- United States

- /

- Software

- /

- NasdaqGS:CHKP

Check Point Software Technologies (CHKP) Valuation After China Restrictions And Renewed Analyst Optimism

Reviewed by Simply Wall St

Check Point Software Technologies (CHKP) has been in focus after Chinese authorities asked domestic companies to stop using certain foreign cybersecurity tools, including Check Point products. Attention has since shifted toward recent analyst commentary and renewed investor interest.

See our latest analysis for Check Point Software Technologies.

Even after the China headlines and a sharp one day drop reported earlier in the month, Check Point’s 1 year total shareholder return of 0.95% and 3 year total shareholder return of 43.01% suggest momentum has cooled recently but has been stronger over a longer horizon.

If the China news has you rethinking cybersecurity exposure, it could be a good moment to widen your search with high growth tech and AI stocks.

With Check Point trading at $188.54, with a 1-year total return under 1% and a 3-year total return above 40%, is the recent cool down a chance to buy into future growth, or is the market already pricing it in?

Most Popular Narrative: 16.8% Undervalued

The most widely followed narrative pegs Check Point’s fair value at about $226.51 per share, compared to the last close of $188.54. This frames the current set up as a discount story built around billings strength and AI security expansion.

The Infinity platform continues to gain traction, with strong double-digit revenue growth and increased customer adoption, now accounting for over 15% of total revenue. This supports expectations for revenue growth through enhanced customer retention and cross-selling opportunities.

Curious what sits behind that fair value gap? The narrative leans on steady top line expansion, firm margins, and a future earnings multiple below many software peers. The exact mix of growth, profitability and discount rate inputs might surprise you.

Result: Fair Value of $226.51 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that fair value gap could close quickly if firewall refresh demand slows or if margin pressure from AI and SASE investment is greater than expected.

Find out about the key risks to this Check Point Software Technologies narrative.

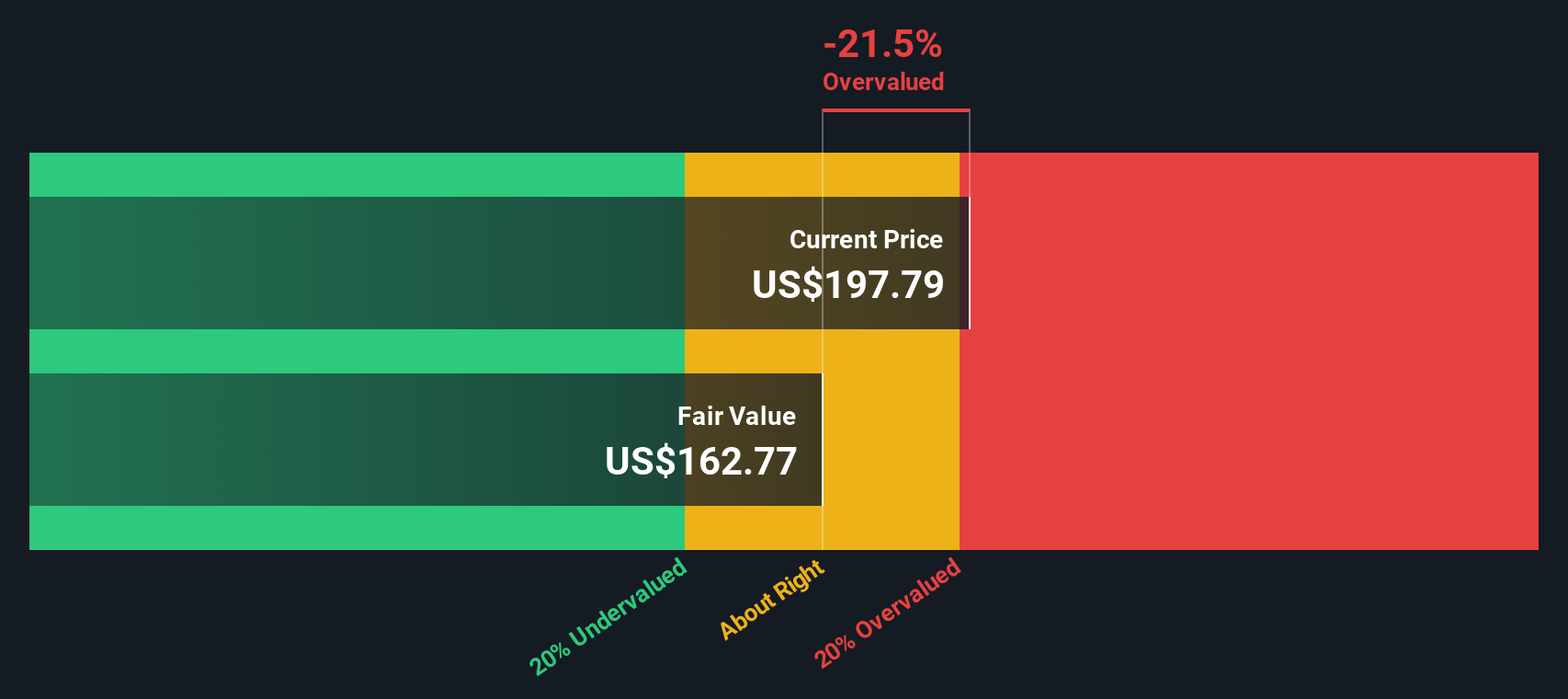

Another View: Our DCF Points The Other Way

Analysts and the consensus narrative frame Check Point as undervalued, but our DCF model presents a different perspective. At $188.54, the shares sit above our estimated fair value of $165.68. This suggests less of a discount story and more of a valuation tightrope for investors to judge.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Check Point Software Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 868 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Check Point Software Technologies Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a custom thesis in just a few minutes by starting with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Check Point Software Technologies.

Looking for more investment ideas?

If you are weighing your next move after looking at Check Point, do not stop here. Fresh opportunities often show up where most people are not paying attention.

- Spot potential value plays by scanning these 868 undervalued stocks based on cash flows that line up with your view on quality and price.

- Target the intersection of healthcare and automation by reviewing these 108 healthcare AI stocks shaping future medical workflows.

- Lean into digital assets by tracking these 80 cryptocurrency and blockchain stocks that tie listed companies to blockchain and cryptocurrency themes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHKP

Check Point Software Technologies

Develops, markets, and supports a range of products and services for IT security worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

The silent giant behind virtually every advanced chip powering AI, smartphones, and modern infrastructure.

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

Looking to be second time lucky with a game-changing new product

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026