- United States

- /

- Software

- /

- NasdaqGS:CIFR

Cipher Mining (CIFR): Assessing Valuation After Major AWS Lease and Expanded Google-Backed AI Infrastructure Deals

Cipher Mining (CIFR) is suddenly on a lot more watchlists after locking in a multi billion dollar AI data center lease with Amazon Web Services, plus an expanded, Google backed Fluidstack hosting deal.

See our latest analysis for Cipher Mining.

Those AI infrastructure deals are arriving on the back of serious momentum, with a 30 day share price return of 14.56 percent and a year to date share price return of 235.61 percent. The three year total shareholder return of 2,901.85 percent shows how powerful the longer term trend has been.

If this AI fueled run has your attention, it could be a good moment to explore other high growth tech names using Simply Wall St's high growth tech and AI stocks.

Yet even with analyst targets sitting far above the current share price and contracts stretching over a decade, investors still need to ask: Is Cipher Mining genuinely undervalued here, or has the market already baked in years of AI growth?

Most Popular Narrative Narrative: 40.5% Undervalued

With the most widely followed fair value sitting well above Cipher Mining's last close of $16.21, the narrative frames today’s price as a sizable discount to long term AI power optionality.

Industry-wide demand for large-scale, flexible, and energy-rich data center sites, driven by accelerating institutional and mainstream adoption of digital assets and AI, aligns with Cipher's strategy to develop infrastructure that can quickly pivot between Bitcoin mining and high-performance computing (HPC), creating upside potential for both revenue diversification and earnings stability.

Want to see what justifies that upside? This narrative leans on aggressive revenue compounding, a sharp profit margin reset, and a punchy future earnings multiple. Curious which assumptions really move the fair value to $27.25 and beyond?

Result: Fair Value of $27.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps on hyperscale projects or prolonged Bitcoin price weakness could quickly erode the growth, margin and valuation assumptions behind this bullish case.

Find out about the key risks to this Cipher Mining narrative.

Another View: Market Multiple Sends a Very Different Signal

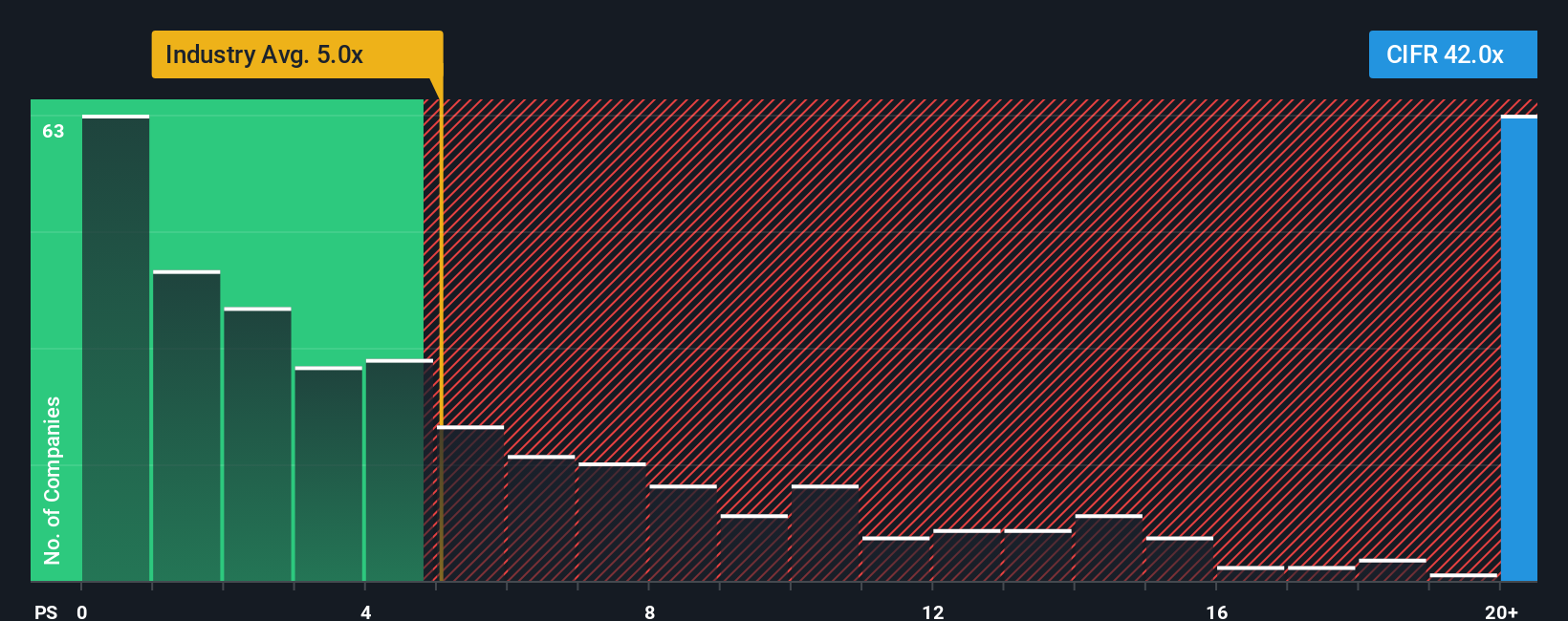

Look beyond that 40.5 percent discount, and the picture gets tougher. On a price to sales basis, Cipher trades at about 31 times versus 4.9 times for the US Software industry and a fair ratio of 8.2 times. This suggests the market is already pricing in a lot of perfection.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cipher Mining Narrative

If you see the story differently, or want to dig into the numbers yourself, you can build a complete narrative in just minutes: Do it your way.

A great starting point for your Cipher Mining research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in fresh opportunities by running targeted screens on Simply Wall St and position yourself ahead of the next wave of strong performers.

- Capture potential home-run opportunities early by scanning these 3634 penny stocks with strong financials built on solid financial foundations instead of hype.

- Ride powerful structural trends in automation and machine learning by focusing on these 24 AI penny stocks that already show momentum and scalability.

- Strengthen your portfolio core with these 12 dividend stocks with yields > 3% that aim to combine income today with room for capital growth tomorrow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CIFR

Cipher Mining

Develops and operates industrial-scale data centers in the United States.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

My long-term take on Nike: A global sports brand with steady growth potential but margin challenges to solve.

QuantumScape: A Mispriced Deep‑Tech Inflection Point With Multi‑Billion‑Dollar Optionality

30 Baggers Silver Miner with Gold/VTM Optionality

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks