- United States

- /

- Software

- /

- NasdaqGS:CIFR

Cipher Mining (CIFR): Evaluating Valuation After Recent 9% Share Price Surge

Cipher Mining (CIFR) has recently seen its shares climb over 9% in a single day, sparking renewed interest among investors. The company’s positive momentum follows a strong run in the past 3 months, with returns up over 150%.

See our latest analysis for Cipher Mining.

Momentum has clearly been building for Cipher Mining, with its 1-day share price return of 9.3% capping off a remarkable 296% year-to-date gain. While the latest move has grabbed attention, it is this surge, reflected in its three-year total shareholder return of an astonishing 1,916%, that shows just how much sentiment has shifted around the stock lately.

If you're looking for the next breakout beyond crypto miners, now is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With such staggering gains already on the board, the key question now is whether Cipher Mining’s current share price reflects all its future promise or if there is still untapped value left for savvy investors to uncover.

Most Popular Narrative: 29.7% Undervalued

With the narrative fair value at $27.25 and Cipher Mining’s last close of $19.15, followers see a substantial gap for potential upside. The popular narrative signals that major infrastructure deals and surging demand could reshape the company's value equation.

Bullish analysts highlight Cipher’s new lease agreements with industry leaders as transformative for the company’s credibility and capabilities in the AI and high-density data center market. The $5.5 billion, 15-year lease deal with Amazon Web Services is seen as providing meaningful earnings visibility and supporting further multiple expansion for the company’s shares.

Want to know how blockbuster tech partnerships and bold financial forecasts shape this story? The narrative’s future valuation draws on high growth, margin expansion, and a multiple rarely seen outside industry leaders. Which projections power that big number? Peek behind the curtain to uncover the factors that make this fair value stand out.

Result: Fair Value of $27.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential power supply shortages and rapid technology shifts could pose significant challenges to Cipher Mining’s ambitious growth story.

Find out about the key risks to this Cipher Mining narrative.

Another View: Multiples Paint a More Cautious Picture

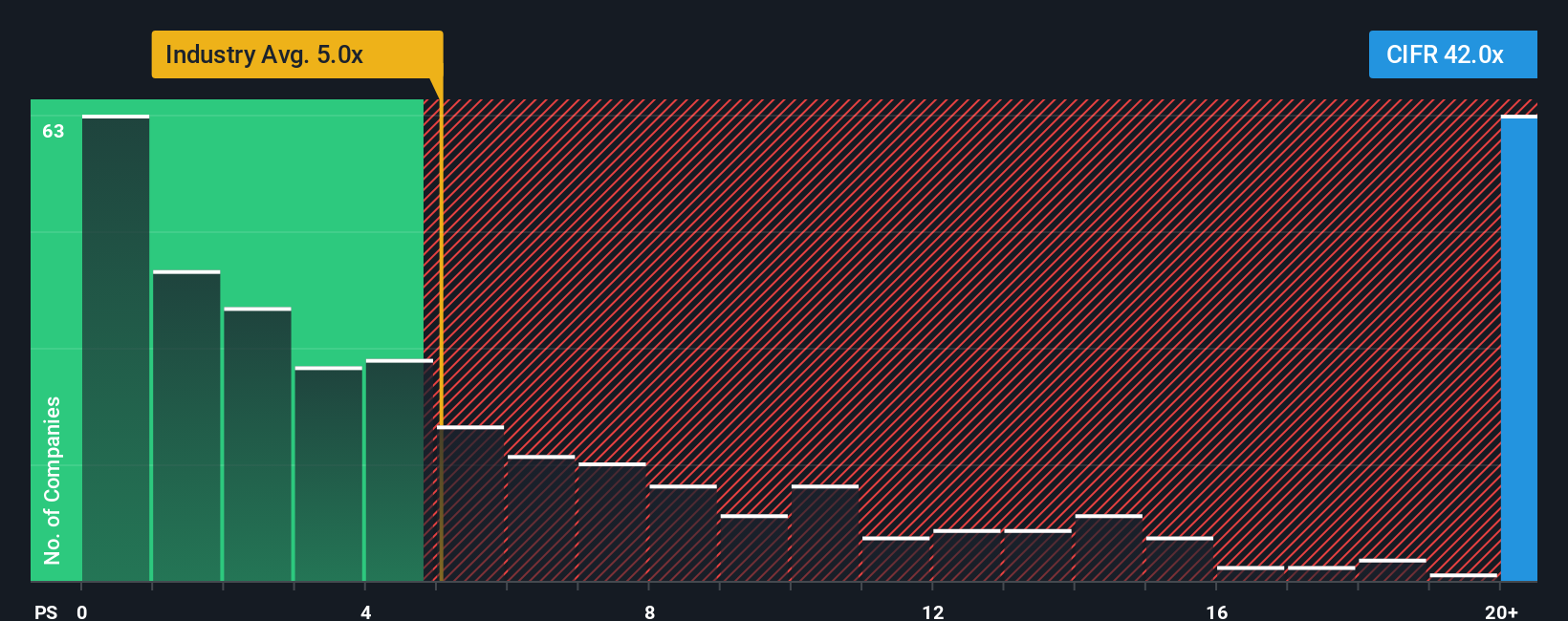

Looking at Cipher Mining from a sales ratio perspective, the stock trades at 36.6 times sales, which is significantly higher than both the US Software industry average of 4.7 times and its peer group’s 19.9 times. In practical terms, this steep gap means investors may be taking on extra valuation risk if market sentiment shifts or growth expectations fall short. This is especially noteworthy since the fair ratio stands at just 13.9 times sales, a level the market could move toward over time. Is there enough underlying growth to justify this premium, or could a reversion to the mean catch investors off guard?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cipher Mining Narrative

If you have a different perspective or prefer hands-on analysis, there is nothing stopping you from shaping your own view of Cipher Mining’s story in just a few minutes. Do it your way

A great starting point for your Cipher Mining research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t limit yourself to just one story when there are powerful opportunities waiting. Get ahead by checking these handpicked ideas that could unlock your next winning move.

- Tap into tomorrow’s disruptive breakthroughs by checking out these 28 quantum computing stocks for companies building the next wave in computing power.

- Boost your portfolio’s growth potential by targeting these 25 AI penny stocks that are transforming industries through artificial intelligence and automation.

- Secure reliable income streams by seeking out these 15 dividend stocks with yields > 3% with strong yields and resilient business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CIFR

Cipher Mining

Develops and operates industrial-scale data centers in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Novo Nordisk - A Fundamental and Historical Valuation

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion