- United States

- /

- Software

- /

- NasdaqGS:CHKP

Returns At Check Point Software Technologies (NASDAQ:CHKP) Appear To Be Weighed Down

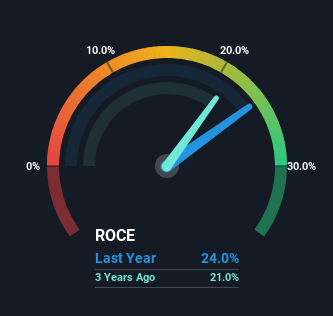

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. Having said that, while the ROCE is currently high for Check Point Software Technologies (NASDAQ:CHKP), we aren't jumping out of our chairs because returns are decreasing.

Return On Capital Employed (ROCE): What Is It?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on Check Point Software Technologies is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.24 = US$897m ÷ (US$5.5b - US$1.8b) (Based on the trailing twelve months to June 2023).

Therefore, Check Point Software Technologies has an ROCE of 24%. In absolute terms that's a great return and it's even better than the Software industry average of 9.2%.

View our latest analysis for Check Point Software Technologies

In the above chart we have measured Check Point Software Technologies' prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Check Point Software Technologies here for free.

The Trend Of ROCE

There hasn't been much to report for Check Point Software Technologies' returns and its level of capital employed because both metrics have been steady for the past five years. Businesses with these traits tend to be mature and steady operations because they're past the growth phase. Although current returns are high, we'd need more evidence of underlying growth for it to look like a multi-bagger going forward.

On another note, while the change in ROCE trend might not scream for attention, it's interesting that the current liabilities have actually gone up over the last five years. This is intriguing because if current liabilities hadn't increased to 32% of total assets, this reported ROCE would probably be less than24% because total capital employed would be higher.The 24% ROCE could be even lower if current liabilities weren't 32% of total assets, because the the formula would show a larger base of total capital employed. With that in mind, just be wary if this ratio increases in the future, because if it gets particularly high, this brings with it some new elements of risk.

In Conclusion...

While Check Point Software Technologies has impressive profitability from its capital, it isn't increasing that amount of capital. Unsurprisingly, the stock has only gained 15% over the last five years, which potentially indicates that investors are accounting for this going forward. As a result, if you're hunting for a multi-bagger, we think you'd have more luck elsewhere.

If you're still interested in Check Point Software Technologies it's worth checking out our FREE intrinsic value approximation to see if it's trading at an attractive price in other respects.

Check Point Software Technologies is not the only stock earning high returns. If you'd like to see more, check out our free list of companies earning high returns on equity with solid fundamentals.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CHKP

Check Point Software Technologies

Develops, markets, and supports a range of products and services for IT security worldwide.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Quanta Services (PWR): Strengthening the Backbone of the AI Power Grid.

KLA Corporation (KLAC): Engineering Yield in the Age of Chiplets and Sub-2nm Nodes.

Monolithic Power Systems (MPWR): The AI "Power Play" Facing a Transition from Scarcity to Scale.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks