- United States

- /

- Software

- /

- NasdaqGS:CHKP

Check Point Software (CHKP): Evaluating Valuation After Q3 Earnings Growth and New AI Security Launches

Check Point Software Technologies (CHKP) just posted higher revenue and net income for the third quarter, while also announcing new AI security launches. The company's latest efforts highlight how it is evolving to protect enterprise AI environments.

See our latest analysis for Check Point Software Technologies.

After a year marked by new deals and the high-profile rollout of AI Cloud Protect, Check Point’s momentum is steady, reflected in a 12.1% total shareholder return over the past year and impressive multi-year gains. While recent share price returns have wobbled a bit, with a decline of nearly 5% in the last month following a dip this week, investors seem focused on the bigger picture: resilient earnings, ongoing buybacks, and bold investments in AI security could well set the stage for further growth.

If you’re curious to see how other tech and AI players are adapting to this rapidly changing landscape, take a moment to explore See the full list for free..

So with shares trading nearly 15% below analyst targets after solid results and ambitious AI bets, is this a compelling entry point for long-term investors, or is the market already factoring in the company’s next chapter?

Most Popular Narrative: 14.9% Undervalued

The most widely followed valuation narrative suggests the fair value for Check Point Software Technologies is $225.46, nearly $34 above its last close. With the recent uptick in analyst expectations, the stage is set for a pivotal growth story in cybersecurity. The narrative itself explains why.

The Infinity platform continues to gain traction, with strong double-digit revenue growth and increased customer adoption, now accounting for over 15% of total revenue. This supports expectations for revenue growth through enhanced customer retention and cross-selling opportunities.

Curious what bold assumptions fuel this bullish outlook? Only the full narrative reveals the future profit targets and ambitious margin expectations that justify a premium valuation. The core thesis relies on more than recent wins. Find out which big numbers really power this price.

Result: Fair Value of $225.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slowdown in the firewall market or unexpected competitive moves could quickly challenge these bullish assumptions and reset investor expectations.

Find out about the key risks to this Check Point Software Technologies narrative.

Another View: Discounted Cash Flow Model

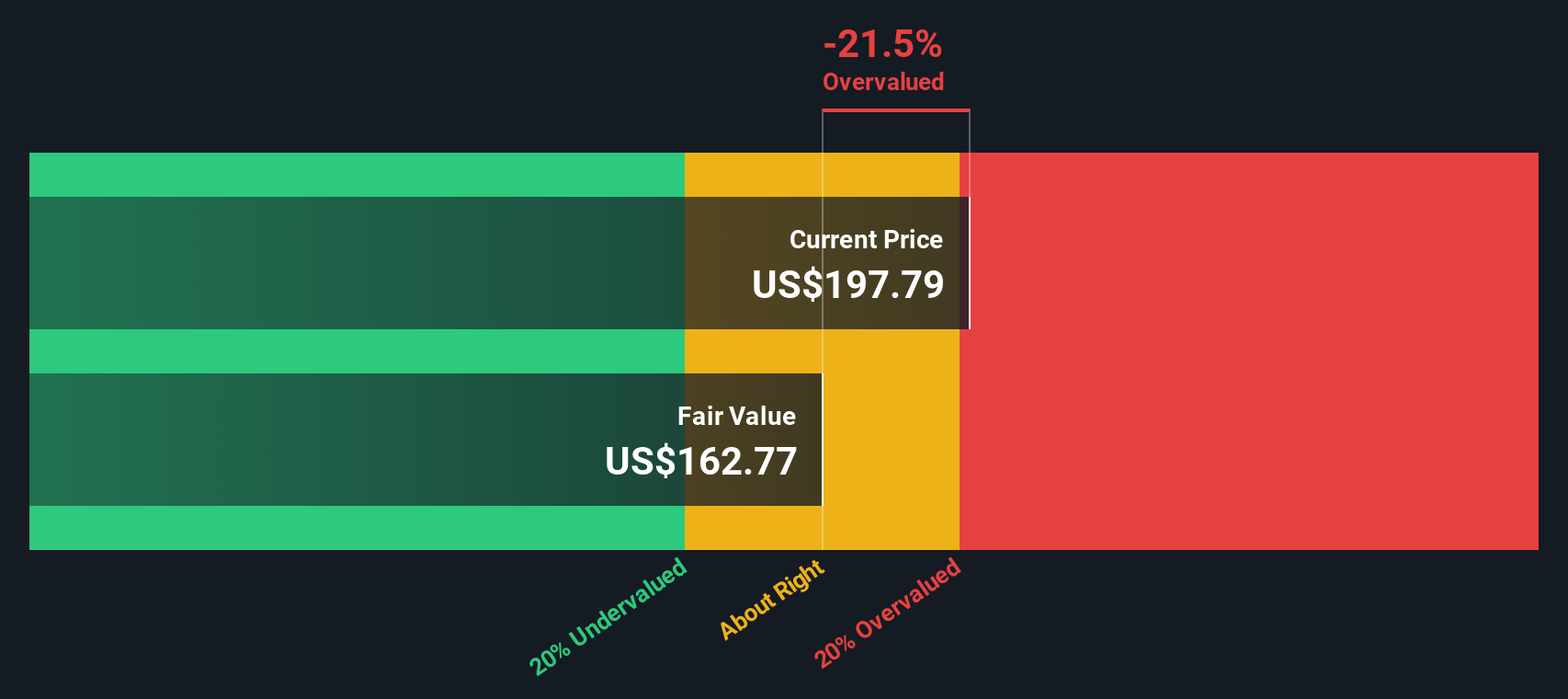

While the narrative-led valuation suggests Check Point Software Technologies is undervalued, our SWS DCF model shows a different perspective. According to this approach, the shares are trading above their intrinsic fair value. This raises an important question for investors: are analyst growth assumptions too optimistic, or is the market overlooking the company’s long-term fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Check Point Software Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 841 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Check Point Software Technologies Narrative

If you’d like to put the story to the test or dig into the data firsthand, it’s simple to build your own view in just a few minutes. Do it your way

A great starting point for your Check Point Software Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Want to stay ahead of market shifts and seize rare opportunities? Don’t settle for just one idea. See what else smart investors are tracking right now.

- Capitalize on robust yields and steady income streams by checking out these 18 dividend stocks with yields > 3% with payouts above 3%.

- Ride the wave of artificial intelligence innovation by getting in early on these 26 AI penny stocks as they transform industries and redefine what’s next.

- Uncover overlooked companies trading at bargain prices with these 841 undervalued stocks based on cash flows based on their strong cash flows and future potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHKP

Check Point Software Technologies

Develops, markets, and supports a range of products and services for IT security worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

BIPC: A strategic player in the energy crisis, a hybrid of Utility and Digital REIT.

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion