- United States

- /

- Software

- /

- NasdaqGS:CLBT

Assessing Cellebrite (NasdaqGS:CLBT) Valuation After Strong Revenue Growth and Share Price Momentum

Reviewed by Kshitija Bhandaru

Cellebrite DI (CLBT) has recently drawn attention after reporting double-digit annual revenue growth. Its latest figures put revenue at $436 million. Investors appear eager to see if this performance will continue through the coming year.

See our latest analysis for Cellebrite DI.

Momentum has been building for Cellebrite DI, with a robust 90-day share price return of 26.43% suggesting that investors are increasingly confident in the company’s growth potential. Despite a slightly negative year-to-date return, Cellebrite’s three-year total shareholder return of 281.93% stands out as a long-term highlight, showing the stock has rewarded those willing to look beyond short-term headline moves.

If strong recent gains like Cellebrite's have you searching for more opportunities, this is the moment to broaden your search and discover fast growing stocks with high insider ownership

With Cellebrite’s earnings momentum and substantial long-term returns, the debate now shifts to valuation. Is the impressive growth story still underappreciated by the market, or is all the good news already reflected in the share price?

Most Popular Narrative: 21.4% Undervalued

Cellebrite DI's most widely followed narrative places its fair value at $23.14 per share, well above the recent closing price of $18.18. This gap has caught the attention of many investors who are looking for signs of upside and deeper logic behind the valuation.

The continued transition to a recurring, subscription-based revenue model, with over 90% of revenues now from subscriptions and growing SaaS/cloud penetration, improves revenue visibility, predictability, and operating leverage. This is already translating into higher EBITDA and free cash flow margins and is likely underappreciated in current valuations.

Want to know the secret behind this valuation leap? The narrative hinges on a critical financial inflection point and bold profit margin assumptions. Which surging metrics power this price target? Unlock the details hiding in the next section of the story.

Result: Fair Value of $23.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent delays in U.S. federal contracts and rapid progress in device security could limit Cellebrite's future revenue and reduce its competitive edge.

Find out about the key risks to this Cellebrite DI narrative.

Another View: Market Multiples Raise a Red Flag

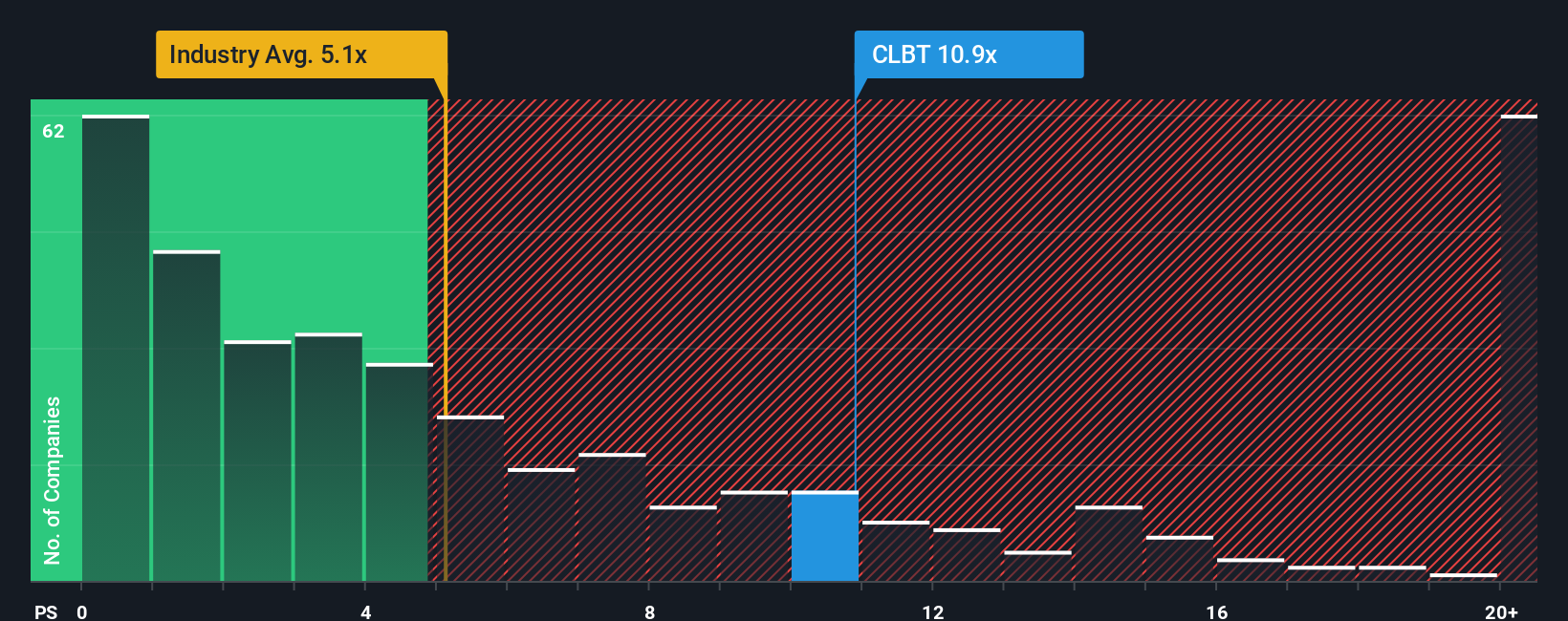

Switching gears, the market’s price-to-sales ratio for Cellebrite sits at 10.2, more than double the US Software sector average of 5 and higher than close peers at 6.2. That is not all; the fair ratio for Cellebrite is pegged at just 7.2, pointing to clear overvaluation on this basis. Could growth outpace these headwinds, or is too much optimism already baked in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cellebrite DI Narrative

If you have a different perspective or want to dig deeper on your own, crafting your own narrative with fresh insights takes just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Cellebrite DI.

Looking for More Investment Ideas?

Don’t wait while opportunity passes by. Step ahead with smart investment themes using Simply Wall Street’s powerful screener tools designed for serious stock pickers.

- Capture potential with companies trading below intrinsic value by using these 877 undervalued stocks based on cash flows when hunting for market bargains others might overlook.

- Tap into the boom in blockchain innovation. Uncover movers in the digital asset surge with these 79 cryptocurrency and blockchain stocks right now.

- Capitalize on the next wave in healthcare technology by checking out these 33 healthcare AI stocks before breakthrough stocks hit the mainstream.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CLBT

Cellebrite DI

Develops solutions for legally sanctioned investigations in Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives