- United States

- /

- Software

- /

- NasdaqGS:CHKP

Check Point Software Technologies Ltd.'s (NASDAQ:CHKP) Share Price Could Signal Some Risk

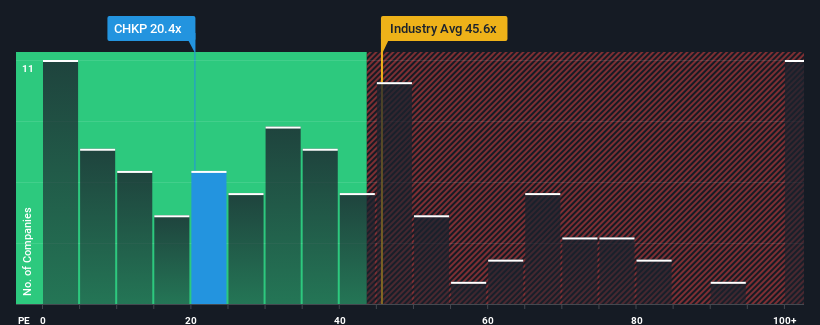

With a price-to-earnings (or "P/E") ratio of 20.4x Check Point Software Technologies Ltd. (NASDAQ:CHKP) may be sending bearish signals at the moment, given that almost half of all companies in the United States have P/E ratios under 17x and even P/E's lower than 9x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Check Point Software Technologies has been doing quite well of late. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Check Point Software Technologies

How Is Check Point Software Technologies' Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like Check Point Software Technologies' to be considered reasonable.

Retrospectively, the last year delivered a decent 11% gain to the company's bottom line. The latest three year period has also seen a 21% overall rise in EPS, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 8.0% per year during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to expand by 10% each year, which is noticeably more attractive.

With this information, we find it concerning that Check Point Software Technologies is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Check Point Software Technologies currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Check Point Software Technologies with six simple checks.

You might be able to find a better investment than Check Point Software Technologies. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CHKP

Check Point Software Technologies

Develops, markets, and supports a range of products and services for IT security worldwide.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

The Transition From Automaker To AI Behemoth Is Underway, But Priced In

Very Bullish

Sezzle's Profits to Soar with 27% Margin Boost

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion