- United States

- /

- Software

- /

- NasdaqCM:CLSK

A Fresh Look at CleanSpark (CLSK) Valuation Following Leadership Reshuffle and Growth Strategy Shift

Reviewed by Simply Wall St

Most Popular Narrative: 52% Undervalued

The prevailing narrative sees CleanSpark as dramatically undervalued and projects a fair value more than 50% above the current share price.

The company's strategic focus on sourcing flexible, low-cost, and increasingly renewable energy, combined with operating in supportive states, reduces exposure to volatile energy markets and supports stable or expanding gross margins. This approach may foster long-term earnings resilience in an industry prone to input cost shocks.

What powers this bullish outlook? The story centers on robust growth assumptions and significant shifts in profitability and market share. Interested in the projections behind the high target price? The full narrative explains the aggressive consensus and the key numbers that underpin this bold valuation.

Result: Fair Value of $20.16 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing Bitcoin price volatility and rising industry competition could quickly undermine CleanSpark's profit forecasts and long-term growth expectations.

Find out about the key risks to this CleanSpark narrative.Another View: What Does the DCF Model Suggest?

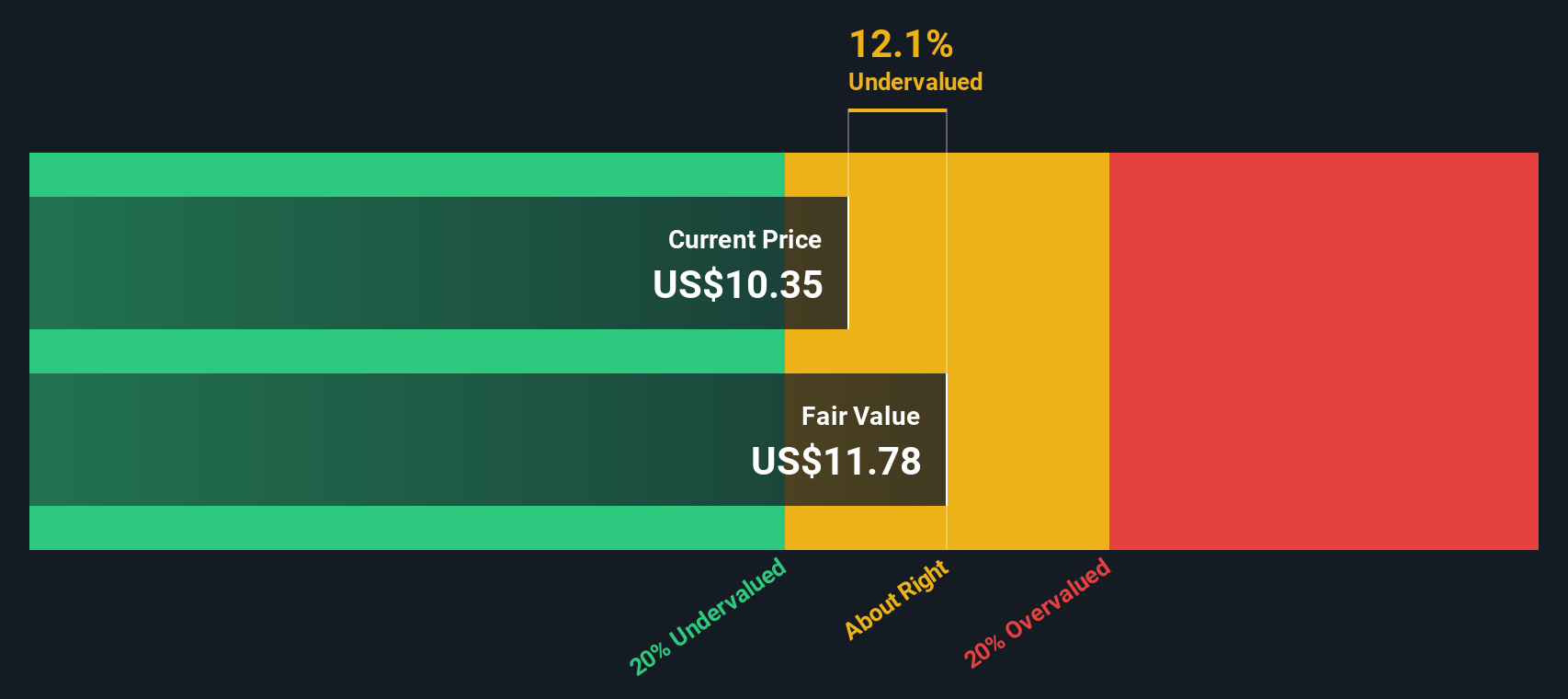

There is another way to look at CleanSpark's value. Our DCF model also points to the shares trading below fair value, which reinforces the earlier undervalued thesis. However, does the market agree with both models, or is something missing in the numbers?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own CleanSpark Narrative

If the story here does not quite fit your view or you are the type who digs deeper, you can always run the numbers yourself and shape your own CleanSpark thesis in minutes. Do it your way.

A great starting point for your CleanSpark research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not let opportunity pass you by. Set your sights on innovative companies blazing new trails, smart value plays, and steady income prospects using our handpicked investment screens below.

- Tap into the world of tomorrow by seeking out growth potential with AI penny stocks as these companies drive artificial intelligence breakthroughs and next-level automation.

- Secure your portfolio with steady returns by following dividend stocks with yields > 3% which offers reliable yields that can boost your income, even when markets are rocky.

- Spot undervalued gems waiting to be recognized by checking undervalued stocks based on cash flows for stocks priced below their true cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CLSK

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives