- United States

- /

- Software

- /

- NasdaqCM:CLSK

A Piece Of The Puzzle Missing From CleanSpark, Inc.'s (NASDAQ:CLSK) 69% Share Price Climb

CleanSpark, Inc. (NASDAQ:CLSK) shareholders would be excited to see that the share price has had a great month, posting a 69% gain and recovering from prior weakness. But the last month did very little to improve the 56% share price decline over the last year.

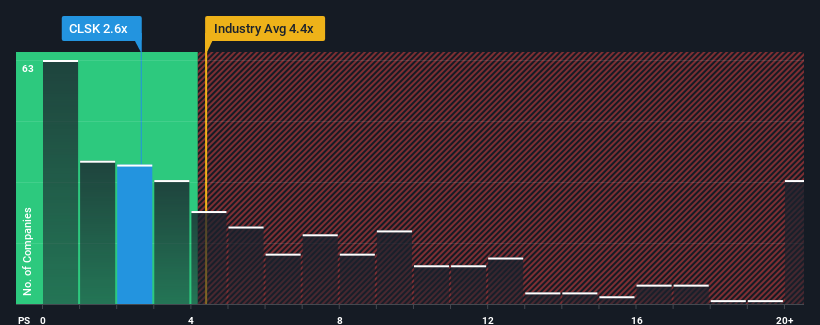

Even after such a large jump in price, CleanSpark's price-to-sales (or "P/S") ratio of 2.6x might still make it look like a buy right now compared to the Software industry in the United States, where around half of the companies have P/S ratios above 4.4x and even P/S above 10x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for CleanSpark

How CleanSpark Has Been Performing

Recent times have been advantageous for CleanSpark as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on CleanSpark.Is There Any Revenue Growth Forecasted For CleanSpark?

There's an inherent assumption that a company should underperform the industry for P/S ratios like CleanSpark's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 65% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 106% as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 13%, which is noticeably less attractive.

With this information, we find it odd that CleanSpark is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does CleanSpark's P/S Mean For Investors?

Despite CleanSpark's share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

To us, it seems CleanSpark currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

You need to take note of risks, for example - CleanSpark has 4 warning signs (and 2 which shouldn't be ignored) we think you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CLSK

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.