- United States

- /

- Software

- /

- NasdaqGS:CHKP

Check Point Software Technologies (NASDAQ:CHKP) Hasn't Managed To Accelerate Its Returns

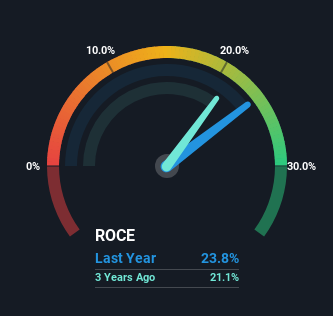

Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. Having said that, while the ROCE is currently high for Check Point Software Technologies (NASDAQ:CHKP), we aren't jumping out of our chairs because returns are decreasing.

What Is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for Check Point Software Technologies, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.24 = US$899m ÷ (US$5.7b - US$1.9b) (Based on the trailing twelve months to December 2023).

Therefore, Check Point Software Technologies has an ROCE of 24%. That's a fantastic return and not only that, it outpaces the average of 7.3% earned by companies in a similar industry.

Check out our latest analysis for Check Point Software Technologies

In the above chart we have measured Check Point Software Technologies' prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Check Point Software Technologies .

How Are Returns Trending?

Things have been pretty stable at Check Point Software Technologies, with its capital employed and returns on that capital staying somewhat the same for the last five years. It's not uncommon to see this when looking at a mature and stable business that isn't re-investing its earnings because it has likely passed that phase of the business cycle. So it may not be a multi-bagger in the making, but given the decent 24% return on capital, it'd be difficult to find fault with the business's current operations.

Another point to note, we noticed the company has increased current liabilities over the last five years. This is intriguing because if current liabilities hadn't increased to 34% of total assets, this reported ROCE would probably be less than24% because total capital employed would be higher.The 24% ROCE could be even lower if current liabilities weren't 34% of total assets, because the the formula would show a larger base of total capital employed. With that in mind, just be wary if this ratio increases in the future, because if it gets particularly high, this brings with it some new elements of risk.

The Bottom Line On Check Point Software Technologies' ROCE

Although is allocating it's capital efficiently to generate impressive returns, it isn't compounding its base of capital, which is what we'd see from a multi-bagger. Unsurprisingly, the stock has only gained 30% over the last five years, which potentially indicates that investors are accounting for this going forward. Therefore, if you're looking for a multi-bagger, we'd propose looking at other options.

If you're still interested in Check Point Software Technologies it's worth checking out our FREE intrinsic value approximation for CHKP to see if it's trading at an attractive price in other respects.

Check Point Software Technologies is not the only stock earning high returns. If you'd like to see more, check out our free list of companies earning high returns on equity with solid fundamentals.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CHKP

Check Point Software Technologies

Develops, markets, and supports a range of products and services for IT security worldwide.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

TLX... a Market's Overreaction or a Falling Knife?

Rally in sustainable practices over value recyclable metal stock

Regeneron Pharmaceuticals Inc. (REGN): The Biotech Stalwart – Defensive Growth Amid Biosimilar Headwinds in 2026.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Nu holdings will continue to disrupt the South American banking market

Trending Discussion