- United States

- /

- Software

- /

- NasdaqGS:CHKP

A Look at Check Point Software Technologies's (CHKP) Valuation Following Microsoft AI Security Collaboration

Check Point Software Technologies (CHKP) just announced a new collaboration with Microsoft, bringing its AI security tools directly into Microsoft Copilot Studio. This partnership aims to enhance protection, compliance, and governance for enterprises using generative AI agents.

See our latest analysis for Check Point Software Technologies.

This latest collaboration is another strong signal that Check Point Software Technologies is leaning into AI-driven security, aiming to stay ahead as enterprises increasingly embrace generative AI. While the recent 30-day share price return saw a dip of 6.56%, the stock has still managed a 1.29% total shareholder return over the past year. This momentum is supported by a robust 38% three-year total return. It is a case of near-term volatility in a company with a history of delivering for long-term shareholders.

If you’re following how AI is reshaping cybersecurity, this is an ideal moment to discover See the full list for free.

With the shares now trading nearly 24% below the average analyst price target and long-term returns still positive, investors may wonder whether Check Point Software Technologies is an overlooked value or if the market has already taken its future growth prospects into account.

Most Popular Narrative: 19% Undervalued

Check Point Software Technologies closed at $184.34, while the narrative-supported fair value stands at $228.40. The gap between consensus projections and market price sets the stage for a compelling catalyst that could sway sentiment.

The Infinity platform continues to gain traction, with strong double-digit revenue growth and increased customer adoption. The platform now accounts for over 15% of total revenue. This supports expectations for revenue growth through enhanced customer retention and cross-selling opportunities.

Want to know what powers this bull case? The narrative hints at ongoing platform adoption, ambitious future profitability, and a rare financial formula often reserved for top-tier tech. What bold projections are baked into that fair value? The answers lie just beneath the surface.

Result: Fair Value of $228.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, it's worth noting that intense competition and potential margin pressures could quickly challenge or even invalidate the current bullish outlook.

Find out about the key risks to this Check Point Software Technologies narrative.

Another View: SWS DCF Model Suggests a Different Story

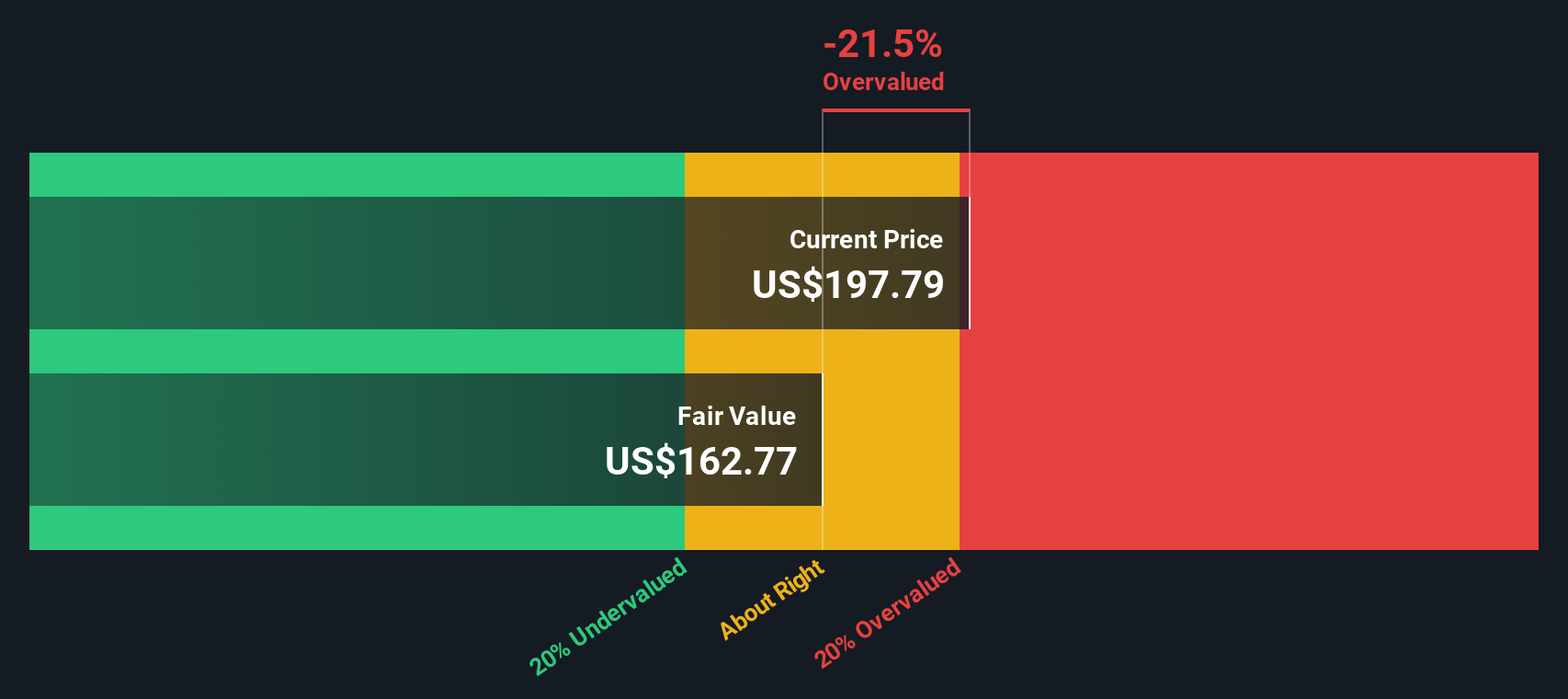

While the narrative-backed consensus points to Check Point Software Technologies being undervalued, our SWS DCF model arrives at a more conservative outcome. According to this model, the current share price of $184.34 actually exceeds the estimated fair value of $167.70. This means the DCF approach sees the stock as overvalued, which is in stark contrast to the optimism built into market expectations. Which method better captures the company’s true position and future prospects?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Check Point Software Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 923 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Check Point Software Technologies Narrative

If the current outlook doesn't match your perspective, you're invited to explore the figures yourself and craft a custom story in just a couple minutes. Do it your way

A great starting point for your Check Point Software Technologies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Upgrade your investing game by uncovering new areas of potential. The right insight now could mean you never miss the next breakout opportunity.

- Uncover cash flow bargains by checking out these 923 undervalued stocks based on cash flows, which are priced well below their fair value and positioned for growth.

- Fuel your portfolio’s momentum by targeting these 25 AI penny stocks, which are at the forefront of AI innovation and reshaping entire industries.

- Maximize income potential with these 15 dividend stocks with yields > 3%, which offer attractive yields above 3% for steady, reliable returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHKP

Check Point Software Technologies

Develops, markets, and supports a range of products and services for IT security worldwide.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

SoFi Technologies: The Apex Aggregator and the Infrastructure of the Modern Financial System

CSL: The Dip Is the Opportunity

DHT Holdings, inc: Strait of Hormuz Risk Amidst US-Israel vs Iran Tensions Spikes VLCC Rates.

Recently Updated Narratives

A Company Preparing for the Future: Charles River Laboratories

The Birth of a High-Grade Canadian Gold Powerhouse

Fundamental Analysis on BNPL companies should be viewed differently for Valuation Metrics.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion