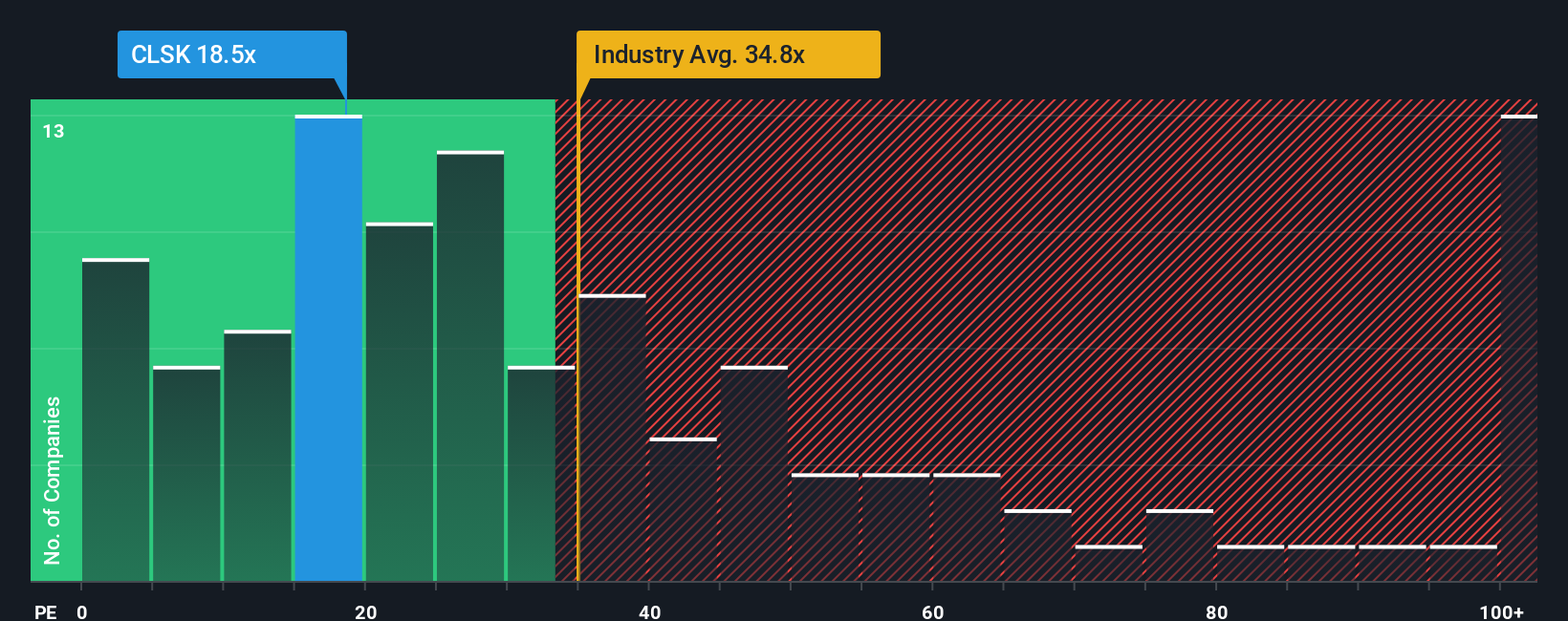

When a company is profitable, the Price-to-Earnings (PE) ratio is a go-to yardstick for investors. It measures how much investors are willing to pay for each dollar of current earnings. This ratio is a practical, time-tested way to put a value on stocks with positive profits. A higher PE ratio usually means higher future growth or lower risk, while a lower ratio can signal slower growth, greater risk, or an undervalued opportunity.

CleanSpark's current PE ratio sits at 15.3x. To put that in context, the average PE ratio for peers is 12.6x and the software industry as a whole trades at an even loftier 35.7x. This means CleanSpark is trading above its direct peer group, yet well below the broader industry's appetite for risk and future growth.

But instead of just comparing to peers or sector averages, there is a smarter way to measure value: Simply Wall St's Fair Ratio. This proprietary metric takes into account CleanSpark's unique factors, including its actual earnings growth outlook, profit margins, market cap, and risks, to work out what multiple would be fair, rather than just “normal.” For CleanSpark, the Fair Ratio comes in at 24.3x, which is notably higher than both the actual multiple and peer averages. This suggests that, based on its fundamentals, CleanSpark deserves a higher valuation than it is currently getting.

Since CleanSpark's PE ratio of 15.3x is meaningfully below its Fair Ratio of 24.3x, the takeaway is clear. The stock may be undervalued based on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CleanSpark Narrative

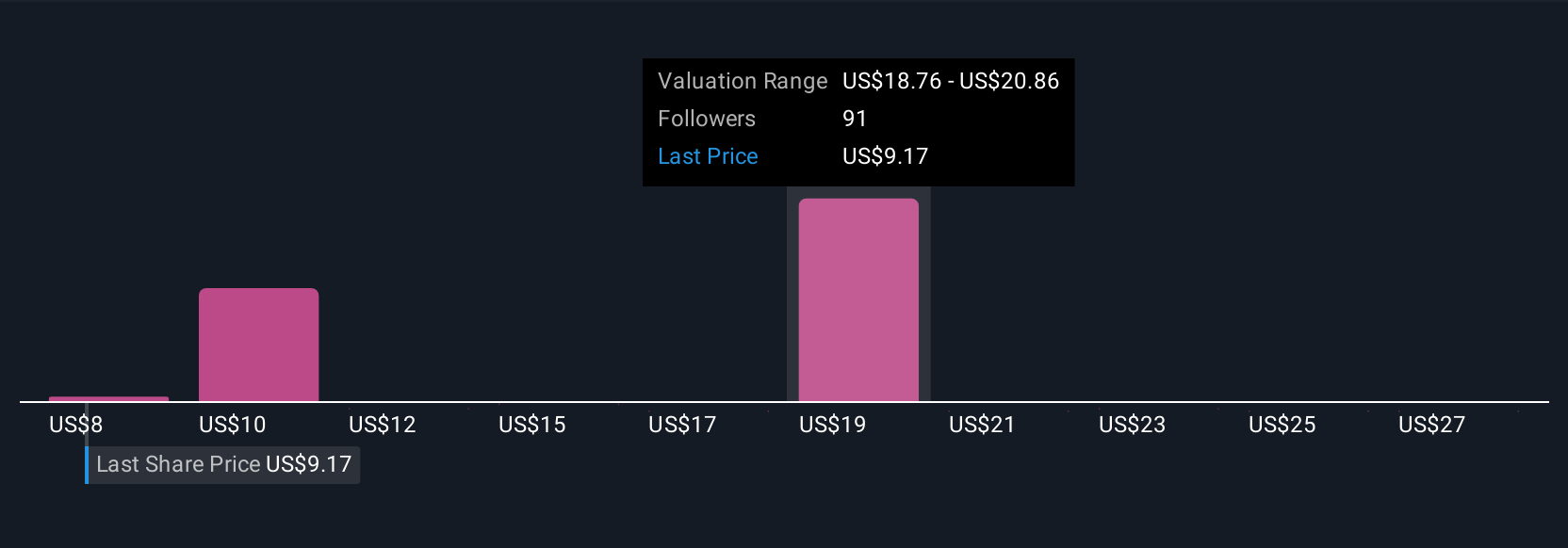

Earlier, we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is your own view or “story” about a company, tying together what you believe about its future revenue, profits, margins, and risks so you can see how these beliefs affect your fair value estimate. Narratives connect the dots from a company’s story to a financial forecast to a calculated fair value, making investment thinking both more meaningful and practical.

Narratives are available right now on Simply Wall St’s Community page, used by millions of investors to share, compare, and update perspectives. They make it easier than ever to decide when to buy or sell by comparing what you think the fair value should be to the current share price. In addition, Narratives update automatically as new information arrives, adapting your outlook in real time with fresh news or earnings.

For example, some investors see CleanSpark surging toward $25.00 per share on booming Bitcoin demand and efficient operations. Others believe $15.00 reflects caution around volatile crypto cycles and rising costs. With Narratives, you can add your own take, see how it stacks up, and invest based on the story and numbers you believe in most.

Do you think there's more to the story for CleanSpark? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CLSK

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives